Question: please help I will thumbs up #38 this is all the information for #38 if that can't done can I just this question done instead#43

please help I will thumbs up #38

this is all the information for #38

if that can't done can I just this question done instead#43

. I will thumbs up still

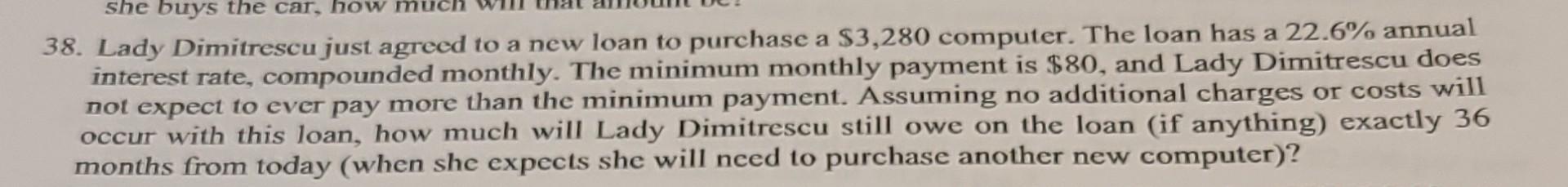

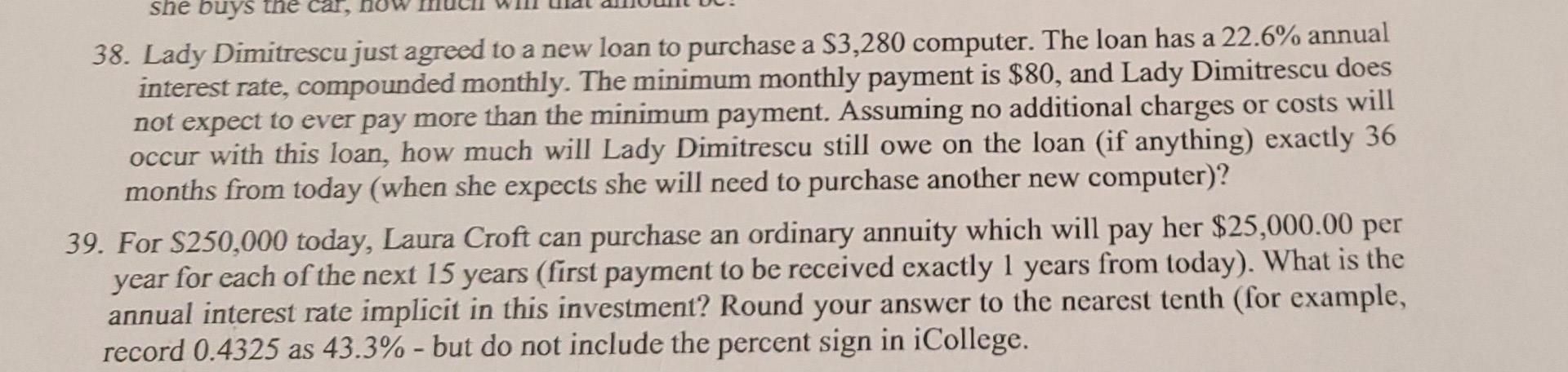

she buys the car, how mu 38. Lady Dimitrescu just agreed to a new loan to purchase a $3,280 computer. The loan has a 22.6% annual interest rate, compounded monthly. The minimum monthly payment is $80, and Lady Dimitrescu does not expect to ever pay more than the minimum payment. Assuming no additional charges or costs will occur with this loan, how much will Lady Dimitrescu still owe on the loan (if anything) exactly 36 months from today (when she expects she will need to purchase another new computer)? she buys the car, 38. Lady Dimitrescu just agreed to a new loan to purchase a $3,280 computer. The loan has a 22.6% annual interest rate, compounded monthly. The minimum monthly payment is $80, and Lady Dimitrescu does not expect to ever pay more than the minimum payment. Assuming no additional charges or costs will occur with this loan, how much will Lady Dimitrescu still owe on the loan (if anything) exactly 36 months from today (when she expects she will need to purchase another new computer)? 39. For $250,000 today, Laura Croft can purchase an ordinary annuity which will pay her $25,000.00 per year for each of the next 15 years (first payment to be received exactly 1 years from today). What is the annual interest rate implicit in this investment? Round your answer to the nearest tenth (for example, record 0.4325 as 43.3% - but do not include the percent sign in iCollege. Elle pay for the 43. Marcus Holloway has $15,000 that he will use as a down payment on a new car. Assuming that Marcus can afford a payment of $875 per month, how much can Marcus spend on a car (that is, what is the total cost of the car that Marcus can purchase) if the interest rate is 5.15% and if he will finance his purchase with a 6-year, monthly payment loan? 69097.15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts