Question: PLEASE HELP, I WILL RATE AND UPVOTE YOUR ANSWER IF IT IS CORRECT. PLEASE DOUBLE CHECK THANK YOU AND BE SAFE Earnings per share ($)

PLEASE HELP, I WILL RATE AND UPVOTE YOUR ANSWER IF IT IS CORRECT. PLEASE DOUBLE CHECK THANK YOU AND BE SAFE

PLEASE HELP, I WILL RATE AND UPVOTE YOUR ANSWER IF IT IS CORRECT. PLEASE DOUBLE CHECK THANK YOU AND BE SAFE

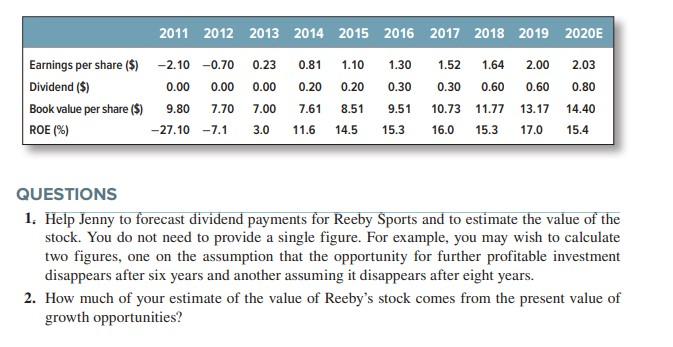

Earnings per share ($) Dividend ($) Book value per share (5) ROE (%) 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020E -2.10 -0.70 0.23 0.81 1.10 1.30 1.52 1.64 2.00 2.03 0.00 0.00 0.00 0.20 0.20 0.30 0.30 0.60 0.60 0.80 9.80 7.70 7.00 7.61 8.51 9.51 10.73 11.77 13.17 14.40 -27.10 -7.1 3.0 11.6 14.5 15.3 16.0 15.3 17.0 15.4 QUESTIONS 1. Help Jenny to forecast dividend payments for Reeby Sports and to estimate the value of the stock. You do not need to provide a single figure. For example, you may wish to calculate two figures, one on the assumption that the opportunity for further profitable investment disappears after six years and another assuming it disappears after eight years. 2. How much of your estimate of the value of Reeby's stock comes from the present value of growth opportunities? Earnings per share ($) Dividend ($) Book value per share (5) ROE (%) 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020E -2.10 -0.70 0.23 0.81 1.10 1.30 1.52 1.64 2.00 2.03 0.00 0.00 0.00 0.20 0.20 0.30 0.30 0.60 0.60 0.80 9.80 7.70 7.00 7.61 8.51 9.51 10.73 11.77 13.17 14.40 -27.10 -7.1 3.0 11.6 14.5 15.3 16.0 15.3 17.0 15.4 QUESTIONS 1. Help Jenny to forecast dividend payments for Reeby Sports and to estimate the value of the stock. You do not need to provide a single figure. For example, you may wish to calculate two figures, one on the assumption that the opportunity for further profitable investment disappears after six years and another assuming it disappears after eight years. 2. How much of your estimate of the value of Reeby's stock comes from the present value of growth opportunities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts