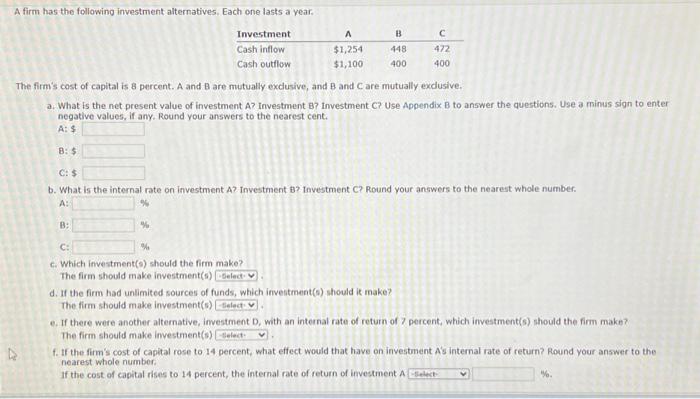

Question: PLEASE HELP! I WILL LIKE ANSWER! A firm has the following investment alternatives. Each one lasts a year. The firm's cost of capital is 8

The firm's cost of capital is 8 percent. A and B are mutually exclusive, and B and Care mutually exclusive.

- What is the net present value of investment A? Investment B? Investment C? Use Appendix B to answer the questions. Use a minus sign to enter negative values, if any. Round your answers to the nearest cent.

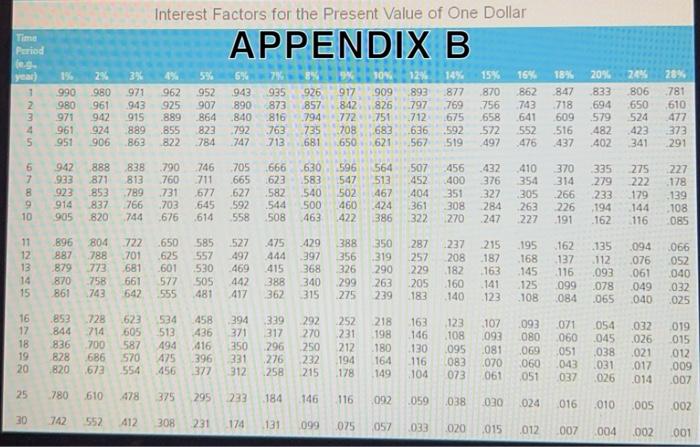

A firm has the following investment alternatives, Each one lasts a vear. The firm's cost of capital is 8 percent. A and B are mutually exclusive, and B and C are mutually exdusive. a. What is the net present value of investment A ? investment B ? Investment C ? Use Appendix B to answer the questions. Use a minus sign to enter negative values. if any. Round your answers to the nearest cent. A: $ 8: 5 C: $ b. What is the internal rate on investment A ? Investment B? Investment C ? Round your answers to the nearest whole number. c. Which investment(s) should the firm make? The firm should make investment(s) d. If the firm had unlimited sources of funds, which inventment(s) should it make? The firm should make investment(s) e. If there were another altemative, imvestment D, with an internal rate of return of 7 percent, which investment(s) should the firm make? The firm should make investment(s) f. If the firm's cost of capital rose to 14 percent, what effect would that have on investment As internal rate of return? Round your answer to the nearest whole number. If the cost of capital rises to 14 percent, the internal rate of return of investment A APPENDIX B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts