Question: please help Instructions Journal (b) Journalize the March 31 adjusting entry required when the amount of unexpired insurance applicable to future periods is $4,040. Refer

please help

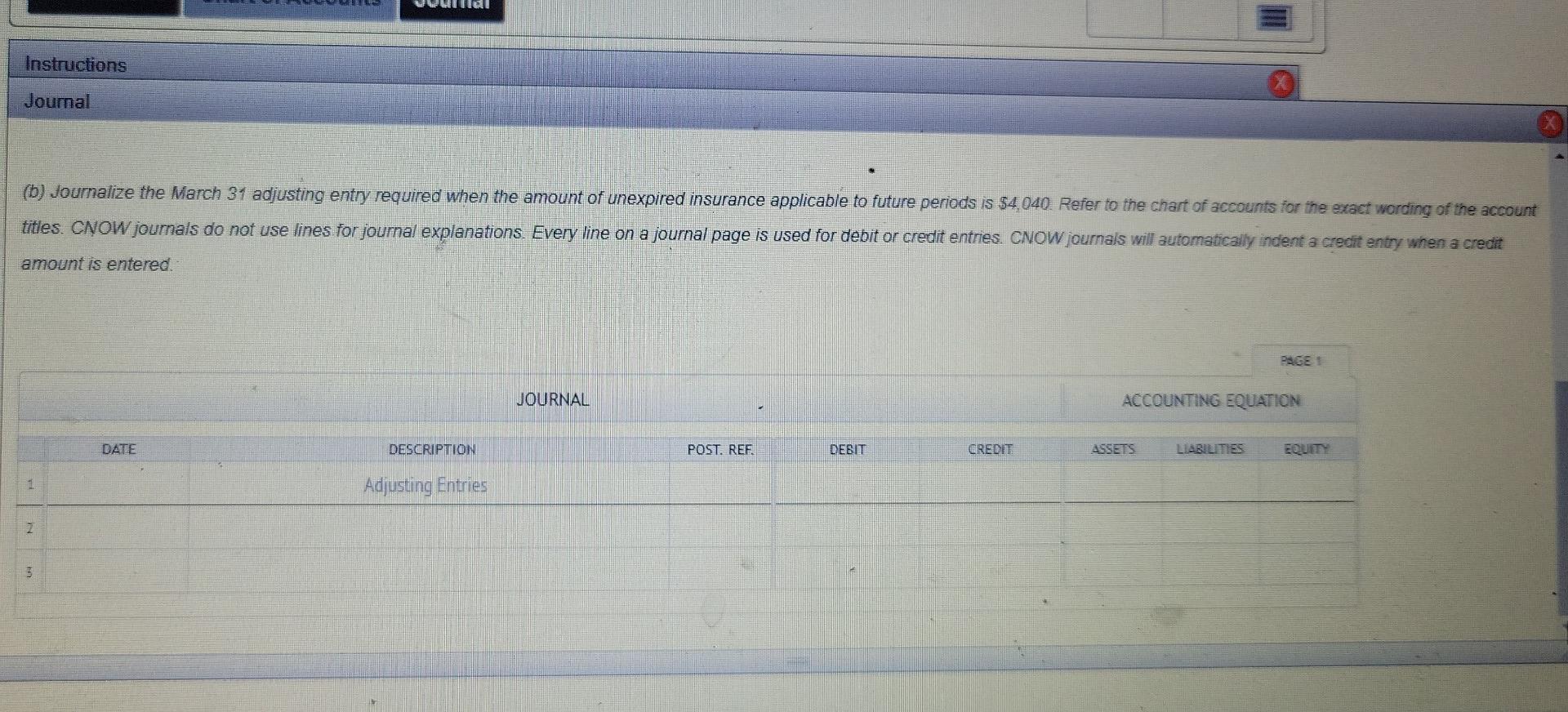

Instructions Journal (b) Journalize the March 31 adjusting entry required when the amount of unexpired insurance applicable to future periods is $4,040. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. PAGE 1 JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION POST. REF. DEBIT CREDIT LIABILITIES Adjusting Entries 1 2 3 ASSETS EQUITY Instructions Journal (b) Journalize the March 31 adjusting entry required when the amount of unexpired insurance applicable to future periods is $4,040. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. PAGE 1 JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION POST. REF. DEBIT CREDIT LIABILITIES Adjusting Entries 1 2 3 ASSETS EQUITY Instructions Journal (b) Journalize the March 31 adjusting entry required when the amount of unexpired insurance applicable to future periods is $4,040. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. PAGE 1 JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION POST. REF. DEBIT CREDIT LIABILITIES Adjusting Entries 1 2 3 ASSETS EQUITY Instructions Journal (b) Journalize the March 31 adjusting entry required when the amount of unexpired insurance applicable to future periods is $4,040. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. PAGE 1 JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION POST. REF. DEBIT CREDIT LIABILITIES Adjusting Entries 1 2 3 ASSETS EQUITY Instructions Journal (b) Journalize the March 31 adjusting entry required when the amount of unexpired insurance applicable to future periods is $4,040. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. PAGE 1 JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION POST. REF. DEBIT CREDIT LIABILITIES Adjusting Entries 1 2 3 ASSETS EQUITY Instructions Journal (b) Journalize the March 31 adjusting entry required when the amount of unexpired insurance applicable to future periods is $4,040. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. PAGE 1 JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION POST. REF. DEBIT CREDIT LIABILITIES Adjusting Entries 1 2 3 ASSETS EQUITY

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts