Question: please help. its urget You are examining the financial viability of investing in some abandoned copper mines in Chile, which still have significant copper deposits

please help. its urget

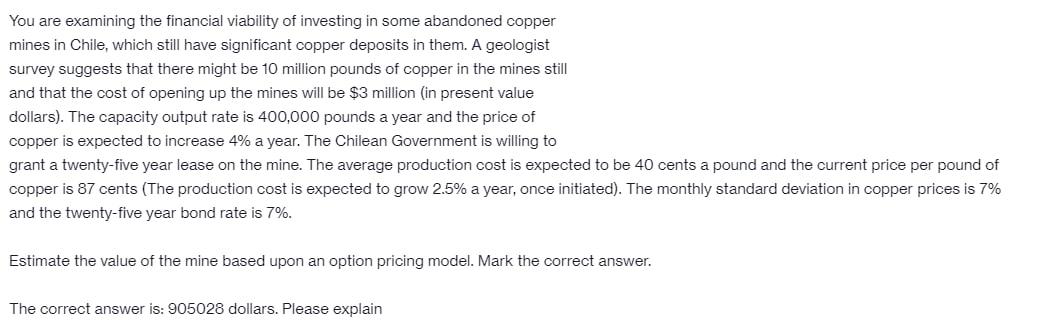

You are examining the financial viability of investing in some abandoned copper mines in Chile, which still have significant copper deposits in them. A geologist survey suggests that there might be 10 million pounds of copper in the mines still and that the cost of opening up the mines will be $3 million (in present value dollars). The capacity output rate is 400,000 pounds a year and the price of copper is expected to increase 4% a year. The Chilean Government is willing to grant a twenty-five year lease on the mine. The average production cost is expected to be 40 cents a pound and the current price per pound of copper is 87 cents (The production cost is expected to grow 2.5% a year, once initiated). The monthly standard deviation in copper prices is 7% and the twenty-five year bond rate is 7%. Estimate the value of the mine based upon an option pricing model. Mark the correct answer. The correct answer is: 905028 dollars. Please explain You are examining the financial viability of investing in some abandoned copper mines in Chile, which still have significant copper deposits in them. A geologist survey suggests that there might be 10 million pounds of copper in the mines still and that the cost of opening up the mines will be $3 million (in present value dollars). The capacity output rate is 400,000 pounds a year and the price of copper is expected to increase 4% a year. The Chilean Government is willing to grant a twenty-five year lease on the mine. The average production cost is expected to be 40 cents a pound and the current price per pound of copper is 87 cents (The production cost is expected to grow 2.5% a year, once initiated). The monthly standard deviation in copper prices is 7% and the twenty-five year bond rate is 7%. Estimate the value of the mine based upon an option pricing model. Mark the correct answer. The correct answer is: 905028 dollars. Please explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts