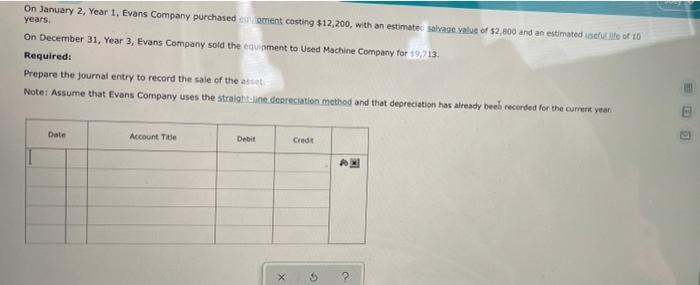

Question: please help in solving! On January 2, Year 1, Evans Company purchased cment costing $12,200, with an estimates salvage value of 52,800 and an estimated

On January 2, Year 1, Evans Company purchased cment costing $12,200, with an estimates salvage value of 52,800 and an estimated cut of 10 years. On December 31, Year 3, Evans Company sold the equipment to Used Machine Company for 9.213. Required: Prepare the journal entry to record the sale of the asset Note: Assume that Evans Company uses the straight line depreciation method and that depreciation has already beed recorded for the current year Date Account Title Debit Credit 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts