Question: PLEASE HELP !!! I WILL UPVOTE: QUESTIONS: 1. Compute the profit (loss) per customer for the retail customer and business customer first using original cost

PLEASE HELP !!! I WILL UPVOTE:

QUESTIONS:

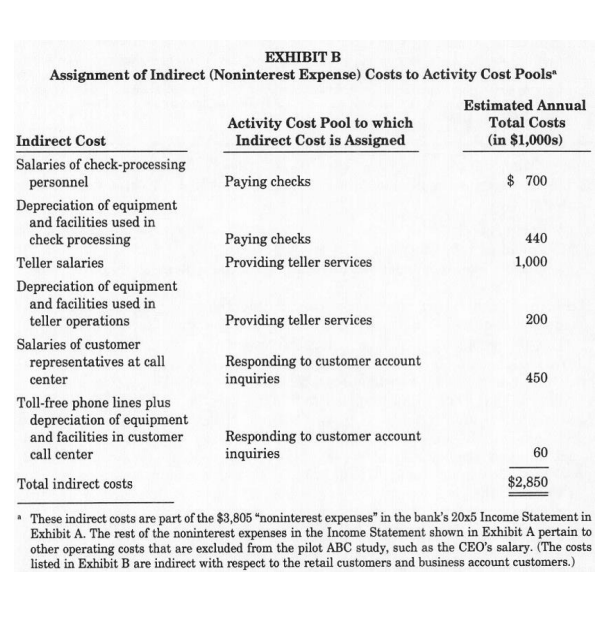

1. Compute the profit (loss) per customer for the retail customer and business customer first using original cost system then using the ABC System. Use the cost data in Exhibit B.

2. Based on the case, do you think the original cost system is broken? And if your answer is yes, explain why. How can it be improved?

3. How can ABC data be used to develop marketing strategies that increase profits? How can the branch manager use ABC data to identify opportunities to trim cost while maintaining or increasing customer satisfaction?

4. Do you think banks incentive bonus plan to increase the number of customers is wise? What changes, if any, would you recommend?

_________ INFO is ABC Bank

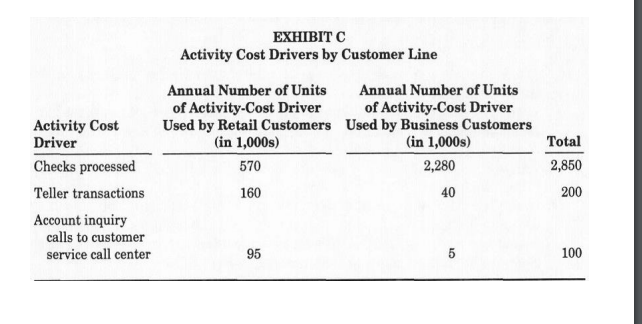

The ABC team estimated that for the three pilot-test bank branches, the retail and business customer lines experienced the annual activity levels (in thousands) as shown in Exhibit C. For example, Exhibit C reveals that retail customers had 160,000 teller transactions and made 95,000 account inquiry calls to the customer service call center.

ABC Bank currently services 150,000 retail customer checking accounts and 50,000 business customer checking accounts. The bank earns net interest revenue on the balances that customers keep in their checking accounts.3 On average, the bank earns the following annualrevenue from each type of account:

Avg. annual revenue per retail customer account $10

Avg. annual revenue per business customer $40 account

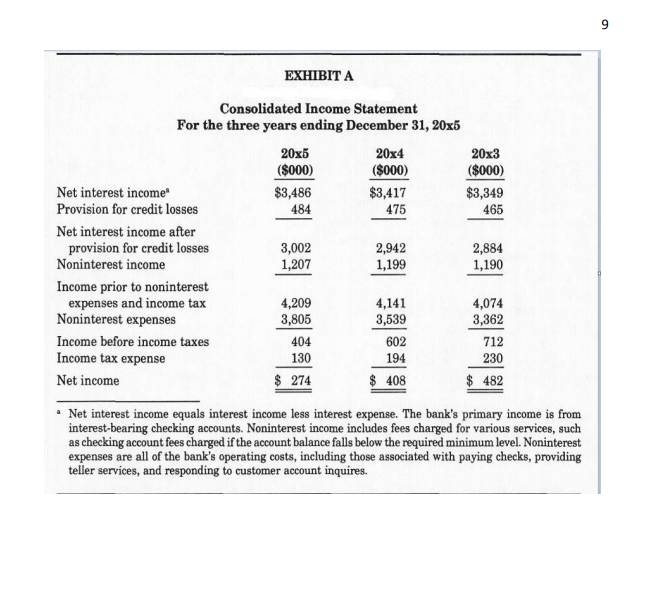

EXHIBIT A Consolidated Income Statement For the three years ending December 31,205 - Net interest income equals interest income less interest expense. The bank's primary income is from interest-bearing checking accounts. Noninterest income includes fees charged for various services, such as checking account fees charged if the account balance falls below the required minimum level. Noninterest expenses are all of the bank's operating costs, including those associated with paying checks, providing teller services, and responding to customer account inquires. EXHIBIT B Assignment of Indirect (Noninterest Expense) Costs to Activity Cost Pools n " These indirect costs are part of the $3,805 "noninterest expenses" in the bank's 205 Income Statement in Exhibit A. The rest of the noninterest expenses in the Income Statement shown in Exhibit A pertain to other operating costs that are excluded from the pilot ABC study, such as the CEO's salary. (The costs listed in Exhibit B are indirect with respect to the retail customers and business account customers.) EXHIBIT C Activity Cost Drivers by Customer Line

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts