Question: Please help in solving for the answers needed in green boxes A G K B D E 8.4 Carroll Clinic's 2020 operating budget and actual

Please help in solving for the answers needed in green boxes

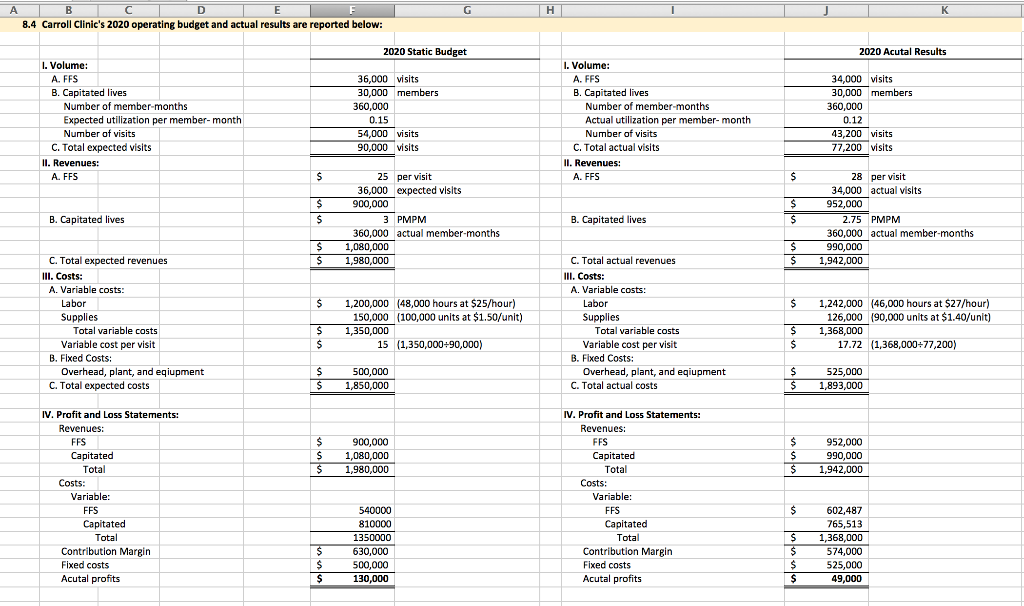

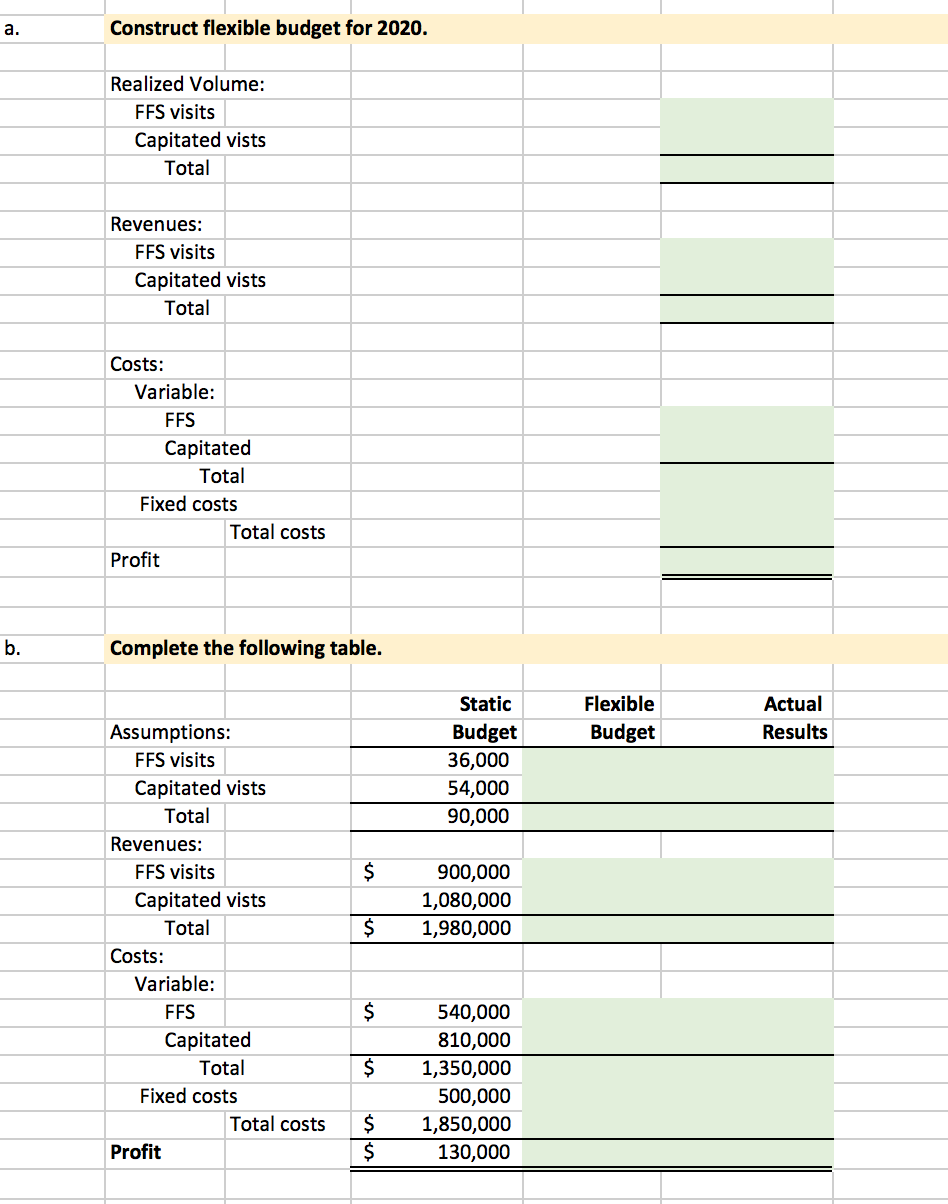

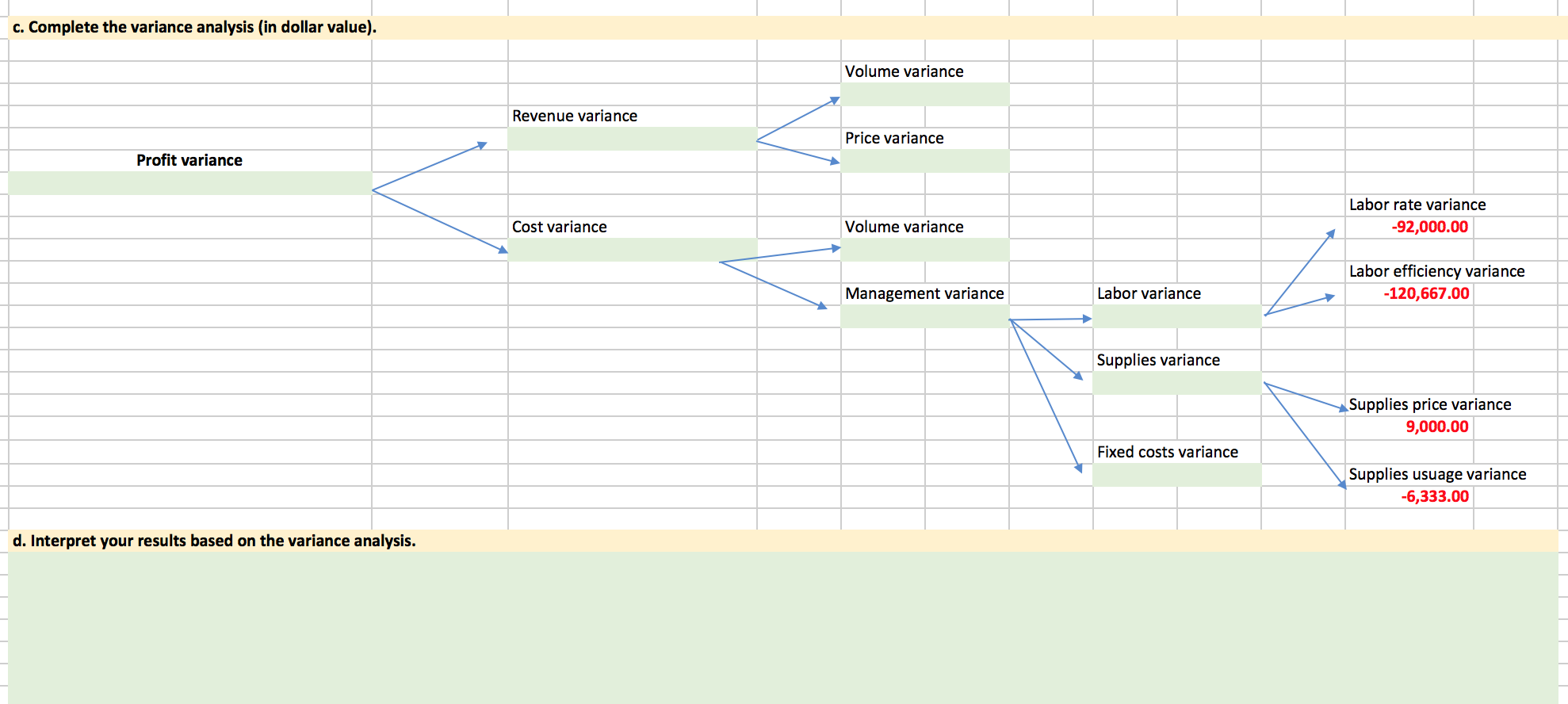

A G K B D E 8.4 Carroll Clinic's 2020 operating budget and actual results are reported below: 2020 Static Budget 2020 Acutal Results I Volume: A. FFS B. Capitated lives Number of member-months Expected utilization per member-month Number of visits C. Total expected visits II. Revenues: A. FFS 36,000 visits 30,000 members 360,000 0.15 54,000 visits 90,000 visits 1. Volume: A. FFS B. Capitated lives Number of member-months Actual utilization per member-month Number of visits C. Total actual visits II. Revenues: A. FFS 34,000 visits 30.000 members 360,000 0.12 13.200 visits 77,200 visits $ $ $ $ 25 per visit 36,000 expected visits 900,000 3 PMPM 360,000 actual member-months 1,080,000 1,980,000 $ $ B. Capitated lives B. Capitated lives 28 per visit 34,000 actual visits 952,000 2.75 PMPM 360,000 actual member-months 990,000 1,942,000 $ S $ $ $ $ C. Total expected revenues III. Costs: A. Variable costs: Labor Supplies Total variable costs Variable cost per visit B. Fixed Costs: Overhead, plant, and eqiupment C. Total expected costs 1,200,000 (48,000 hours at $25/hour) 150,000 (100,000 units at $1.50/unit) 1,350,000 15 (1,350,000:90,000) C. Total actual revenues III. Costs: A. Variable costs: Labor Supplies Total variable costs Variable cost per visit B. Fixed Costs: Overhead, plant, and eqiupment C. Total actual costs 1,242,000 (46,000 hours at $27/hour) 126,000 (90,000 units at $1.40/unit) 1,368,000 17.72 (1,368,000+77,200) $ $ $ $ $ $ 500,000 1,850,000 $ $ 525,000 1,893,000 $ $ $ 900,000 1,080,000 1,980,000 $ $ $ 952,000 990,000 1,942,000 IV. Profit and Loss Statements: Revenues: FFS Capitated Total Costs: Variable: FFS Capitated Total Contribution Margin Fixed costs Acutal profits IV. Profit and Loss Statements: Revenues: FFS Capitated Total Costs: Variable: FFS Capitated Total Contribution Margin Fixed costs Acutal profits $ 540000 810000 1350000 630,000 500,000 130,000 602,487 765,513 1,368,000 574,000 525,000 49,000 $ $ $ $ $ $ $ $ a. Construct flexible budget for 2020. Realized Volume: FFS visits Capitated vists Total Revenues: FFS visits Capitated vists Total Costs: Variable: FFS Capitated Total Fixed costs Total costs Profit b. Complete the following table. Flexible Budget Actual Results Static Budget 36,000 54,000 90,000 $ Assumptions: FFS visits Capitated vists Total Revenues: FFS visits Capitated vists Total Costs: Variable: FFS Capitated Total Fixed costs Total costs Profit 900,000 1,080,000 1,980,000 $ $ $ 540,000 810,000 1,350,000 500,000 1,850,000 130,000 $ $ c. Complete the variance analysis (in dollar value). Volume variance Revenue variance Price variance Profit variance Labor rate variance -92,000.00 Cost variance Volume variance Labor efficiency variance -120,667.00 Management variance Labor variance Supplies variance Supplies price variance 9,000.00 Fixed costs variance Supplies usuage variance -6,333.00 d. Interpret your results based on the variance analysis. A G K B D E 8.4 Carroll Clinic's 2020 operating budget and actual results are reported below: 2020 Static Budget 2020 Acutal Results I Volume: A. FFS B. Capitated lives Number of member-months Expected utilization per member-month Number of visits C. Total expected visits II. Revenues: A. FFS 36,000 visits 30,000 members 360,000 0.15 54,000 visits 90,000 visits 1. Volume: A. FFS B. Capitated lives Number of member-months Actual utilization per member-month Number of visits C. Total actual visits II. Revenues: A. FFS 34,000 visits 30.000 members 360,000 0.12 13.200 visits 77,200 visits $ $ $ $ 25 per visit 36,000 expected visits 900,000 3 PMPM 360,000 actual member-months 1,080,000 1,980,000 $ $ B. Capitated lives B. Capitated lives 28 per visit 34,000 actual visits 952,000 2.75 PMPM 360,000 actual member-months 990,000 1,942,000 $ S $ $ $ $ C. Total expected revenues III. Costs: A. Variable costs: Labor Supplies Total variable costs Variable cost per visit B. Fixed Costs: Overhead, plant, and eqiupment C. Total expected costs 1,200,000 (48,000 hours at $25/hour) 150,000 (100,000 units at $1.50/unit) 1,350,000 15 (1,350,000:90,000) C. Total actual revenues III. Costs: A. Variable costs: Labor Supplies Total variable costs Variable cost per visit B. Fixed Costs: Overhead, plant, and eqiupment C. Total actual costs 1,242,000 (46,000 hours at $27/hour) 126,000 (90,000 units at $1.40/unit) 1,368,000 17.72 (1,368,000+77,200) $ $ $ $ $ $ 500,000 1,850,000 $ $ 525,000 1,893,000 $ $ $ 900,000 1,080,000 1,980,000 $ $ $ 952,000 990,000 1,942,000 IV. Profit and Loss Statements: Revenues: FFS Capitated Total Costs: Variable: FFS Capitated Total Contribution Margin Fixed costs Acutal profits IV. Profit and Loss Statements: Revenues: FFS Capitated Total Costs: Variable: FFS Capitated Total Contribution Margin Fixed costs Acutal profits $ 540000 810000 1350000 630,000 500,000 130,000 602,487 765,513 1,368,000 574,000 525,000 49,000 $ $ $ $ $ $ $ $ a. Construct flexible budget for 2020. Realized Volume: FFS visits Capitated vists Total Revenues: FFS visits Capitated vists Total Costs: Variable: FFS Capitated Total Fixed costs Total costs Profit b. Complete the following table. Flexible Budget Actual Results Static Budget 36,000 54,000 90,000 $ Assumptions: FFS visits Capitated vists Total Revenues: FFS visits Capitated vists Total Costs: Variable: FFS Capitated Total Fixed costs Total costs Profit 900,000 1,080,000 1,980,000 $ $ $ 540,000 810,000 1,350,000 500,000 1,850,000 130,000 $ $ c. Complete the variance analysis (in dollar value). Volume variance Revenue variance Price variance Profit variance Labor rate variance -92,000.00 Cost variance Volume variance Labor efficiency variance -120,667.00 Management variance Labor variance Supplies variance Supplies price variance 9,000.00 Fixed costs variance Supplies usuage variance -6,333.00 d. Interpret your results based on the variance analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts