Question: Please help In a joint processing operation, Scarecrow Gardens Ltd. manufactures three varieties of products from a common input, corn. Joint processing costs up to

Please help

Please help

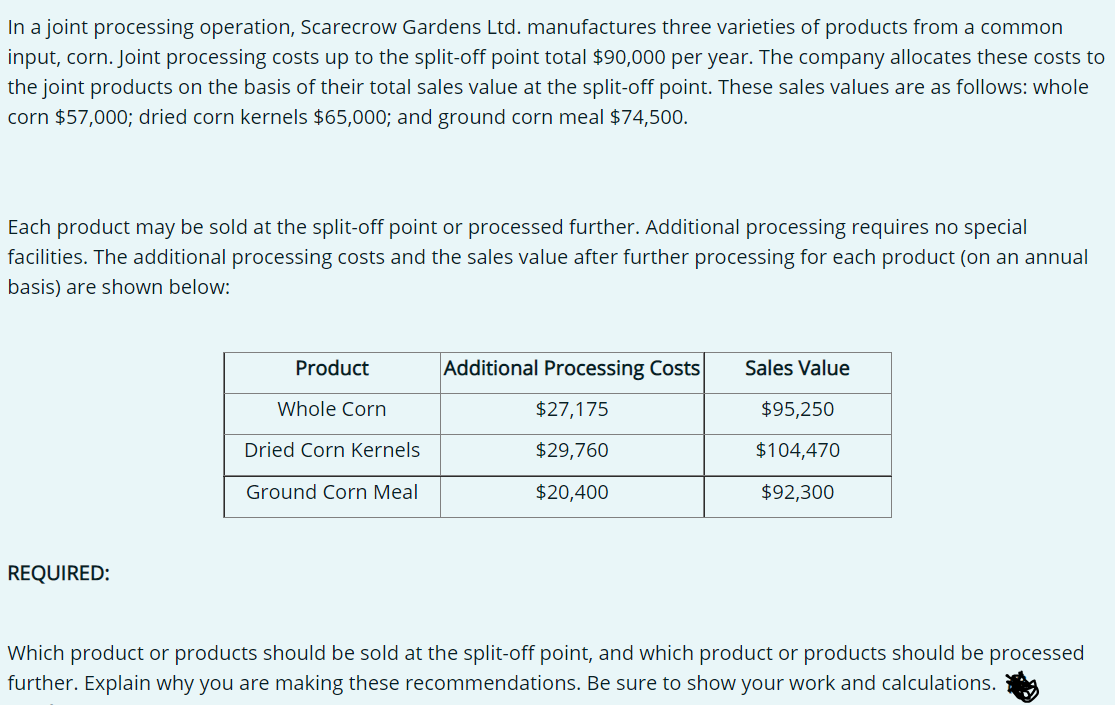

In a joint processing operation, Scarecrow Gardens Ltd. manufactures three varieties of products from a common input, corn. Joint processing costs up to the split-off point total $90,000 per year. The company allocates these costs to the joint products on the basis of their total sales value at the split-off point. These sales values are as follows: whole corn $57,000; dried corn kernels $65,000; and ground corn meal $74,500. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities. The additional processing costs and the sales value after further processing for each product (on an annual basis) are shown below: Product Additional Processing Costs Sales Value Whole Corn $27,175 $95,250 Dried Corn kernels $29,760 $104,470 Ground Corn Meal $20,400 $92,300 REQUIRED: Which product or products should be sold at the split-off point, and which product or products should be processed further. Explain why you are making these recommendations. Be sure to show your work and calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts