Question: please help in these 6 quistions Walker Machine Tools has 6.5 million shares of common stock outstanding. The current market price of Walker common stock

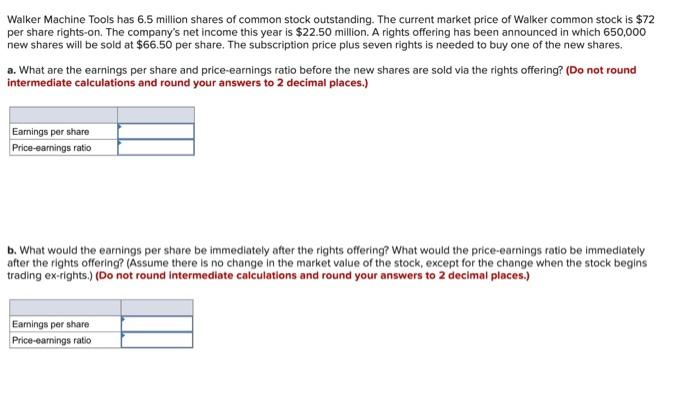

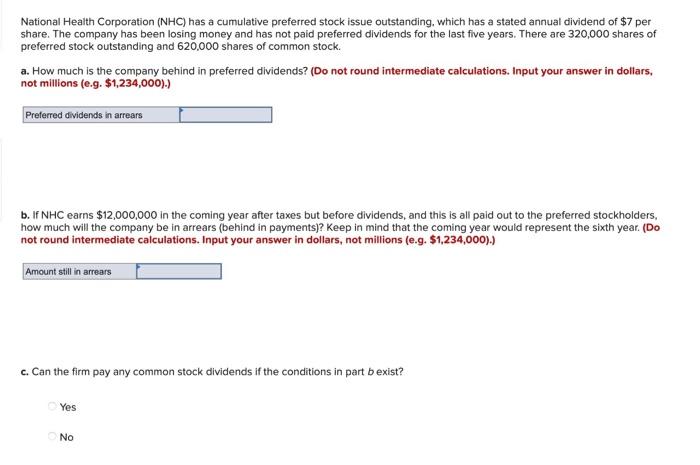

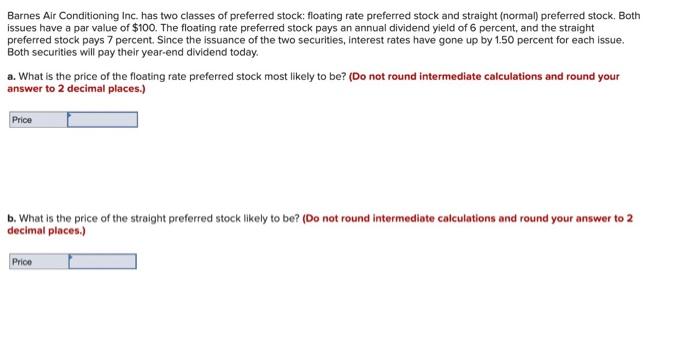

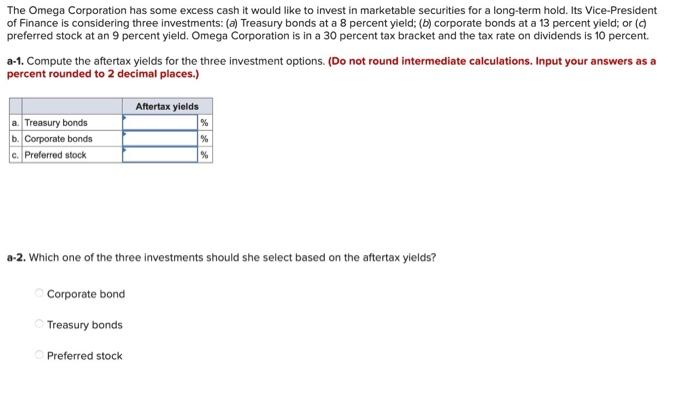

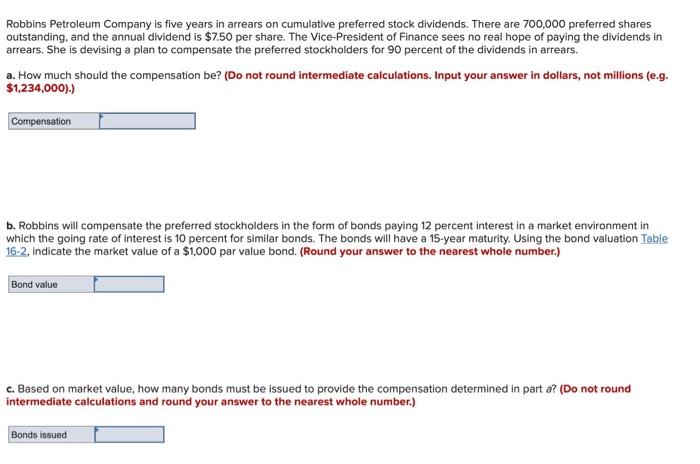

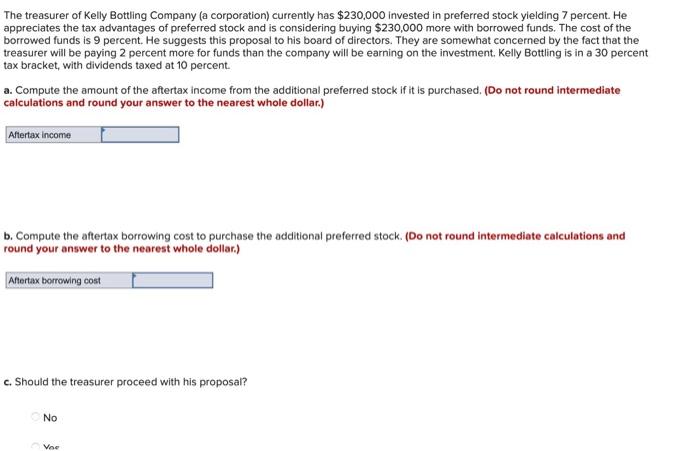

Walker Machine Tools has 6.5 million shares of common stock outstanding. The current market price of Walker common stock is $72 per share rights-on. The company's net income this year is $22.50 million. A rights offering has been announced in which 650,000 new shares will be sold at $66.50 per share. The subscription price plus seven rights is needed to buy one of the new shares. a. What are the earnings per share and price-earnings ratio before the new shares are sold via the rights offering? (Do not round intermediate calculations and round your answers to 2 decimal places.) Earnings per share Price-earnings ratio b. What would the earnings per share be immediately after the rights offering? What would the price-earnings ratio be immediately after the rights offering? (Assume there is no change in the market value of the stock, except for the change when the stock begins trading ex-rights.) (Do not round intermediate calculations and round your answers to 2 decimal places.) Earnings per share Price-earnings ratio National Health Corporation (NHC) has a cumulative preferred stock issue outstanding, which has a stated annual dividend of $7 per share. The company has been losing money and has not paid preferred dividends for the last five years. There are 320,000 shares of preferred stock outstanding and 620,000 shares of common stock. a. How much is the company behind in preferred dividends? (Do not round intermediate calculations. Input your answer in dollars, not millions (e.g. $1,234,000).) Preferred dividends in arrears b. If NHC earns $12,000,000 in the coming year after taxes but before dividends, and this is all paid out to the preferred stockholders, how much will the company be in arrears (behind in payments)? Keep in mind that the coming year would represent the sixth year. (Do not round intermediate calculations. Input your answer in dollars, not millions (e.g. $1,234,000).) Amount still in arrears c. Can the firm pay any common stock dividends if the conditions in part bexist? Yes No Barnes Air Conditioning Inc. has two classes of preferred stock: floating rate preferred stock and straight (normal) preferred stock. Both issues have a par value of $100. The floating rate preferred stock pays an annual dividend yield of 6 percent, and the straight preferred stock pays 7 percent. Since the issuance of the two securities, interest rates have gone up by 150 percent for each issue. Both securities will pay their year-end dividend today. a. What is the price of the floating rate preferred stock most likely to be? (Do not round intermediate calculations and round your answer to 2 decimal places.) Price b. What is the price of the straight preferred stock likely to be? (Do not round intermediate calculations and round your answer to 2 decimal places.) Price The Omega Corporation has some excess cash it would like to invest in marketable securities for a long-term hold. Its Vice-President of Finance is considering three investments: (a) Treasury bonds at a 8 percent yield; (b) corporate bonds at a 13 percent yield; or (a preferred stock at an 9 percent yield. Omega Corporation is in a 30 percent tax bracket and the tax rate on dividends is 10 percent. a-1. Compute the aftertax yields for the three investment options. (Do not round intermediate calculations. Input your answers as a percent rounded to 2 decimal places.) Aftertax yields Treasury bonds b. Corporate bonds c. Preferred stock % % a-2. Which one of the three investments should she select based on the aftertax yields? Corporate bond Treasury bonds Preferred stock Robbins Petroleum Company is five years in arrears on cumulative preferred stock dividends. There are 700,000 preferred shares outstanding, and the annual dividend is $7.50 per share. The Vice-President of Finance sees no real hope of paying the dividends in arrears. She is devising a plan to compensate the preferred stockholders for 90 percent of the dividends in arrears. a. How much should the compensation be? (Do not round intermediate calculations. Input your answer in dollars, not millions (e.g. $1,234,000).) Compensation b. Robbins will compensate the preferred stockholders in the form of bonds paying 12 percent interest in a market environment in which the going rate of interest is 10 percent for similar bonds. The bonds will have a 15-year maturity. Using the bond valuation Table 16-2. indicate the market value of a $1,000 par value bond. (Round your answer to the nearest whole number.) Bond value c. Based on market value, how many bonds must be issued to provide the compensation determined in part a? (Do not round intermediate calculations and round your answer to the nearest whole number.) Bonds issued The treasurer of Kelly Bottling Company (a corporation) currently has $230,000 invested in preferred stock yielding 7 percent. He appreciates the tax advantages of preferred stock and is considering buying $230,000 more with borrowed funds. The cost of the borrowed funds is 9 percent. He suggests this proposal to his board of directors. They are somewhat concerned by the fact that the treasurer will be paying 2 percent more for funds than the company will be earning on the investment, Kelly Bottling is in a 30 percent tax bracket, with dividends taxed at 10 percent. a. Compute the amount of the aftertax income from the additional preferred stock if it is purchased. (Do not round intermediate calculations and round your answer to the nearest whole dollar.) Aftertax income b. Compute the aftertax borrowing cost to purchase the additional preferred stock. (Do not round intermediate calculations and round your answer to the nearest whole dollar) Aftortax borrowing cost c. Should the treasurer proceed with his proposal? No Voe

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts