Question: PLEASE HELP!! Its timed so i dont have much time left An asset used in a 4 -year project folls in the 5 year MACRS

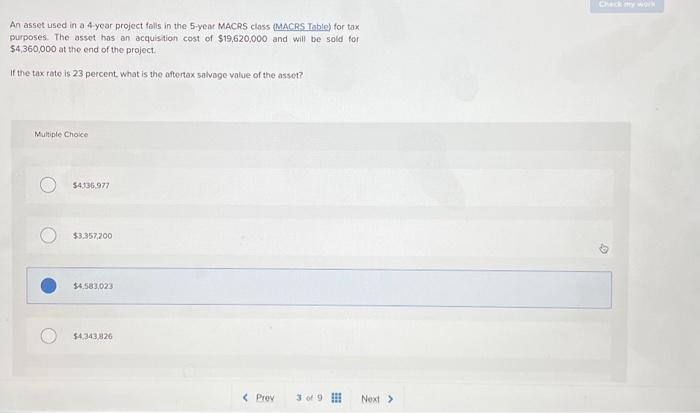

An asset used in a 4 -year project folls in the 5 year MACRS class (MACRS Table) for tax purposes. The asset has an acquistion cost of $19,620,000 and will be sold for $4,360,000 at the end of the project. If the tax rate is 23 percent, what is the aftortax salvage value of the asset? Multiple Choice $4.56.977 $3,357,200 $4,583,023 54.343 .826 If the tax rate is 23 percent, what is the aftertax salvage value of the asset? Multiple Choice $4,136,977 $3,357,200 $4,583.023 $4,343,826 $3,930,128

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts