Question: Please help, I will thumbs up your answer! Capital Losses. To better understand the rules for offsetting capital losses and how to treat capital losses

Please help, I will thumbs up your answer!

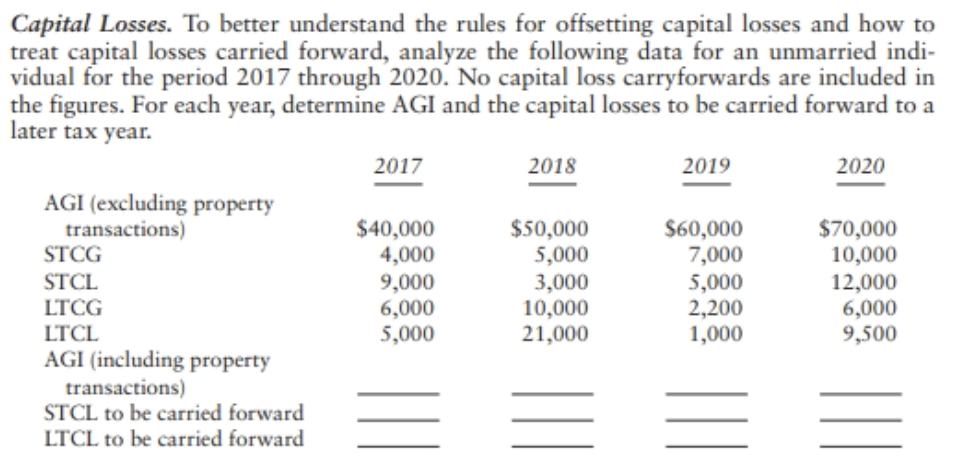

Capital Losses. To better understand the rules for offsetting capital losses and how to treat capital losses carried forward, analyze the following data for an unmarried indi- vidual for the period 2017 through 2020. No capital loss carryforwards are included in the figures. For each year, determine AGI and the capital losses to be carried forward to a later tax year. 2017 2018 2019 2020 AGI (excluding property transactions) $40,000 $50,000 $60,000 $70,000 STCG 4,000 5,000 7,000 10,000 STCL 9,000 3,000 5,000 12,000 LTCG 6,000 10,000 2,200 6,000 LTCL 5,000 21,000 1,000 9,500 AGI (including property transactions) STCL to be carried forward LTCL to be carried forward

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts