Question: please help! ill leave a like! Check My Work (No more tries available) Problem 7-13 Nonconstant Growth Stock Valuation Simpkins Corporation does not pay any

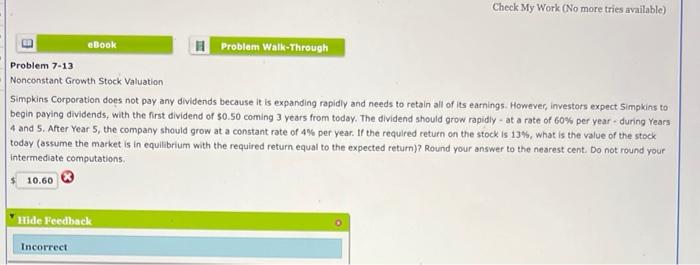

Check My Work (No more tries available) Problem 7-13 Nonconstant Growth Stock Valuation Simpkins Corporation does not pay any dividends because it is expanding rapidly and needs to retain all of its earnings. However, investors expect 5 implins to begin paying dividends, with the first dividend of 50.50 coming 3 years from today. The dividend should grow rapidly - at a rate of 60% per year - during Years 4 and 5. After Year 5, the company should grow at a constant rate of 4% per year. If the required return on the stock. Is 13%, what is the value of the stock today (assume the market is in equilibrium with the required return equal to the expected return)? Round your answer to the nearest cent. Do not round your intermediate computations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts