Question: please help j j j j j j Required information Problem 13-34A (Algo) Two complete accounting cycles LO 13-1, 13-2, 13-3, 13-4 [The following information

please help

j

j

j![information applies to the questions displayed below.] Colton Enterprises experienced the following](https://s3.amazonaws.com/si.experts.images/answers/2024/07/66a98289b2a92_03366a9828910a15.jpg)

j

j

j

j

j

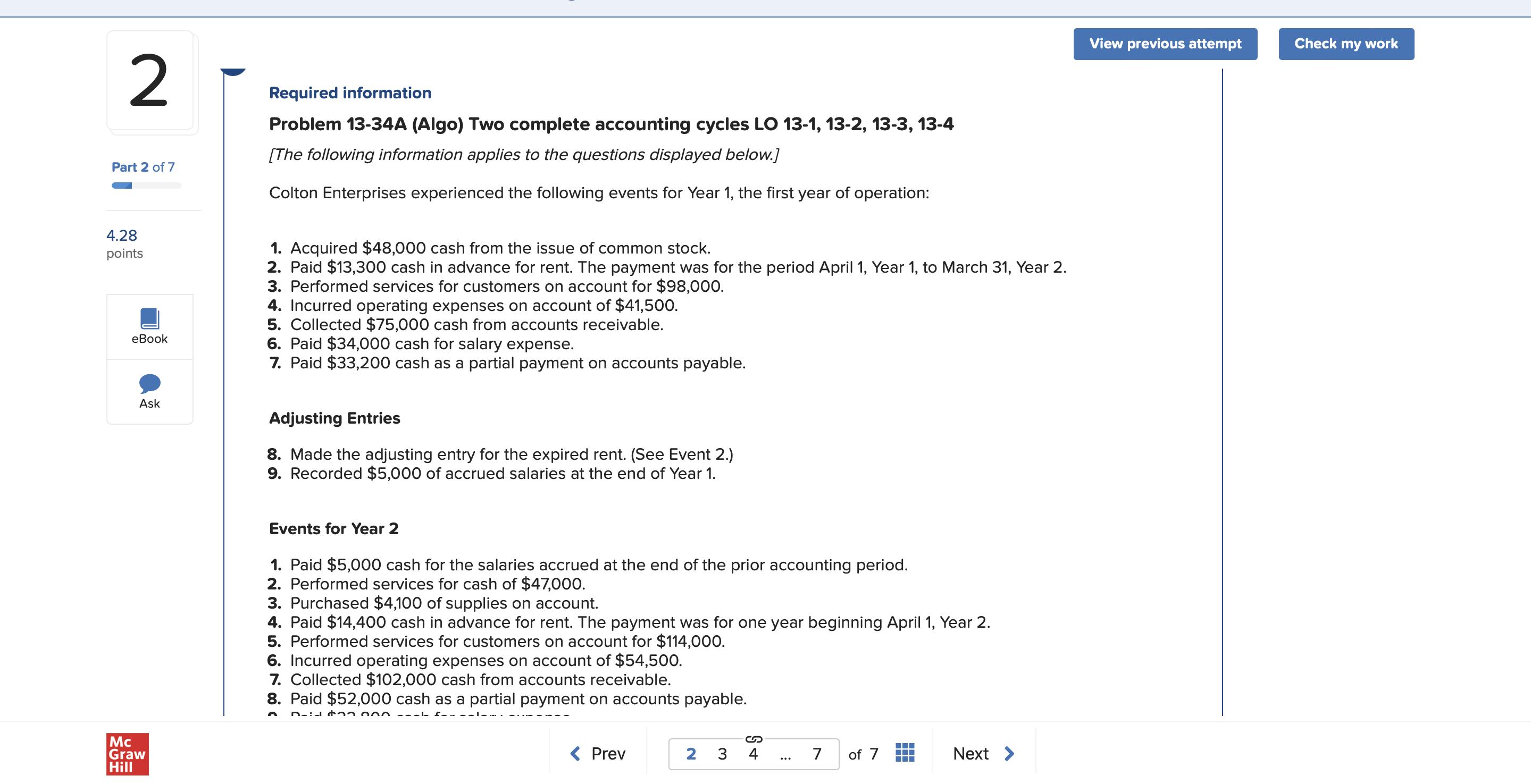

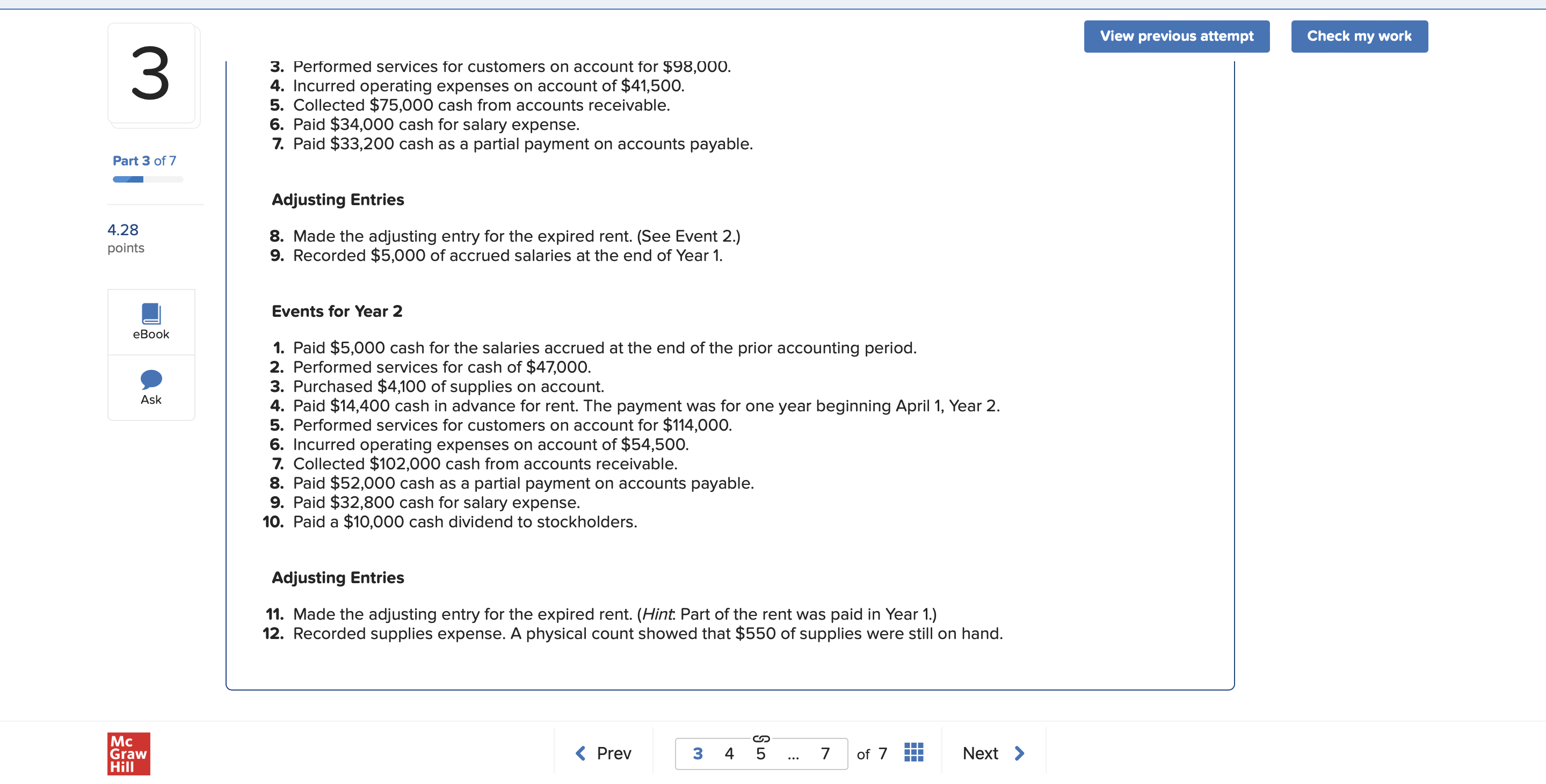

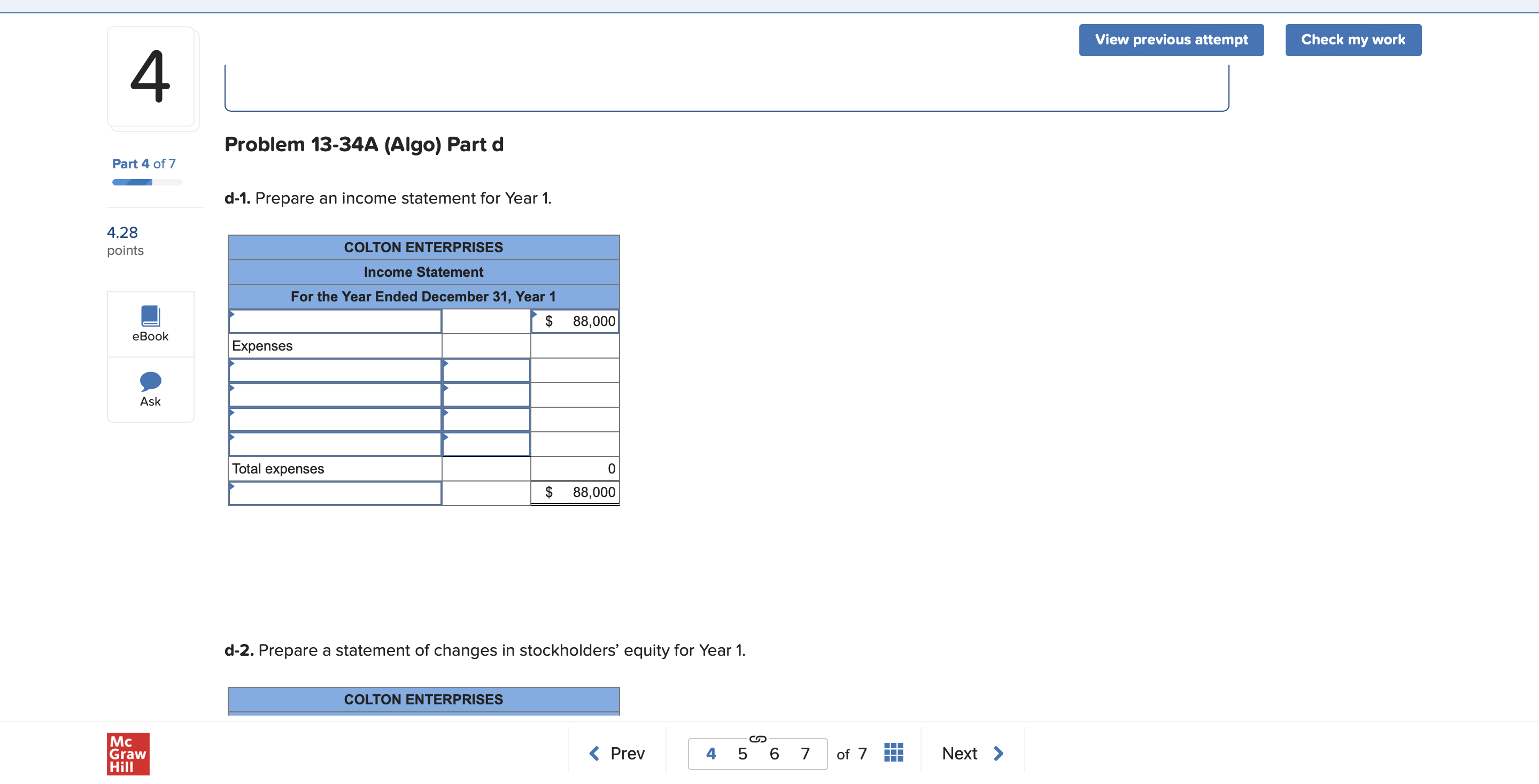

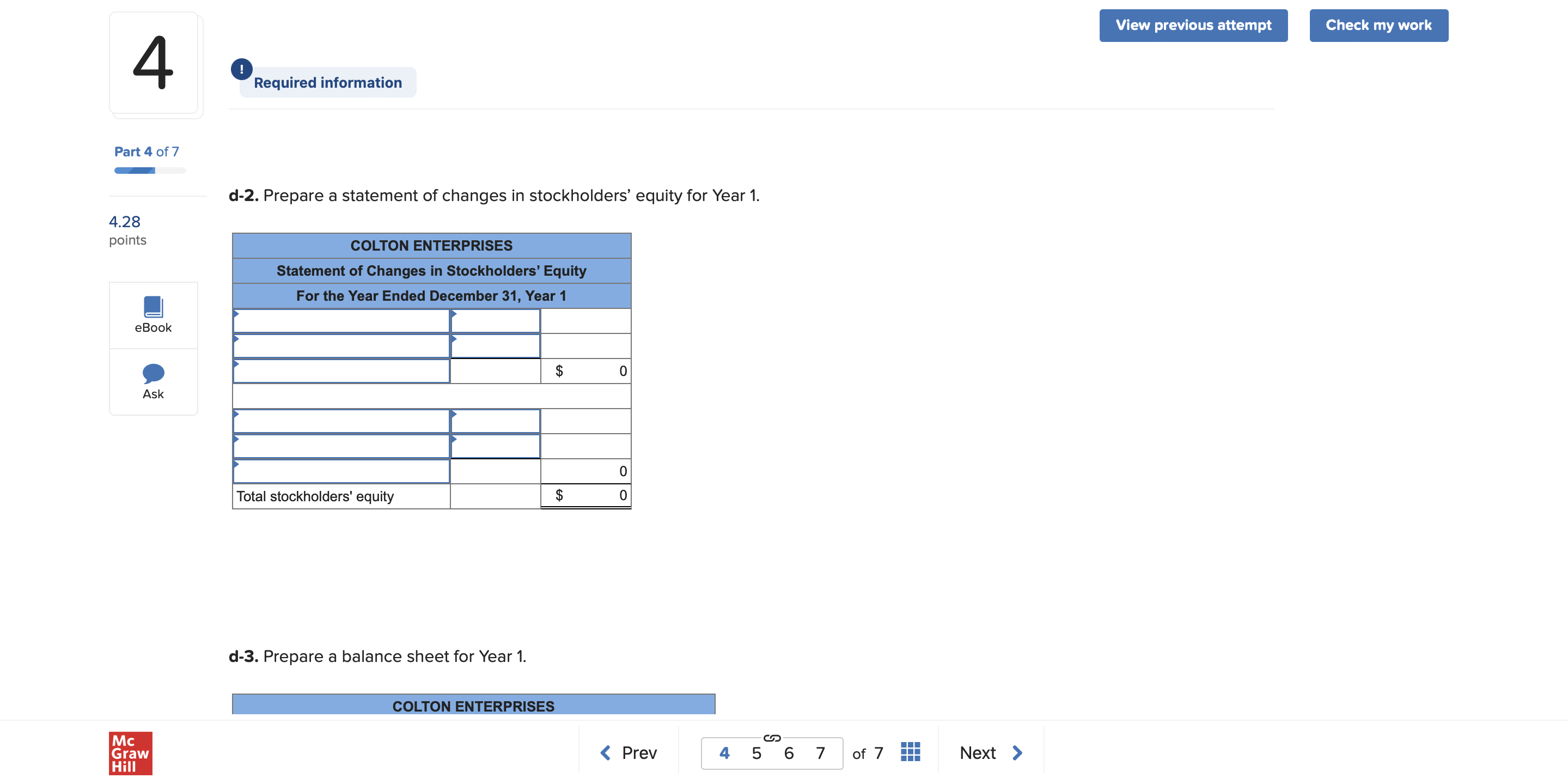

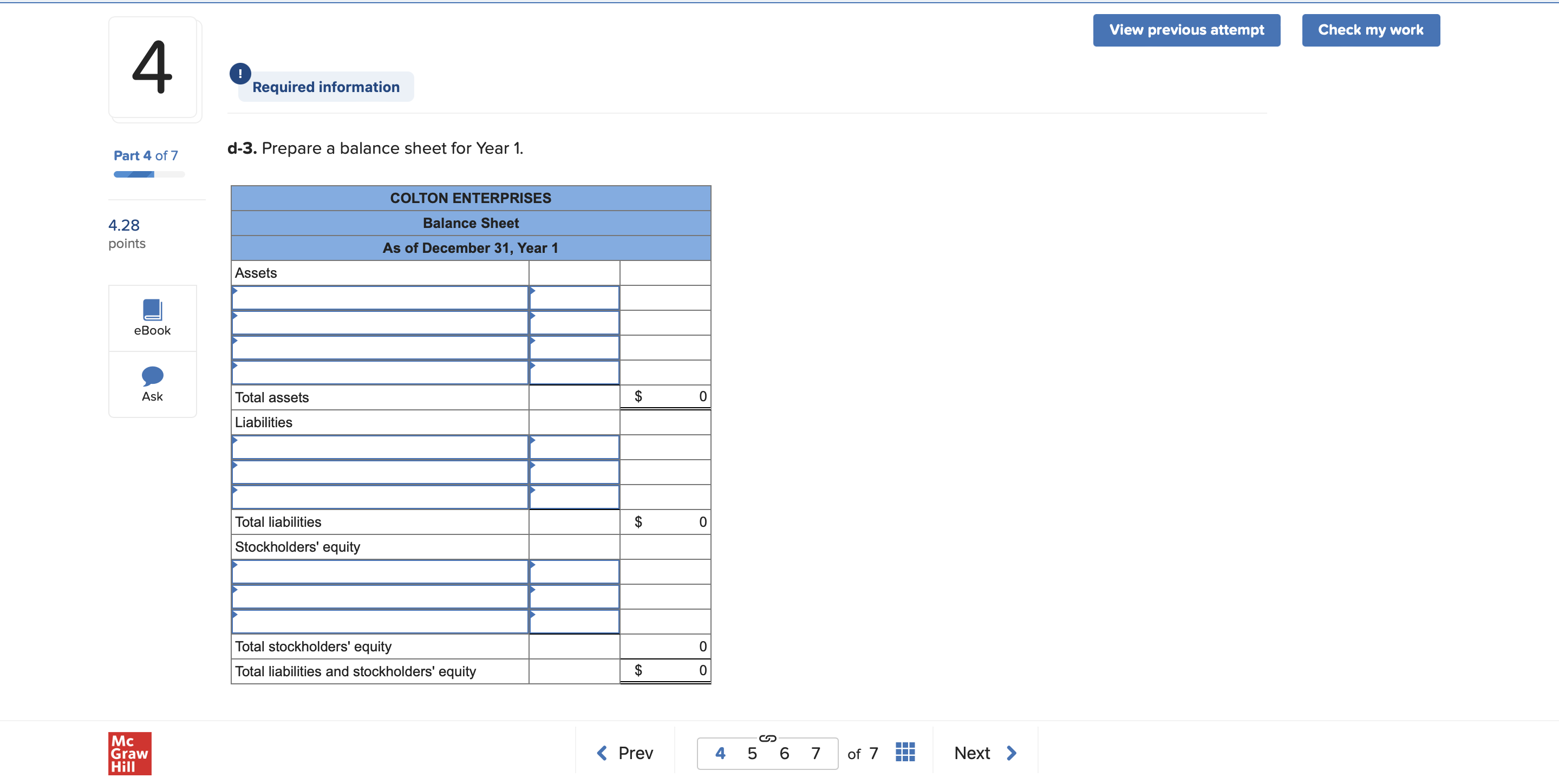

Required information Problem 13-34A (Algo) Two complete accounting cycles LO 13-1, 13-2, 13-3, 13-4 [The following information applies to the questions displayed below.] Colton Enterprises experienced the following events for Year 1, the first year of operation: 1. Acquired $48,000 cash from the issue of common stock. 2. Paid $13,300 cash in advance for rent. The payment was for the period April 1, Year 1, to March 31 , Year 2. 3. Performed services for customers on account for $98,000. 4. Incurred operating expenses on account of $41,500. 5. Collected $75,000 cash from accounts receivable. 6. Paid $34,000 cash for salary expense. 7. Paid $33,200 cash as a partial payment on accounts payable. Adjusting Entries 8. Made the adjusting entry for the expired rent. (See Event 2.) 9. Recorded $5,000 of accrued salaries at the end of Year 1. Events for Year 2 1. Paid $5,000 cash for the salaries accrued at the end of the prior accounting period. 2. Performed services for cash of $47,000. 3. Purchased $4,100 of supplies on account. 4. Paid $14,400 cash in advance for rent. The payment was for one year beginning April 1, Year 2. 5. Performed services for customers on account for $114,000. 6. Incurred operating expenses on account of $54,500. 7. Collected $102,000 cash from accounts receivable. 8. Paid $52,000 cash as a partial payment on accounts payable. 3. Performed services for customers on account for $98,000. 4. Incurred operating expenses on account of $41,500. 5. Collected $75,000 cash from accounts receivable. 6. Paid $34,000 cash for salary expense. 7. Paid $33,200 cash as a partial payment on accounts payable. Adjusting Entries 8. Made the adjusting entry for the expired rent. (See Event 2.) 9. Recorded $5,000 of accrued salaries at the end of Year 1. Events for Year 2 1. Paid $5,000 cash for the salaries accrued at the end of the prior accounting period. 2. Performed services for cash of $47,000. 3. Purchased $4,100 of supplies on account. 4. Paid $14,400 cash in advance for rent. The payment was for one year beginning April 1, Year 2 . 5. Performed services for customers on account for $114,000. 6. Incurred operating expenses on account of $54,500. 7. Collected $102,000 cash from accounts receivable. 8. Paid $52,000 cash as a partial payment on accounts payable. 9. Paid $32,800 cash for salary expense. 10. Paid a $10,000 cash dividend to stockholders. Adjusting Entries d-4. Prepare a statement of cash flows for Year 1. (Enter any decreases to account balances and cash outflows with a minus sign.) Problem 13-34A (Algo) Part d d-1. Prepare an income statement for Year 1. d-2. Prepare a statement of changes in stockholders' equity for Year 1. d-2. Prepare a statement of changes in stockholders' equity for Year 1. d-3. Prepare a balance sheet for Year 1. d-3. Prepare a balance sheet for Year 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts