Question: Please help . Instructions Selected transactions completed by Primo Discount Corporation during the current fiscal year are as follows: Jan. 9 Split the common stock

Please help .

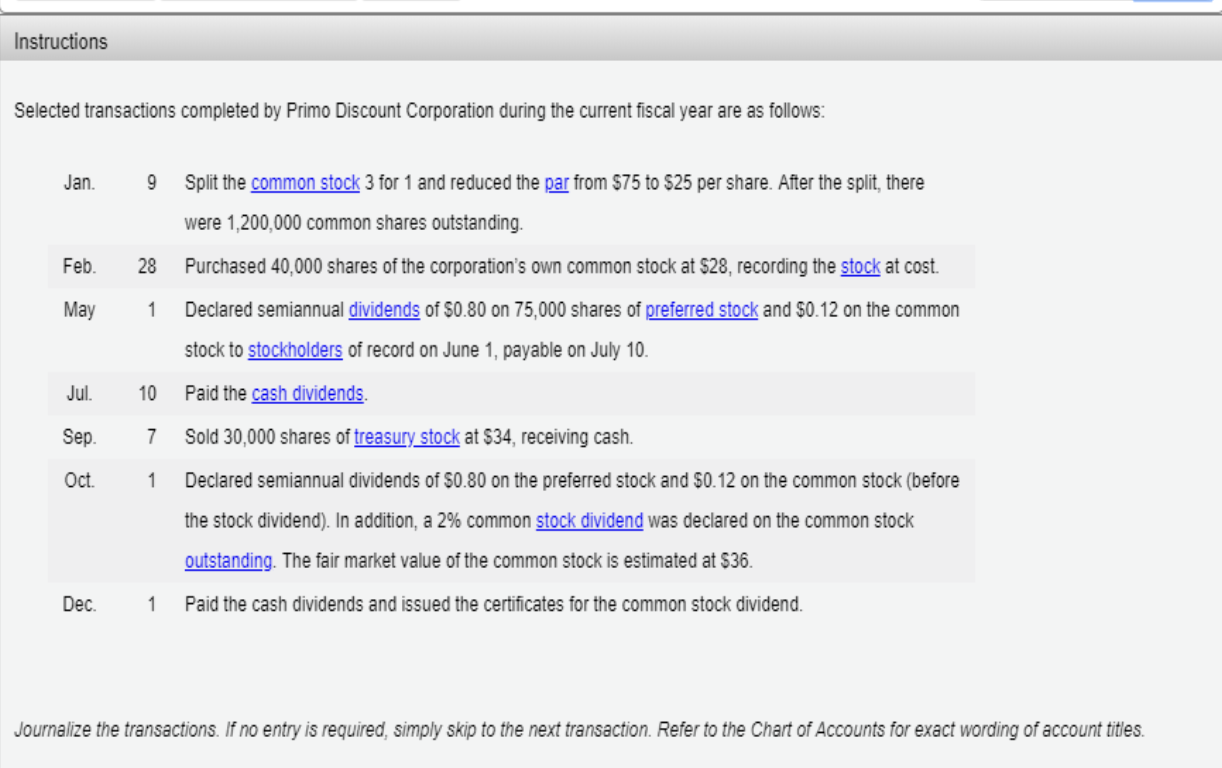

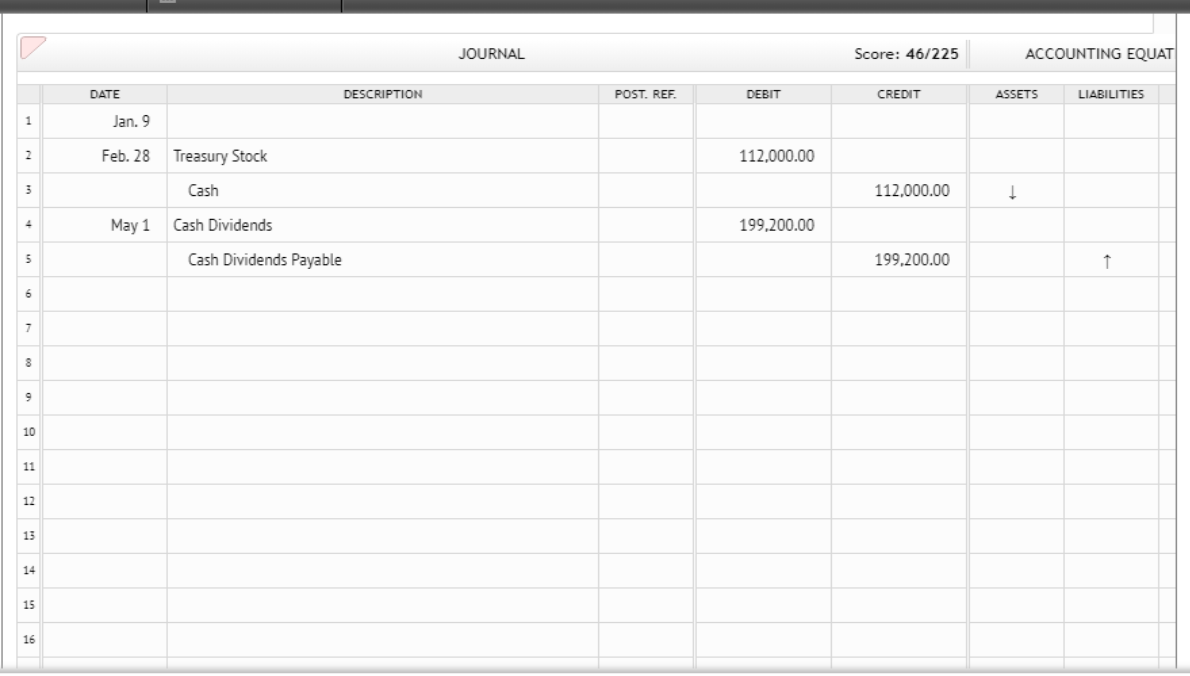

Instructions Selected transactions completed by Primo Discount Corporation during the current fiscal year are as follows: Jan. 9 Split the common stock 3 for 1 and reduced the par from $75 to $25 per share. After the split, there were 1,200,000 common shares outstanding. Feb. 28 Purchased 40,000 shares of the corporation's own common stock at $28, recording the stock at cost. May 1 Declared semiannual dividends of $0.80 on 75,000 shares of preferred stock and $0.12 on the common stock to stockholders of record on June 1, payable on July 10. Jul. 10 Paid the cash dividends. Sep 7 Sold 30,000 shares of treasury stock at $34, receiving cash. Oct. 1 Declared semiannual dividends of $0.80 on the preferred stock and $0.12 on the common stock (before the stock dividend). In addition, a 2% common stock dividend was declared on the common stock outstanding. The fair market value of the common stock is estimated at $36. Dec. 1 Paid the cash dividends and issued the certificates for the common stock dividend. Journalize the transactions. If no entry is required, simply skip to the next transaction. Refer to the Chart of Accounts for exact wording of account titles.JOURNAL Score: 46/225 ACCOUNTING EQUAT DATE DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES Jan. 9 Feb. 28 Treasury Stock 112,000.00 Cash 112,000.00 May 1 Cash Dividends 199,200.00 5 Cash Dividends Payable 199,200.00 5 7 9 10 11 12 13 14 15 16

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts