Question: please help journalize the transactions Nov. 1 Curt Hovey contributed $25,000 and a truck, with a market value of $8,000, to the business in exchange

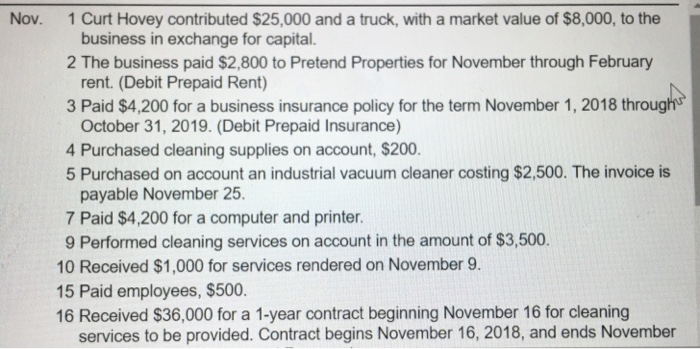

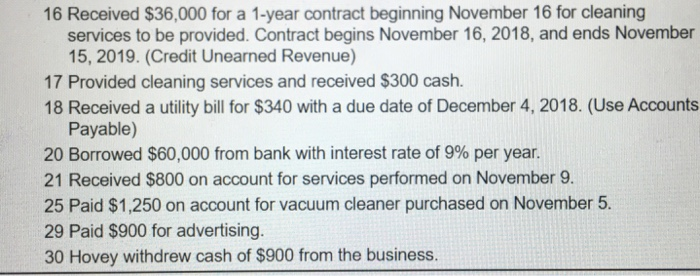

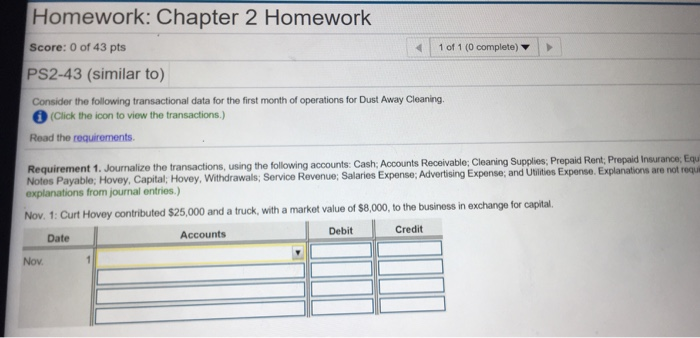

Nov. 1 Curt Hovey contributed $25,000 and a truck, with a market value of $8,000, to the business in exchange for capital. 2 The business paid $2,800 to Pretend Properties for November through February rent. (Debit Prepaid Rent) 3 Paid $4,200 for a business insurance policy for the term November 1, 2018 through October 31, 2019. (Debit Prepaid Insurance) 4 Purchased cleaning supplies on account, $200. 5 Purchased on account an industrial vacuum cleaner costing $2,500. The invoice is payable November 25. 7 Paid $4,200 for a computer and printer. 9 Performed cleaning services on account in the amount of $3,500. 10 Received $1,000 for services rendered on November 9. 15 Paid employees, $500. 16 Received $36,000 for a 1-year contract beginning November 16 for cleaning services to be provided. Contract begins November 16, 2018, and ends November 16 Received $36,000 for a 1-year contract beginning November 16 for cleaning services to be provided. Contract begins November 16, 2018, and ends November 15, 2019. (Credit Unearned Revenue) 17 Provided cleaning services and received $300 cash. 18 Received a utility bill for $340 with a due date of December 4, 2018. (Use Accounts Payable) 20 Borrowed $60,000 from bank with interest rate of 9% per year. 21 Received $800 on account for services performed on November 9. 25 Paid $1,250 on account for vacuum cleaner purchased on November 5. 29 Paid $900 for advertising. 30 Hovey withdrew cash of $900 from the business, 1 of 1 (0 completo) Homework: Chapter 2 Homework Score: 0 of 43 pts PS2-43 (similar to) Consider the following transactional data for the first month of operations for Dust Away Cleaning, (Click the icon to view the transactions.) Read the requirements Requirement 1. Journalize the transactions, using the following accounts: Cash: Accounts Receivable; Cleaning Supplies; Prepaid Rent; Prepaid Insurance Equ Notes Payable; Hovey, Capital; Hovey, Withdrawals; Service Revenue: Salaries Expense; Advertising Expense; and Utilities Expense. Explanations are not requ. explanations from journal entries.) Nov. 1: Curt Hovey contributed $25,000 and a truck, with a market value of $8,000, to the business in exchange for capital. Date Accounts Debit Credit Nov

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts