Question: please help I will show as well an example on how to answer the question. 1. my problem example Save Score: 0 of 1 pt

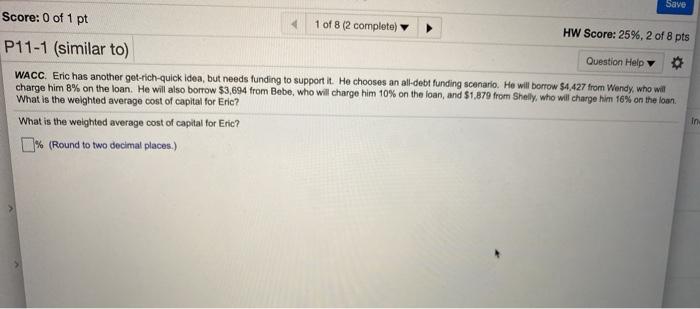

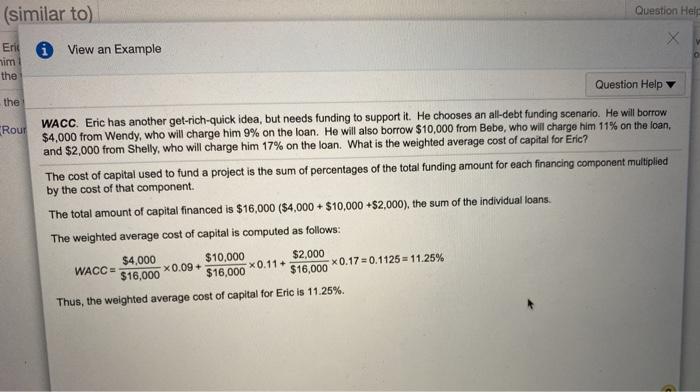

Save Score: 0 of 1 pt 1 of 8 (2 completel HW Score: 25%, 2 of 8 pts P11-1 (similar to) Question Help WACC. Eric has another get-rich-quick idea, but needs funding to support it. He chooses an all-debt funding scenario. He will borrow $4.427 from Wendy, who will charge him 8% on the loan. He will also borrow $3,694 from Bebe, who will charge him 10% on the loan and $1,879 from Shelly, who will charge him 16% on the loan. What is the weighted average cost of capital for Eric? What is the weighted average cost of capital for Eric? [% (Round to two decimal places.) in (similar to) Question Help i View an Example Erit nim the Question Help the Rout WACC. Eric has another get-rich-quick idea, but needs funding to support it. He chooses an all-debt funding scenario. He will borrow $4,000 from Wendy, who will charge him 9% on the loan. He will also borrow $10,000 from Bebe, who will charge him 11% on the loan, and $2,000 from Shelly, who will charge him 17% on the loan. What is the weighted average cost of capital for Eric? The cost of capital used to fund a project is the sum of percentages of the total funding amount for each financing component multiplied by the cost of that component. The total amount of capital financed is $16,000 ($4,000+ $10,000 $2,000), the sum of the individual loans. The weighted average cost of capital is computed as follows: $4,000 $10,000 $2,000 WACC = x0.09+ x0.11+ x0.17 = 0.1125 = 11.25% $16,000 $16,000 $16,000 Thus, the weighted average cost of capital for Eric is 11.25%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts