Question: please help if you know the the answer to these two parts A three-against-nine FRA has an agreement rate of 4.3 percent. You believe six-month

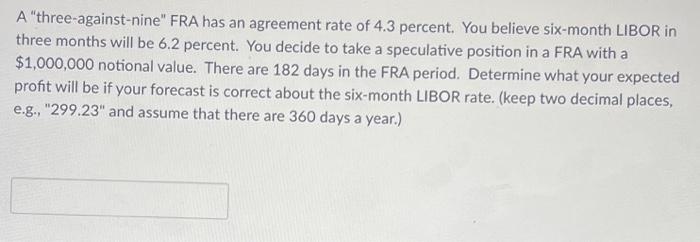

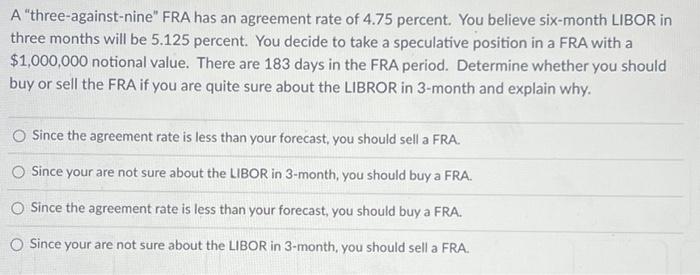

A "three-against-nine" FRA has an agreement rate of 4.3 percent. You believe six-month LIBOR in three months will be 6.2 percent. You decide to take a speculative position in a FRA with a $1,000,000 notional value. There are 182 days in the FRA period. Determine what your expected profit will be if your forecast is correct about the six-month LIBOR rate. (keep two decimal places, e.g., "299.23" and assume that there are 360 days a year.) A "three-against-nine" FRA has an agreement rate of 4.75 percent. You believe six-month LIBOR in three months will be 5.125 percent. You decide to take a speculative position in a FRA with a $1,000,000 notional value. There are 183 days in the FRA period. Determine whether you should buy or sell the FRA if you are quite sure about the LIBROR in 3-month and explain why. Since the agreement rate is less than your forecast, you should sell a FRA. Since your are not sure about the LIBOR in 3-month, you should buy a FRA. Since the agreement rate is less than your forecast, you should buy a FRA. O Since your are not sure about the LIBOR in 3-month, you should sell a FRA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts