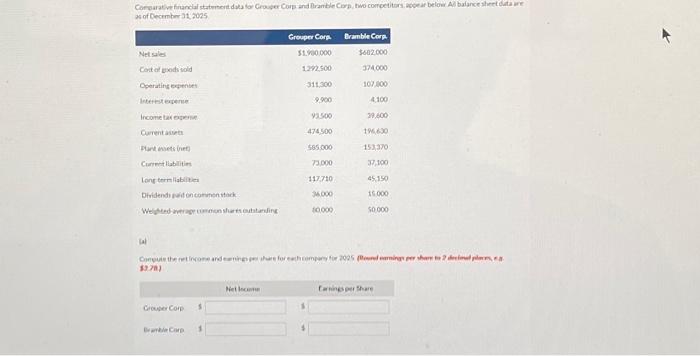

Question: PLEASE HELP! IF CORRECT ILL THUMBS UP!Comparative financial statement data for Grouper Corp. and Bramble Corp., two competitors, appear below. All balance sheet data are

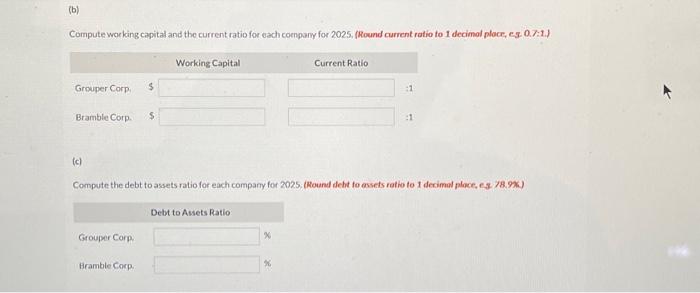

as of Cecember 31,2025 |a) 8) Compute working capital and the current ratio for each coenpary for 2025, (Round current ratio to 1 decimol plocr, e.s. 0.7:1.) (c) Compute the debt to assets ratio for each company for 2025. (Wound deht to assets ratho to 1 decimul ploce, es. 78.92)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts