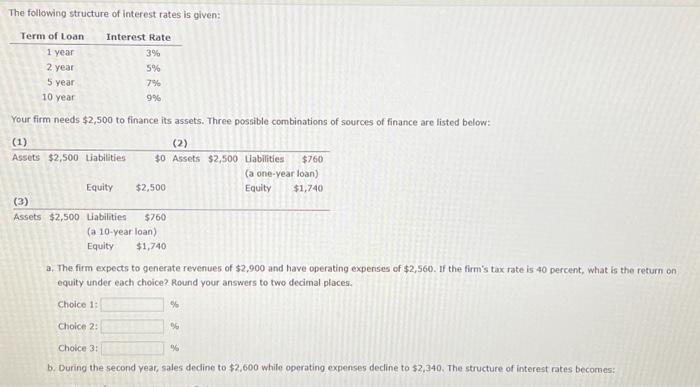

Question: PLEASE HELP!! I WILL LIKE ANSWER!! The following structure of interest rates is given: Term of Loan Interest Rate 1 year 3% 2 year 5%

| Term of Loan | Interest Rate |

| 1 year | 3% |

| 2 year | 5% |

| 5 year | 7% |

| 10 year | 9% |

Your firm needs $2,500 to finance its assets. Three possible combinations of sources of finance are listed below:

(1)

Assets $2,500 Liabilities

Equity

$2,500

(2)

$0 Assets $2,500 Liabilities $760

(a one-year loan)

Equity

$1,740

(3)

Assets $2,500 Liabilities

(a 10-year loan)

Equity

$760

$1,740

a. The firm expects to generate revenues of $2,900 and have operating expenses of $2,560. If the firm's tax rate is 40 percent, what is the return on equity under each choice? Round your answers to two decimal places.

Choice 1:

Choice 2:

Choice 3:

%

%

%

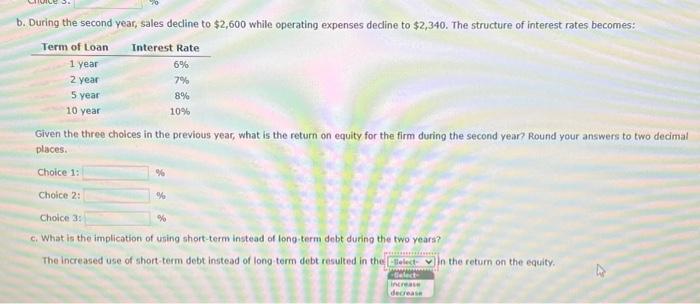

b. During the second year, sales decline to $2,600 while operating expenses decline to $2,340. The structure of interest rates becomes:

| Term of Loan | Interest Rate |

| 1 year | 6% |

| 2 year | 7% |

| 5 year | 8% |

| 10 year | 10% |

b. During the second year, sales decline to $2,600 while operating expenses decline to $2,340. The structure of interest rates becomes:

Given the three choices in the previous year, what is the return on equity for the firm during the second year? Round your answers to two decimal places.

Choice 1:

Choice 2:

Choice 3:

%

%

%

c. What is the implication of using short-term instead of long-term debt during the two years?

The increased use of short-term debt instead of long-term debt resulted in thei Select vin the return on the equity.

~ in the return on the equity.

The following structure of interest rates is given: Your firm needs $2,500 to finance its assets. Three possible combinations of sources of finance are listed below: Assets $2,500 Liabilities $760 (a 10-year loan) Equity $1,740 a. The firm expects to generate revenues of $2,900 and have operating expenses of $2,560. If the firm's tax rate is 40 percent, what is the return on equity under each choice? Round your answers to two decimal places. Choice 1: % Choice 2: os Choice 3 : as b. During the second year, sales decline to $2,600 while operating expenses decline to $2,340. The structure of interest rates becornes: b. During the second year, sales decline to $2,600 while operating expenses decline to $2,340. The structure of interest rates becomes: Given the three choices in the previous year, what is the return on equity for the firm during the second yean Round your answers to two decimal places. Choice 1: % Choice 2: Choice 3: % c. What is the implication of uning short-term instead of long-term debt during the two vears? The increased use of short-term debt instead of long-term debt resulted in the in the retum on the equity. The following structure of interest rates is given: Your firm needs $2,500 to finance its assets. Three possible combinations of sources of finance are listed below: Assets $2,500 Liabilities $760 (a 10-year loan) Equity $1,740 a. The firm expects to generate revenues of $2,900 and have operating expenses of $2,560. If the firm's tax rate is 40 percent, what is the return on equity under each choice? Round your answers to two decimal places. Choice 1: % Choice 2: os Choice 3 : as b. During the second year, sales decline to $2,600 while operating expenses decline to $2,340. The structure of interest rates becornes: b. During the second year, sales decline to $2,600 while operating expenses decline to $2,340. The structure of interest rates becomes: Given the three choices in the previous year, what is the return on equity for the firm during the second yean Round your answers to two decimal places. Choice 1: % Choice 2: Choice 3: % c. What is the implication of uning short-term instead of long-term debt during the two vears? The increased use of short-term debt instead of long-term debt resulted in the in the retum on the equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts