Question: Please help I will upvote! QUESTION 14 Entity G uses the allowance method for uncollectible accounts. When it later writes off an account, it should:

Please help I will upvote!

Please help I will upvote!

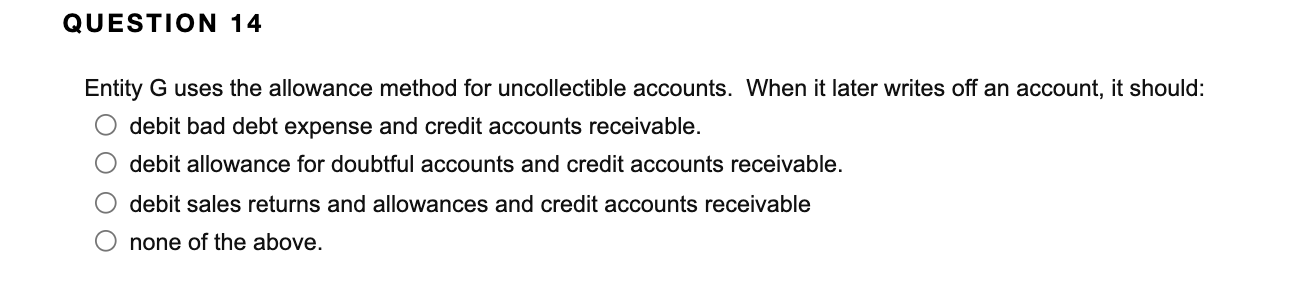

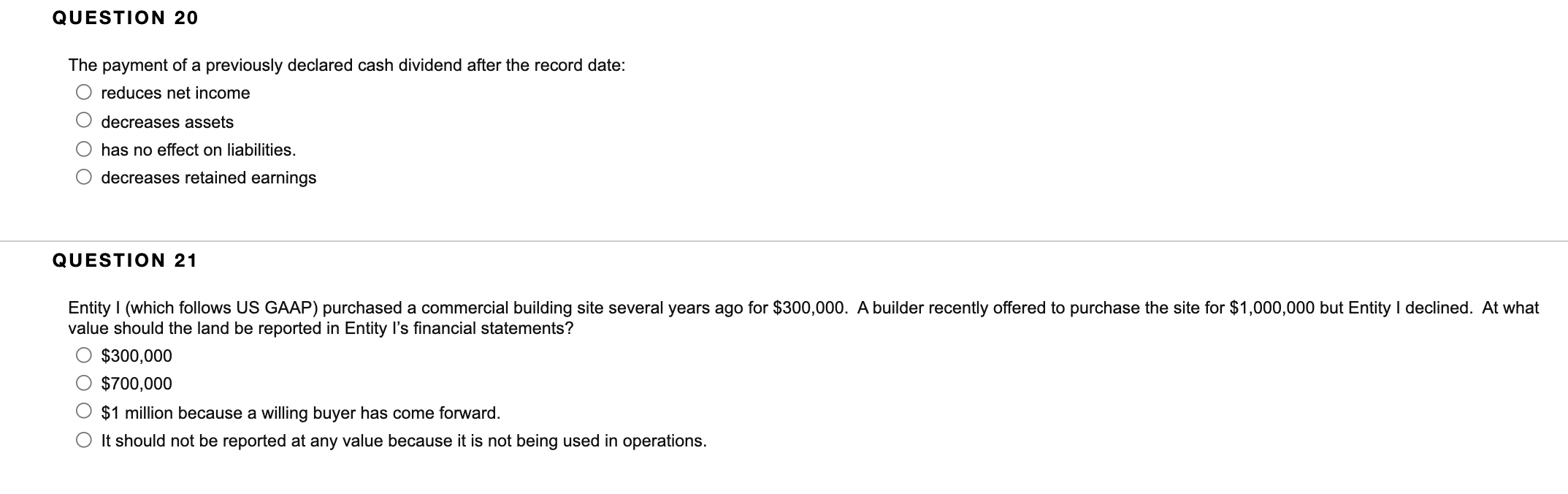

QUESTION 14 Entity G uses the allowance method for uncollectible accounts. When it later writes off an account, it should: debit bad debt expense and credit accounts receivable. debit allowance for doubtful accounts and credit accounts receivable. debit sales returns and allowances and credit accounts receivable none of the above. QUESTION 20 The payment of a previously declared cash dividend after the record date: reduces net income decreases assets has no effect on liabilities. decreases retained earnings QUESTION 21 Entity I (which follows US GAAP) purchased a commercial building site several years ago for $300,000. A builder recently offered to purchase the site for $1,000,000 but Entity I declined. At what value should the land be reported in Entity l's financial statements? $300,000 $700,000 $1 million because a willing buyer has come forward. It should not be reported at any value because it is not being used in operations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts