Question: please help. ive also uploaded 2019 tax rates if needed Part 2: Abagail is 66 not married and fully supports her 16 year old daughter

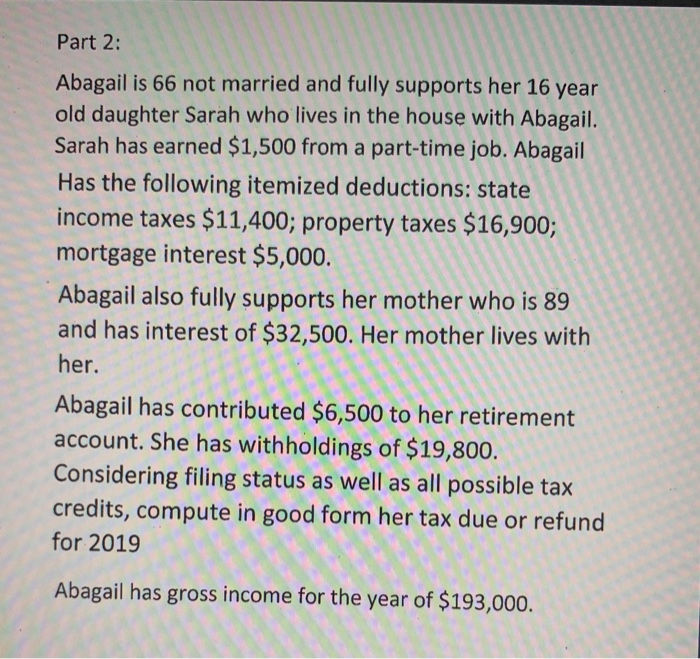

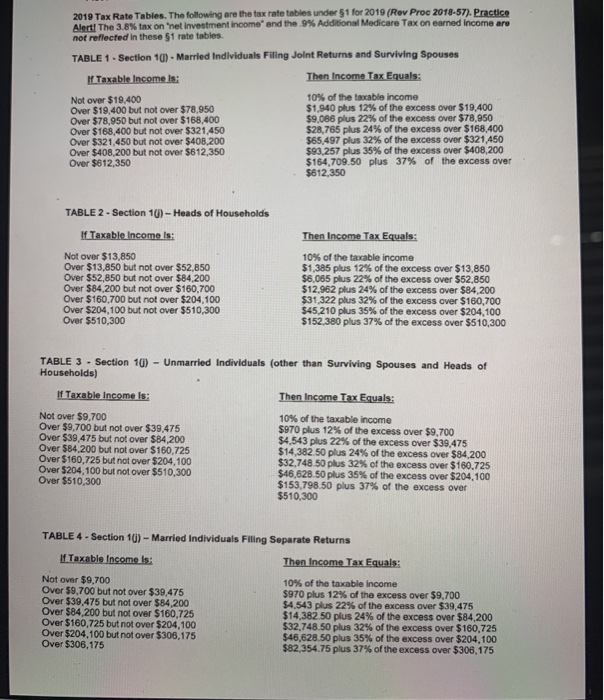

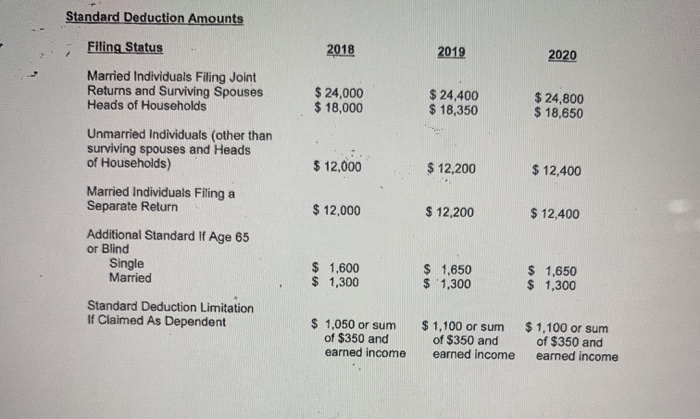

Part 2: Abagail is 66 not married and fully supports her 16 year old daughter Sarah who lives in the house with Abagail. Sarah has earned $1,500 from a part-time job. Abagail Has the following itemized deductions: state income taxes $11,400; property taxes $16,900; mortgage interest $5,000. Abagail also fully supports her mother who is 89 and has interest of $32,500. Her mother lives with her. Abagail has contributed $6,500 to her retirement account. She has withholdings of $19,800. Considering filing status as well as all possible tax credits, compute in good form her tax due or refund for 2019 Abagail has gross income for the year of $193,000. 2019 Tax Rate Tables. The following are the tax rate tables under $1 for 2019 (Rev Proc 2018-57). Practice Alert! The 3.8% tax on "net investment income and the 9% Additional Medicare Tax on earned income are not reflected in these $1 rate tables. TABLE 1 - Section 10) - Married Individuals Filing Joint Returns and Surviving Spouses Taxable income is: Then Income Tax Equals: Not over $19.400 10% of the taxable income Over $19,400 but not over $78,950 $1.940 plus 12% of the excess over $19,400 Over $78,950 but not over $168,400 $9,086 plus 22% of the excess over $78,950 Over $168,400 but not over $321,450 $28,765 plus 24% of the excess over $168.400 Over $321,450 but not over $408,200 $65,497 plus 32% of the excess over $321,450 Over $408,200 but not over $612,350 $93,257 plus 35% of the excess over $408,200 Over $612,350 $164,709.50 plus 37% of the excess over $612,350 TABLE 2 - Section 10) - Heads of Households If Taxable income is: Then Income Tax Equals: Not over $13,850 Over $13,850 but not over $52,850 Over $52,850 but not over $84.200 Over $84,200 but not over $160,700 Over $160,700 but not over $204,100 Over $204,100 but not over $510,300 Over $510,300 10% of the taxable income $1,385 plus 12% of the excess over $13.850 $6,065 plus 22% of the excess over $52,850 $12,962 plus 24% of the excess over $84,200 $31,322 plus 32% of the excess over $160,700 $45,210 plus 35% of the excess over $204,100 $152,380 plus 37% of the excess over $510,300 TABLE 3 - Section 10) - Unmarried Individuals (other than Surviving Spouses and Heads of Households) If Taxable income is: Then Income Tax Equals: Not over $9,700 10% of the taxable income Over $9.700 but not over $39,475 $970 plus 12% of the excess over $9.700 ver $39,475 but not over $84.200 $4,543 plus 22% of the excess over $39,475 Over $84.200 but not over $160,725 $14,382.50 plus 24% of the excess over $84.200 Over $160,725 but not over $204,100 $32.748.50 plus 32% of the excess over $160.725 Over $204,100 but not over $510,300 $46,628.50 plus 35% of the excess over $204,100 Over $510,300 $153,798,50 plus 37% of the excess over $510,300 TABLE 4 - Section 10) - Married Individuals Filing Separate Returns If Taxable income is: Then Income Tax Equals: Not over $9,700 Over $9.700 but not over $39,475 Over $39,475 but not over $84,200 Over $84,200 but not over $160,725 Over $160,725 but not over $204,100 Over $204,100 but not over $306,175 Over $306,175 10% of the taxable income $970 plus 12% of the excess over $9,700 $4,543 plus 22% of the excess over $39,475 $14,382 50 plus 24% of the excess over $84.200 $32,748.50 plus 32% of the excess over $160,725 $46,628.50 plus 35% of the excess over $204,100 $82,354.75 plus 37% of the excess over $306,175 Standard Deduction Amounts Filing Status 2018 2019 2020 Married Individuals Filing Joint Returns and Surviving Spouses Heads of Households $ 24,000 $ 18,000 $ 24,400 $ 18,350 $ 24,800 $ 18,650 Unmarried Individuals (other than surviving spouses and Heads of Households) Married Individuals Filing a Separate Return $ 12,000 $ 12,200 $ 12,400 $ 12,000 $ 12,200 $ 12,400 Additional Standard If Age 65 or Blind Single Married $ 1.600 $ 1,300 $ 1,650 $ 1,300 $ 1,650 $ 1,300 Standard Deduction Limitation If Claimed As Dependent $ 1.050 or sum of $350 and earned income $ 1,100 or sum of $350 and earned income $ 1,100 or sum of $350 and earned income Part 2: Abagail is 66 not married and fully supports her 16 year old daughter Sarah who lives in the house with Abagail. Sarah has earned $1,500 from a part-time job. Abagail Has the following itemized deductions: state income taxes $11,400; property taxes $16,900; mortgage interest $5,000. Abagail also fully supports her mother who is 89 and has interest of $32,500. Her mother lives with her. Abagail has contributed $6,500 to her retirement account. She has withholdings of $19,800. Considering filing status as well as all possible tax credits, compute in good form her tax due or refund for 2019 Abagail has gross income for the year of $193,000. 2019 Tax Rate Tables. The following are the tax rate tables under $1 for 2019 (Rev Proc 2018-57). Practice Alert! The 3.8% tax on "net investment income and the 9% Additional Medicare Tax on earned income are not reflected in these $1 rate tables. TABLE 1 - Section 10) - Married Individuals Filing Joint Returns and Surviving Spouses Taxable income is: Then Income Tax Equals: Not over $19.400 10% of the taxable income Over $19,400 but not over $78,950 $1.940 plus 12% of the excess over $19,400 Over $78,950 but not over $168,400 $9,086 plus 22% of the excess over $78,950 Over $168,400 but not over $321,450 $28,765 plus 24% of the excess over $168.400 Over $321,450 but not over $408,200 $65,497 plus 32% of the excess over $321,450 Over $408,200 but not over $612,350 $93,257 plus 35% of the excess over $408,200 Over $612,350 $164,709.50 plus 37% of the excess over $612,350 TABLE 2 - Section 10) - Heads of Households If Taxable income is: Then Income Tax Equals: Not over $13,850 Over $13,850 but not over $52,850 Over $52,850 but not over $84.200 Over $84,200 but not over $160,700 Over $160,700 but not over $204,100 Over $204,100 but not over $510,300 Over $510,300 10% of the taxable income $1,385 plus 12% of the excess over $13.850 $6,065 plus 22% of the excess over $52,850 $12,962 plus 24% of the excess over $84,200 $31,322 plus 32% of the excess over $160,700 $45,210 plus 35% of the excess over $204,100 $152,380 plus 37% of the excess over $510,300 TABLE 3 - Section 10) - Unmarried Individuals (other than Surviving Spouses and Heads of Households) If Taxable income is: Then Income Tax Equals: Not over $9,700 10% of the taxable income Over $9.700 but not over $39,475 $970 plus 12% of the excess over $9.700 ver $39,475 but not over $84.200 $4,543 plus 22% of the excess over $39,475 Over $84.200 but not over $160,725 $14,382.50 plus 24% of the excess over $84.200 Over $160,725 but not over $204,100 $32.748.50 plus 32% of the excess over $160.725 Over $204,100 but not over $510,300 $46,628.50 plus 35% of the excess over $204,100 Over $510,300 $153,798,50 plus 37% of the excess over $510,300 TABLE 4 - Section 10) - Married Individuals Filing Separate Returns If Taxable income is: Then Income Tax Equals: Not over $9,700 Over $9.700 but not over $39,475 Over $39,475 but not over $84,200 Over $84,200 but not over $160,725 Over $160,725 but not over $204,100 Over $204,100 but not over $306,175 Over $306,175 10% of the taxable income $970 plus 12% of the excess over $9,700 $4,543 plus 22% of the excess over $39,475 $14,382 50 plus 24% of the excess over $84.200 $32,748.50 plus 32% of the excess over $160,725 $46,628.50 plus 35% of the excess over $204,100 $82,354.75 plus 37% of the excess over $306,175 Standard Deduction Amounts Filing Status 2018 2019 2020 Married Individuals Filing Joint Returns and Surviving Spouses Heads of Households $ 24,000 $ 18,000 $ 24,400 $ 18,350 $ 24,800 $ 18,650 Unmarried Individuals (other than surviving spouses and Heads of Households) Married Individuals Filing a Separate Return $ 12,000 $ 12,200 $ 12,400 $ 12,000 $ 12,200 $ 12,400 Additional Standard If Age 65 or Blind Single Married $ 1.600 $ 1,300 $ 1,650 $ 1,300 $ 1,650 $ 1,300 Standard Deduction Limitation If Claimed As Dependent $ 1.050 or sum of $350 and earned income $ 1,100 or sum of $350 and earned income $ 1,100 or sum of $350 and earned income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts