Question: please help im stuck Problem 1-9B Analyzing transactions and preparing financial statements [ P1 Rivera Roofing Company, owned by Reyna Rivera, began operations in July

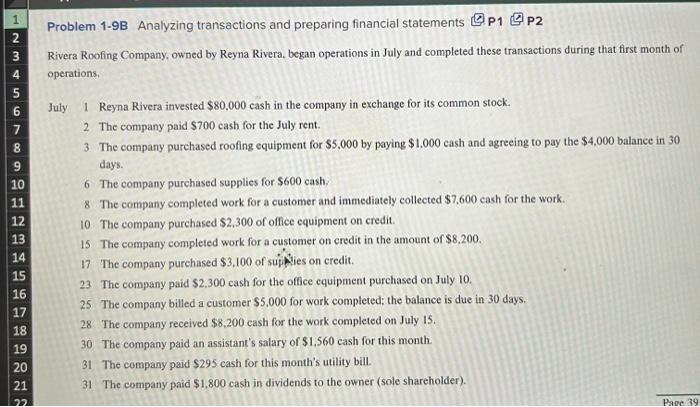

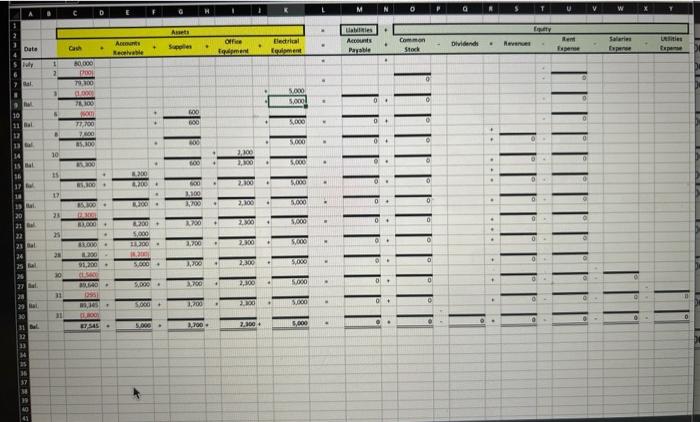

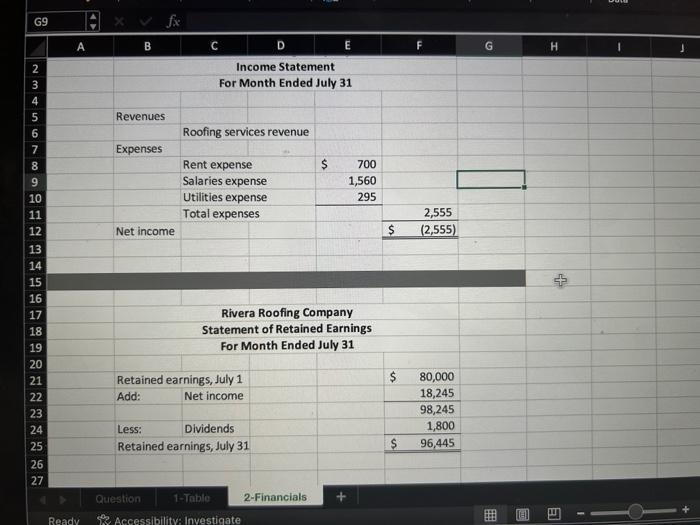

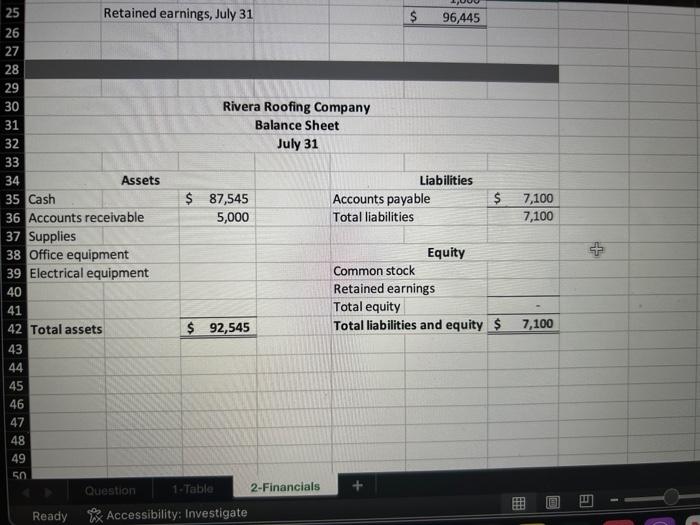

Problem 1-9B Analyzing transactions and preparing financial statements [ P1 Rivera Roofing Company, owned by Reyna Rivera, began operations in July and completed these transactions during that first month of operations. July 1 Reyna Rivera invested $80,000 cash in the company in exchange for its common stock. 2 The company paid $700 cash for the July rent. 3. The company purchased roofing equipment for $5,000 by paying $1,000 cash and agreeing to pay the $4,000 balance in 30 days. 6 The company purchased supplies for $600 cash. 8 The company completed work for a customer and immediately collected $7,600 cash for the work. 10 The company purchased $2,300 of office equipment on credit. 15. The company completed work for a customer on credit in the amount of $8,200. 17 The company purchased $3,100 of suipies on credit. 23 The company paid $2.300 cash for the office cquipment purchased on July 10. 25 The company billed a customer $5.000 for work completed; the balance is due in 30 days. 28 The company received $8.200 cash for the work completed on July is. 30 The company paid an assistant's salary of $1,560 cash for this month. 31 The company paid $295 cash for this month's utility bill. 31 The company paid $1,800 cash in dividends to the owner (sole shareholder). Rivera Roofing Company Statement of Retained Earnings For Month Ended July 31 Retained earnings, July 1 Add: Net income Less: Dividends Retained earnings, July 31 \begin{tabular}{rr|} \hline$ & 80,000 \\ & 18,245 \\ \hline & 98,245 \\ & 1,800 \\ \hline$ & 96,445 \\ \hline \end{tabular} Rivera Roofing Company Balance Sheet July 31 Assets Liabilities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts