Question: Please help in solving question C. Thank you! Determining Bond Selling Price Calculate the bond selling price for the three separate scenarios that follow. a.

Please help in solving question C. Thank you!

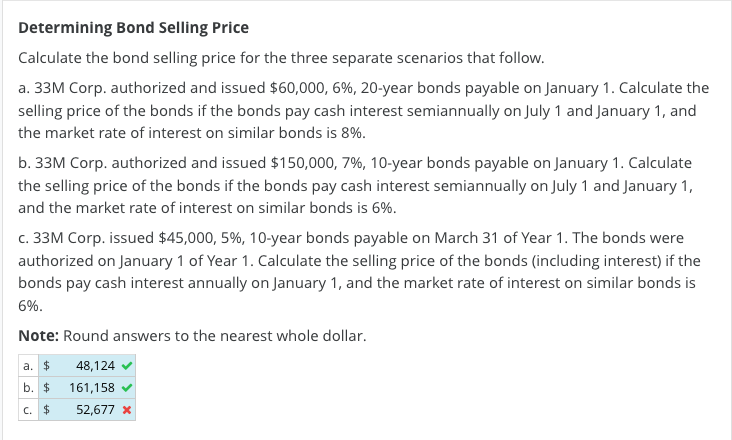

Determining Bond Selling Price Calculate the bond selling price for the three separate scenarios that follow. a. 33M Corp. authorized and issued $60,000,6%, 20-year bonds payable on January 1 . Calculate the selling price of the bonds if the bonds pay cash interest semiannually on July 1 and January 1 , and the market rate of interest on similar bonds is 8%. b. 33M Corp. authorized and issued $150,000,7%,10-year bonds payable on January 1 . Calculate the selling price of the bonds if the bonds pay cash interest semiannually on July 1 and January 1 , and the market rate of interest on similar bonds is 6%. c. 33M Corp. issued $45,000,5%,10-year bonds payable on March 31 of Year 1 . The bonds were authorized on January 1 of Year 1 . Calculate the selling price of the bonds (including interest) if the bonds pay cash interest annually on January 1 , and the market rate of interest on similar bonds is 6% Note: Round answers to the nearest whole dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts