Question: Please help! I really need to check my work. E3-22A. (Learning Objective 3: Adjust the accounts) Dellroy Rentals Company faced the following situations. Journalize the

Please help! I really need to check my work.

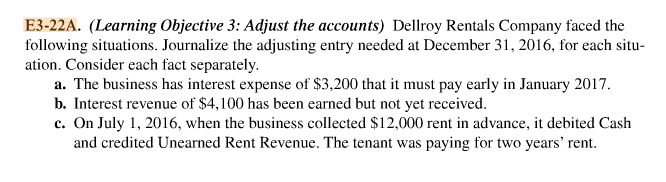

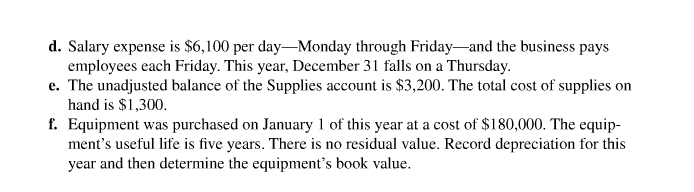

E3-22A. (Learning Objective 3: Adjust the accounts) Dellroy Rentals Company faced the following situations. Journalize the adjusting entry needed at December 31, 2016, for each situ- ation. Consider each fact separately a. The business has interest expense of $3,200 that it must pay early in January 2017. b. Interest revenue of $4,100 has been earned but not yet received c. On July 1, 2016, when the business collected $12,000 rent in advance, it debited Cash and credited Unearned Rent Revenue. The tenant was paying for two years' rent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts