Question: please help Josh made $80,000 last year and contributed $5,000 to his 401(k) during the year. He didn't have any other income, but did pay

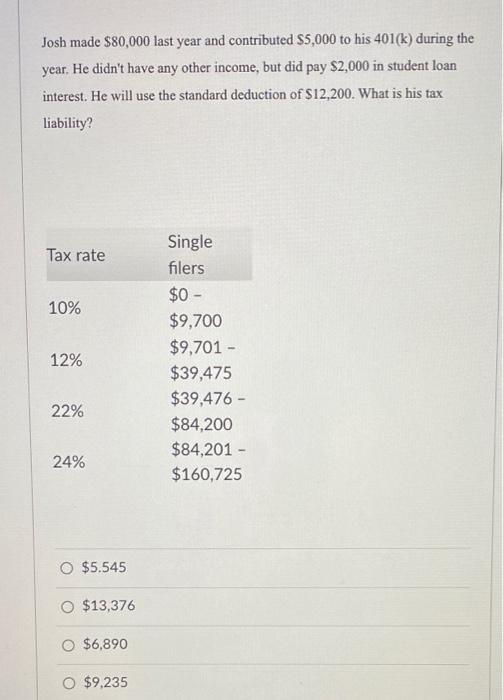

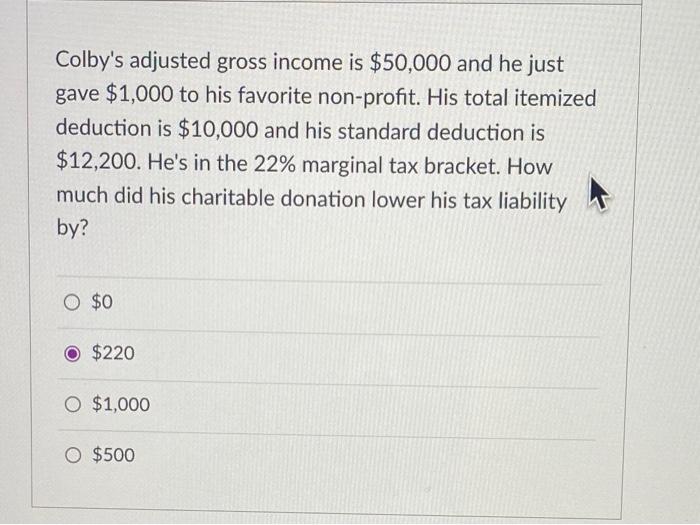

Josh made $80,000 last year and contributed $5,000 to his 401(k) during the year. He didn't have any other income, but did pay $2,000 in student loan interest. He will use the standard deduction of $12,200. What is his tax liability? Tax rate 10% 12% Single filers $0 - $9,700 $9,701 - $39,475 $39,476 - $84,200 $84,201 - $160,725 22% 24% O $5.545 O $13,376 O $6,890 O $9.235 Colby's adjusted gross income is $50,000 and he just gave $1,000 to his favorite non-profit. His total itemized deduction is $10,000 and his standard deduction is $12,200. He's in the 22% marginal tax bracket. How much did his charitable donation lower his tax liability by? O $0 $220 O $1,000 O $500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts