Question: please help I will thumbs up 30. Consider a Zerobond (i.e., a bond that pays no coupon payment, meaning that the coupon rate on the

please help I will thumbs up

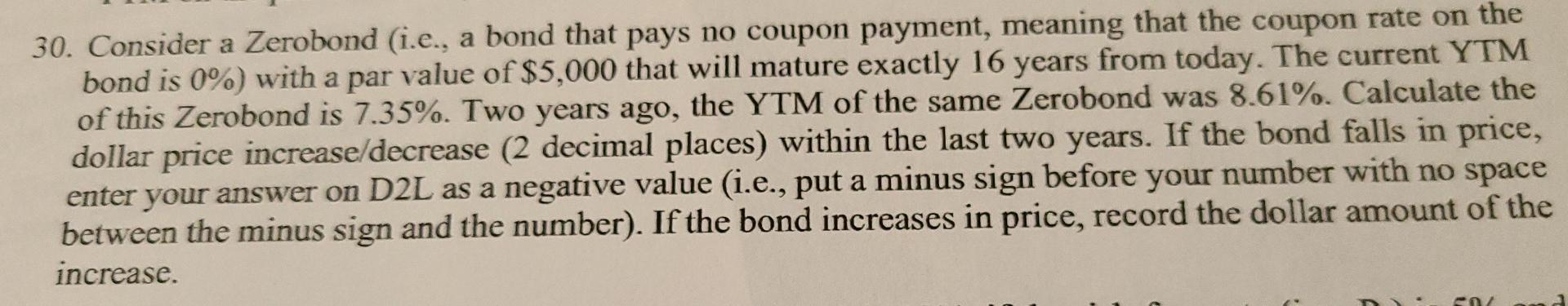

30. Consider a Zerobond (i.e., a bond that pays no coupon payment, meaning that the coupon rate on the bond is 0%) with a par value of $5,000 that will mature exactly 16 years from today. The current YTM a of this Zerobond is 7.35%. Two years ago, the YTM of the same Zerobond was 8.61%. Calculate the dollar price increase/decrease (2 decimal places) within the last two years. If the bond falls in price, enter your answer on D2L as a negative value (i.e., put a minus sign before your number with no space between the minus sign and the number). If the bond increases in price, record the dollar amount of the increase. 07

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts