Question: Please help. I think question 11 and 13 are correct but not 100% sure. this is all the data given for these specific questions If

Please help. I think question 11 and 13 are correct but not 100% sure.

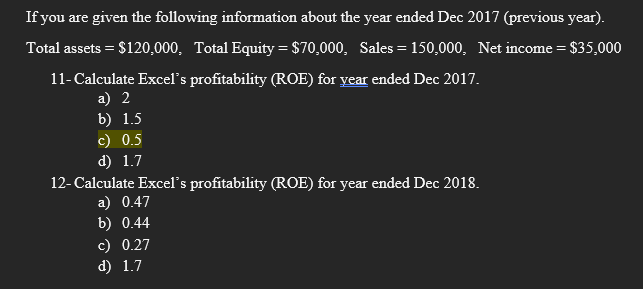

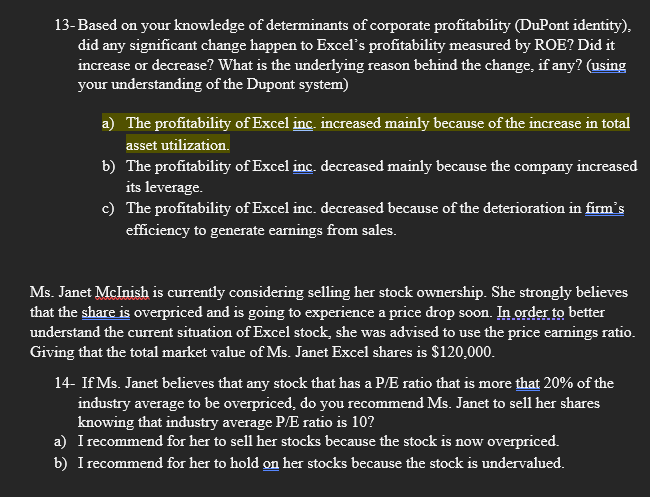

If you are given the following information about the year ended Dec 2017 (previous year). Total assets =$120,000, Total Equity =$70,000, Sales =150,000, Net income =$35,000 11- Calculate Excel's profitability (ROE) for year ended Dec 2017. a) 2 b) 1.5 c) 0.5 d) 1.7 12- Calculate Excel's profitability (ROE) for year ended Dec 2018. a) 0.47 b) 0.44 c) 0.27 d) 1.7 13-Based on your knowledge of determinants of corporate profitability (DuPont identity), did any significant change happen to Excel's profitability measured by ROE? Did it increase or decrease? What is the underlying reason behind the change, if any? (using your understanding of the Dupont system) a) The profitability of Excel inc. increased mainly because of the increase in total asset utilization. b) The profitability of Excel inc. decreased mainly because the company increased its leverage. c) The profitability of Excel inc. decreased because of the deterioration in firm's efficiency to generate earnings from sales. Ms. Janet McInish is currently considering selling her stock ownership. She strongly believes that the share is overpriced and is going to experience a price drop soon. In order to better understand the current situation of Excel stock, she was advised to use the price earnings ratio. Giving that the total market value of Ms. Janet Excel shares is $120,000. 14- If Ms. Janet believes that any stock that has a P/E ratio that is more that 20% of the industry average to be overpriced, do you recommend Ms. Janet to sell her shares knowing that industry average P/E ratio is 10 ? a) I recommend for her to sell her stocks because the stock is now overpriced. b) I recommend for her to hold on her stocks because the stock is undervalued

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts