Question: Please help in completing below question as I am struggling with the dates for Balance section. Dropdown Values: The trancartinne of Carla Victa Rrnthere I

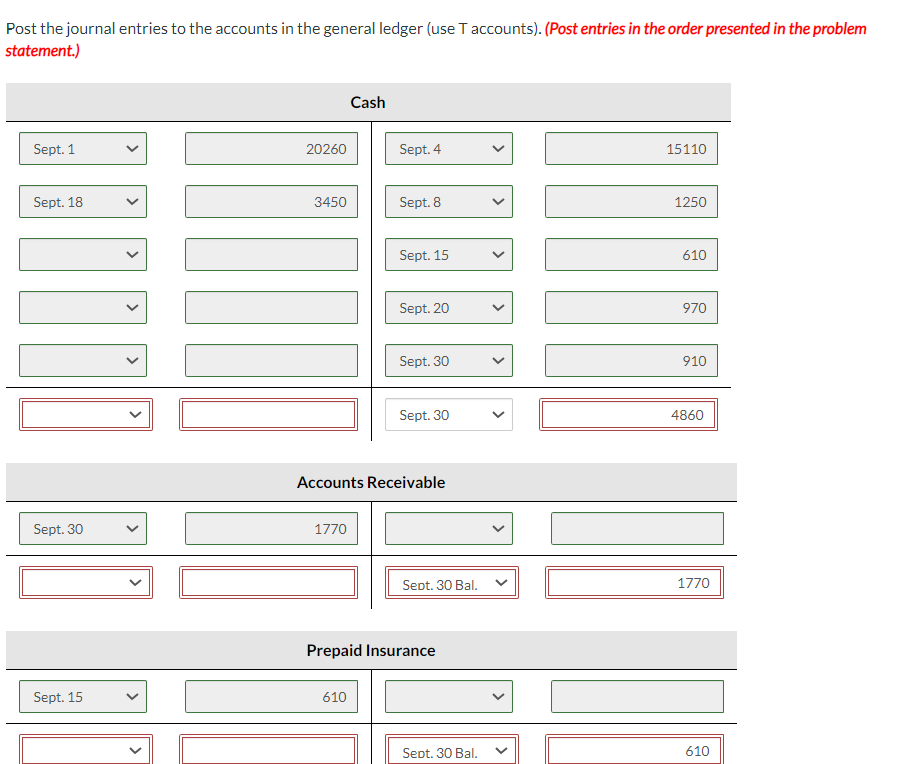

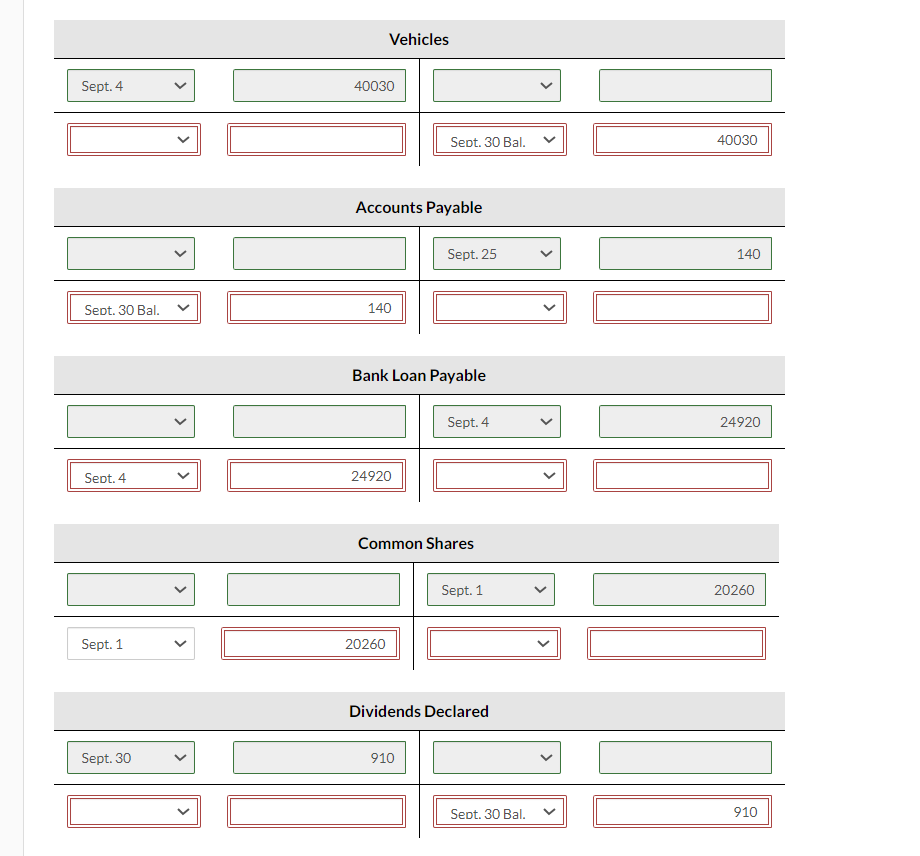

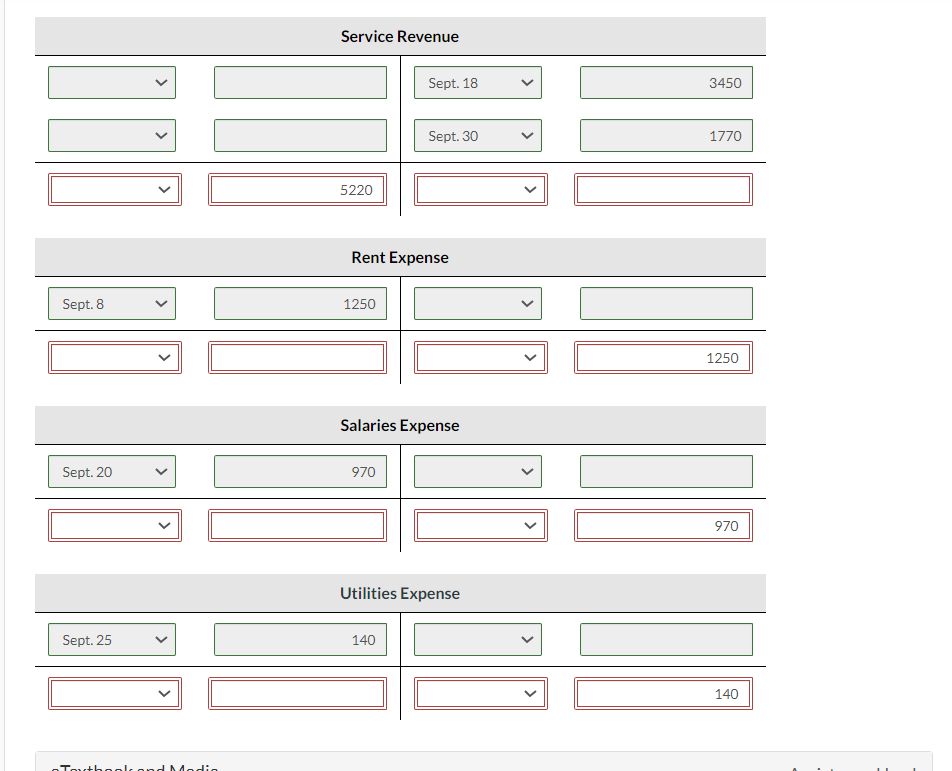

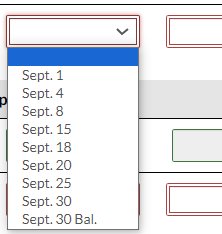

Please help in completing below question as I am struggling with the dates for Balance section.

Dropdown Values:

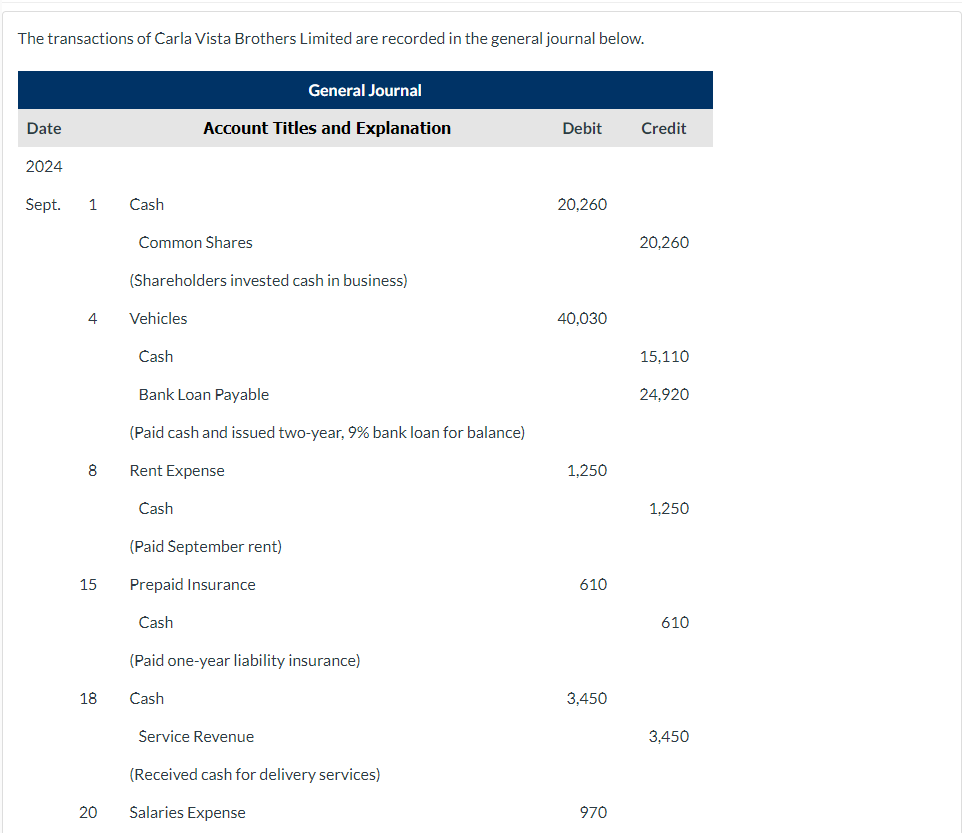

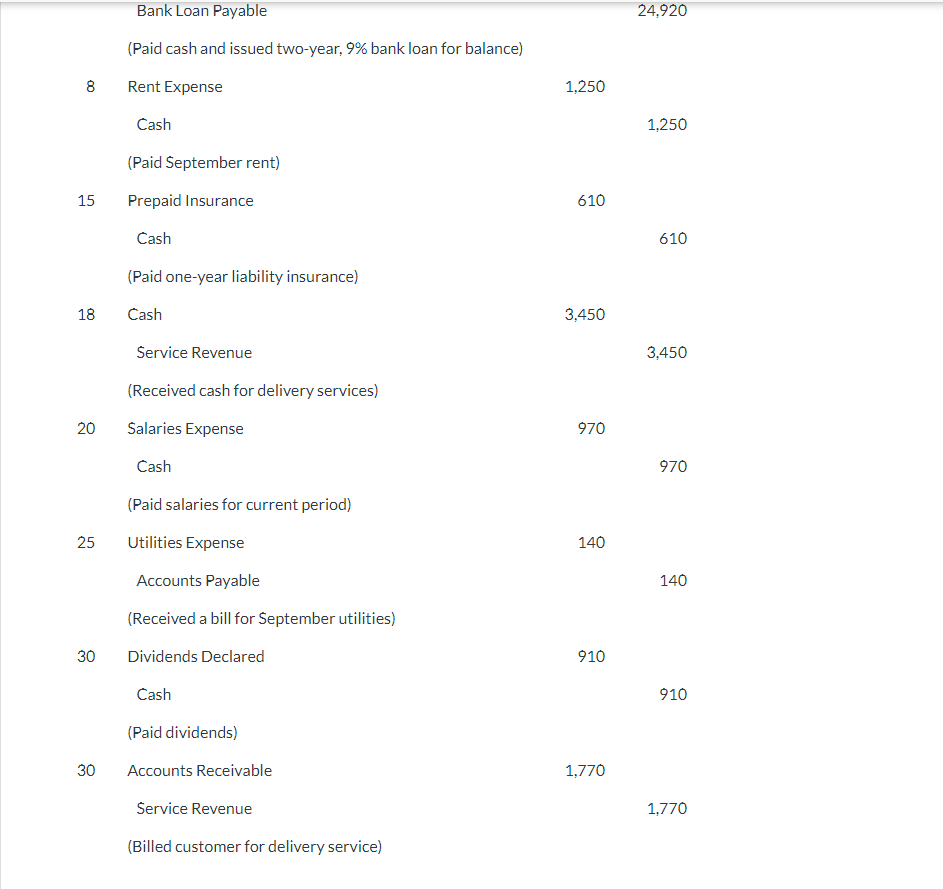

The trancartinne of Carla Victa Rrnthere I imited are rernerled in the oeneral inu urnal helnus \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Vehicles } \\ \hline Sept. 4 & 40030 & & \\ \hline & & Seot. 30 Bal. & 40030 \\ \hline \multicolumn{4}{|c|}{ Accounts Payable } \\ \hline & & Sept. 25 & 140 \\ \hline Seot. 30 Bal. & 140 & & \\ \hline \multicolumn{4}{|c|}{ Bank Loan Payable } \\ \hline & & Sept. 4 & 24920 \\ \hline Seot. 4 & 24920 & & \\ \hline \multicolumn{4}{|c|}{ Common Shares } \\ \hline & & Sept. 1 & 20260 \\ \hline Sept. 1 & 20260 & & \\ \hline \multicolumn{4}{|c|}{ Dividends Declared } \\ \hline Sept. 30 & 910 & & \\ \hline & & Seot. 30 Bal. & 910 \\ \hline \end{tabular} Sept. 1 Sept. 4 Sept. 8 Sept. 15 Sept. 18 Sept. 20 Sept. 25 Sept. 30 Sept. 30 Bal. Post the journal entries to the accounts in the general ledger (use T accounts). (Post entries in the order presented in the problem tatement.) Bank Loan Payable 24,920 (Paid cash and issued two-year, 9\% bank loan for balance) 8 Rent Expense 1,250 Cash 1,250 (Paid September rent) 15 Prepaid Insurance 610 Cash 610 (Paid one-year liability insurance) 18 Cash 3,450 Service Revenue 3,450 (Received cash for delivery services) 20 Salaries Expense 970 Cash 970 (Paid salaries for current period) 25 Utilities Expense 140 Accounts Payable 140 (Received a bill for September utilities) 30 Dividends Declared 910 Cash 910 (Paid dividends) 30 Accounts Receivable 1,770 Service Revenue 1,770 (Billed customer for delivery service)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts