Question: please help! IF Interest Rate Parity Holds, given information, What should be the Forward Rate between British Pound and Argentine Peso. Interest Rates: Argentina =40%

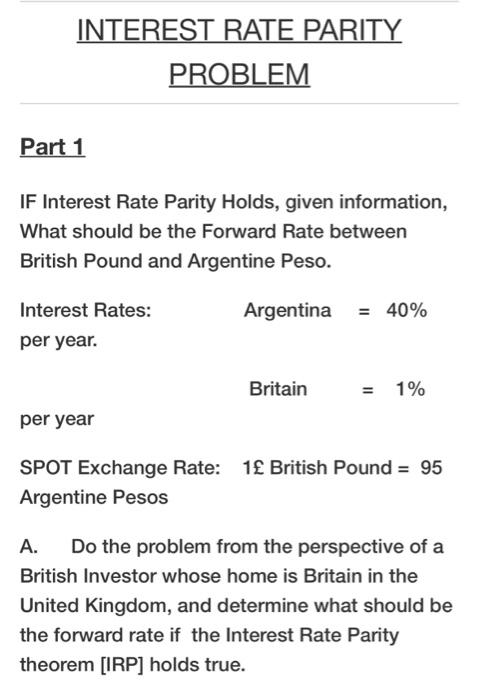

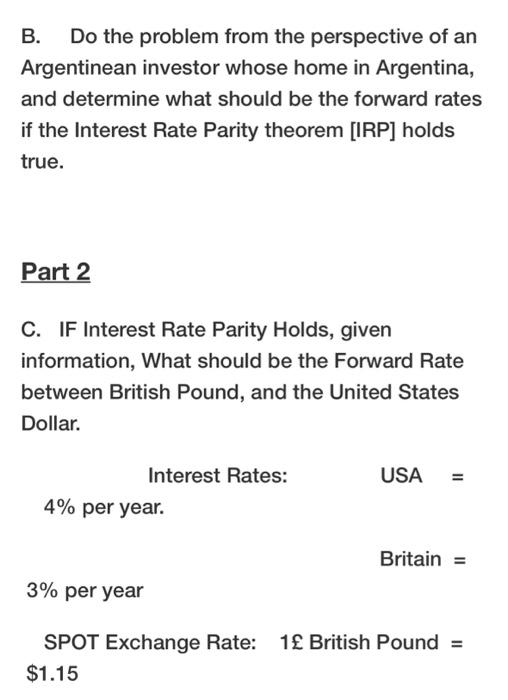

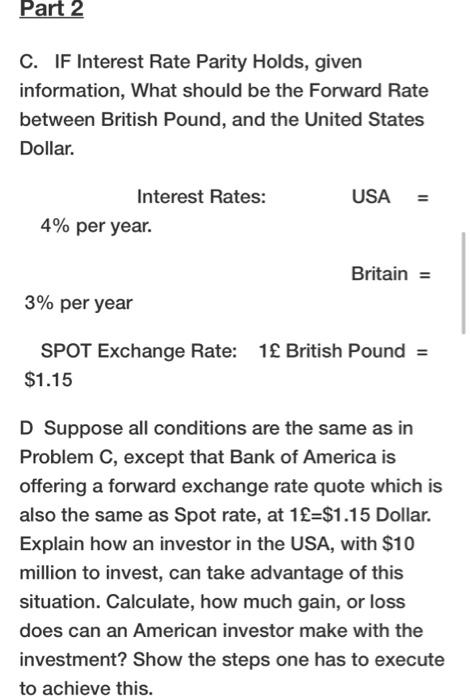

IF Interest Rate Parity Holds, given information, What should be the Forward Rate between British Pound and Argentine Peso. Interest Rates: Argentina =40% per year. Britain =1% per year SPOT Exchange Rate: 1 British Pound =95 Argentine Pesos A. Do the problem from the perspective of a British Investor whose home is Britain in the United Kingdom, and determine what should be the forward rate if the Interest Rate Parity theorem [IRP] holds true. B. Do the problem from the perspective of an Argentinean investor whose home in Argentina, and determine what should be the forward rates if the Interest Rate Parity theorem [IRP] holds true. Part 2 C. IF Interest Rate Parity Holds, given information, What should be the Forward Rate between British Pound, and the United States Dollar. Interest Rates: USA = 4% per year. Britain = 3% per year SPOT Exchange Rate: 1 British Pound = $1.15 Part 2 C. IF Interest Rate Parity Holds, given information, What should be the Forward Rate between British Pound, and the United States Dollar. Interest Rates: = 4% per year. 3% per year Britain = SPOT Exchange Rate: 1 British Pound = $1.15 D Suppose all conditions are the same as in Problem C, except that Bank of America is offering a forward exchange rate quote which is also the same as Spot rate, at 1=$1.15 Dollar. Explain how an investor in the USA, with $10 million to invest, can take advantage of this situation. Calculate, how much gain, or loss does can an American investor make with the investment? Show the steps one has to execute to achieve this

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts