Question: PLEASE HELP!!!! I'LL LEAVE THUMBS UP!!! our Bolung 2. Based on the article provided to you in class, compute the optimal portfolio weights of two

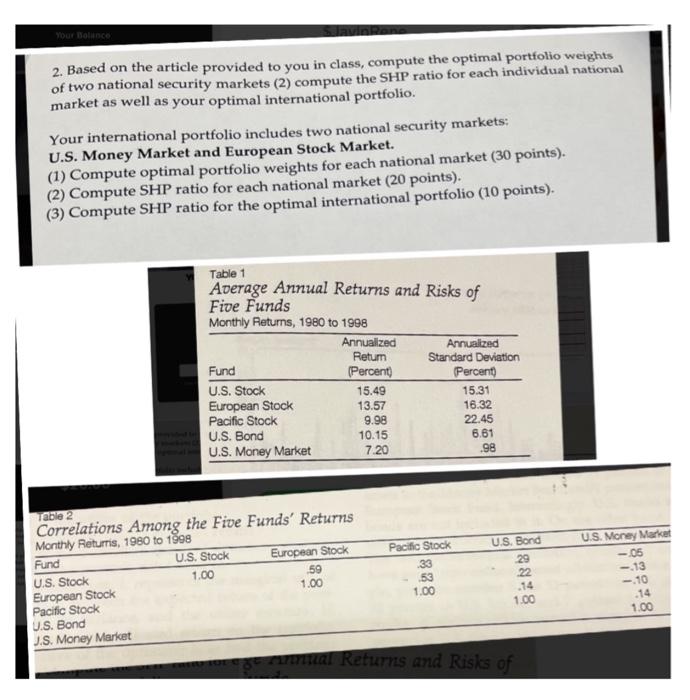

our Bolung 2. Based on the article provided to you in class, compute the optimal portfolio weights of two national security markets (2) compute the SHP ratio for each individual national market as well as your optimal international portfolio. Your international portfolio includes two national security markets: U.S. Money Market and European Stock Market. (1) Compute optimal portfolio weights for each national market (30 points). (2) Compute SHP ratio for each national market (20 points). (3) Compute SHP ratio for the optimal international portfolio (10 points). Table 1 Average Annual Returns and Risks of Five Funds Monthly Returns, 1980 to 1998 Annualized Annualized Return Standard Deviation Fund (Percent) Percent U.S. Stock 15.49 15.31 European Stock 13.57 16.32 Pacific Stock 9.98 22.45 U.S. Bond 10.15 6.61 U.S. Money Market 720 .98 Table 2 Correlations Among the Five Funds' Returns Monthly Returns, 1980 to 1998 Fund U.S. Stock European Stock U.S. Stock 1.00 59 European Stock 1.00 Pacific Stock U.S. Bond J.S. Money Market Pacific Stock 33 53 1.00 U.S. Bond 29 22 .14 1.00 U.S. Money Market -05 - 13 - 10 .14 1.00 al Returns and Risks of our Bolung 2. Based on the article provided to you in class, compute the optimal portfolio weights of two national security markets (2) compute the SHP ratio for each individual national market as well as your optimal international portfolio. Your international portfolio includes two national security markets: U.S. Money Market and European Stock Market. (1) Compute optimal portfolio weights for each national market (30 points). (2) Compute SHP ratio for each national market (20 points). (3) Compute SHP ratio for the optimal international portfolio (10 points). Table 1 Average Annual Returns and Risks of Five Funds Monthly Returns, 1980 to 1998 Annualized Annualized Return Standard Deviation Fund (Percent) Percent U.S. Stock 15.49 15.31 European Stock 13.57 16.32 Pacific Stock 9.98 22.45 U.S. Bond 10.15 6.61 U.S. Money Market 720 .98 Table 2 Correlations Among the Five Funds' Returns Monthly Returns, 1980 to 1998 Fund U.S. Stock European Stock U.S. Stock 1.00 59 European Stock 1.00 Pacific Stock U.S. Bond J.S. Money Market Pacific Stock 33 53 1.00 U.S. Bond 29 22 .14 1.00 U.S. Money Market -05 - 13 - 10 .14 1.00 al Returns and Risks of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts