Question: please help! Joetha Hernander is a singio parent wth two children and eams $54,200 a year. Her employers group lfo insurance policy would pay 2.5

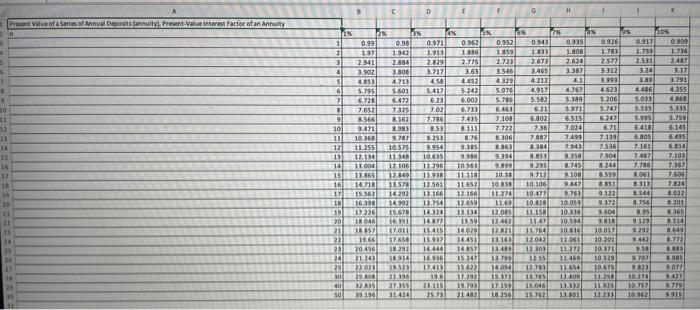

Joetha Hernander is a singio parent wth two children and eams $54,200 a year. Her employers group lfo insurance policy would pay 2.5 times her salary. She also has $72,267 saved in a 401 (k0 dan, $5,002 in mutual funds, and a $3.613 certificale of deposit. She wants to purchase term lfe insurance for 15 years, untli hec youngest child is self supporting She is not concemed about hor outstanding mortgage, as the children would live with her sister in the event of Joetta's death. Assuming she can recelve a 4 percent after-tax, afteralnflation return on insurance proceeda, uate the eamings multiple method to cadculate her imurance need. How much more insurance does Jootha need to buy? What other information would you need to krow ta use the noeds approsch to calculate Jootta's insurance coverage? Click on the table icon to ver the PVIFA table: Aswuming the can recehe a 4% after-tax, after-inflaton return on insurance proceeds and using the earnings multiple method, Joetta's insurance need is 3 (Round to the nearest doloc)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts