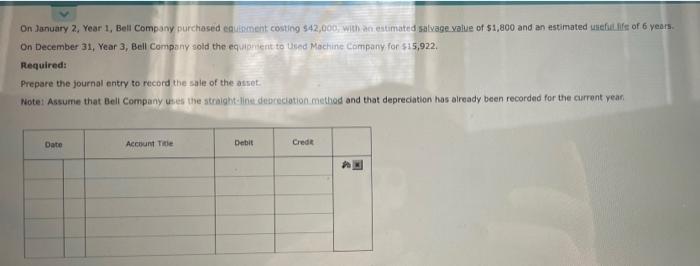

Question: please help in solving! On January 2, Year 1, Bell Company purchased equement conting $42,000, with an estimated salvage value of $1,800 and an estimated

On January 2, Year 1, Bell Company purchased equement conting $42,000, with an estimated salvage value of $1,800 and an estimated wat nfs of 6 years. On December 31, Year 3, Bell Company sold the equipment to Used Machine company for $15,922 Required: Prepare the journal entry to record the sale of the asset Note: Assume that Bell Company uses the straight-line depreciation method and that depreciation has already been recorded for the current year Date Account Title Debit Crede

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts