Question: Please help! I would like to know how to find the contribution amount with an traditional 401(k) and a Roth 401(k). Seven questions total. There

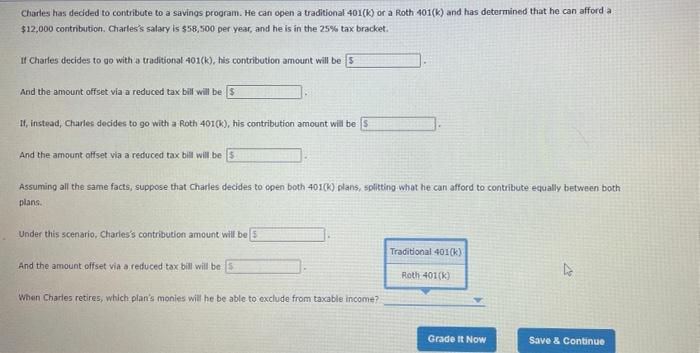

Charles has decided to contribute to a savings program. He can open a traditional 401(k) or a Roth 401(k) and has determined that he can afford a $12,000 contribution. Charles's salary is $58,500 per year, and he is in the 25% tax bracket If Charles decides to go with a traditional 401(k), his contribution amount will be s And the amount offset via a reduced tax bill will be $ If, instead, Charles decides to go with a Roth 401(k), his contribution amount will be And the amount offset via a reduced tax bill will be 5 Assuming all the same facts, suppose that Charles decides to open both 401(K) plans, splitting what he can afford to contribute equally between both plans. Under this scenario, Charles's contribution amount will be Traditional 401(k) And the amount offset via a reduced tax bill will be 5 Roth 401(k) When Charles retires, which plan's monies will he be able to exclude from taxable income? Grade it Now Save & Continue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts