Question: Please help! I've been stuck on this problem for 30 minutes and this is my last attempt Amortization schedule. Chuck Ponzi has talked an elderly

Please help! I've been stuck on this problem for 30 minutes and this is my last attempt

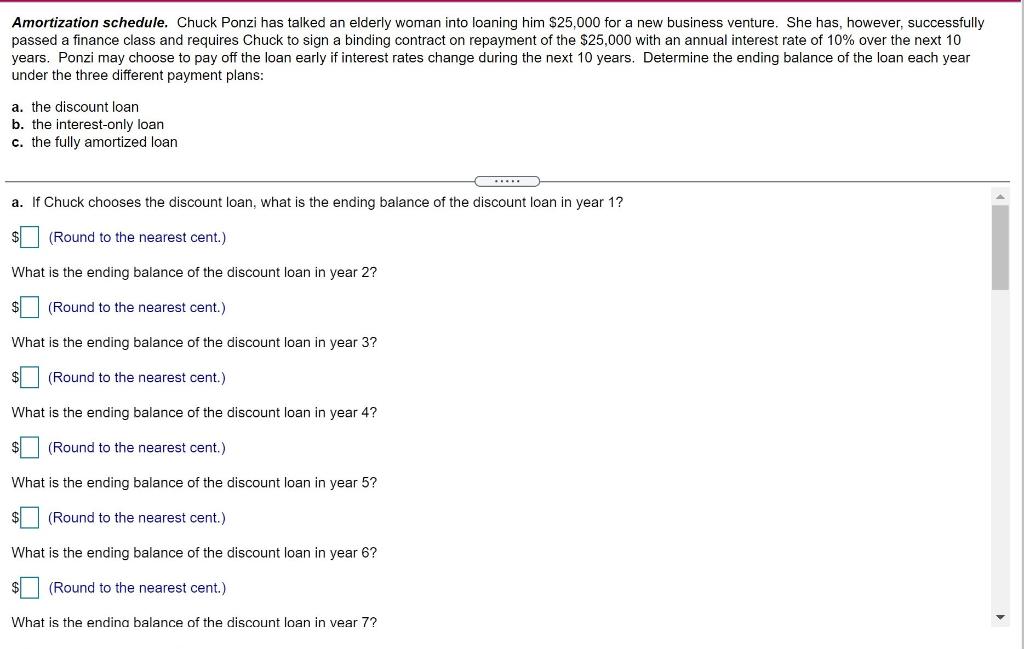

Amortization schedule. Chuck Ponzi has talked an elderly woman into loaning him $25,000 for a new business venture. She has, however, successfully passed a finance class and requires Chuck to sign a binding contract on repayment of the $25,000 with an annual interest rate of 10% over the next 10 years. Ponzi may choose to pay off the loan early if interest rates change during the next 10 years. Determine the ending balance of the loan each year under the three different payment plans: a. the discount loan b. the interest-only loan c. the fully amortized loan a. If Chuck chooses the discount loan, what is the ending balance of the discount loan in year 1? (Round to the nearest cent.) What is the ending balance of the discount loan in year 2? $ (Round to the nearest cent.) What is the ending balance of the discount loan in year 3? $ (Round to the nearest cent.) What is the ending balance of the discount loan in year 4? (Round to the nearest cent.) What is the ending balance of the discount loan in year 5? $ (Round to the nearest cent.) What is the ending balance of the discount loan in year 6? (Round to the nearest cent.) What is the ending balance of the discount loan in vear 7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts