Question: please help immediately! The King Solomon Mining Company is contemplating a cash tender offer of $1,200,000 for the outstanding shares of Roanoke Coal Corporation Roanoke

please help immediately!

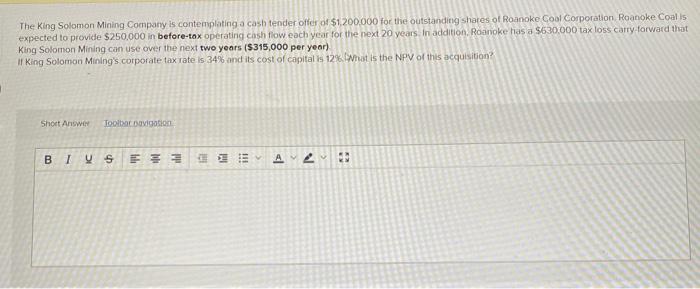

The King Solomon Mining Company is contemplating a cash tender offer of $1,200,000 for the outstanding shares of Roanoke Coal Corporation Roanoke Coalls expected to provide $250,000 in before tax operating cash flow each year for the next 20 years. In addition, Roanoke has a $630,000 tax loss carry forward that King Solomon Mining can use over the next two years ($315,000 per year) If King Solomon Mining's corporate tax rate is 34% and its cost of capital is 12% What is the NPV of this acquisition Shot Answer Toolba bavigation BIS E33 A2

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock