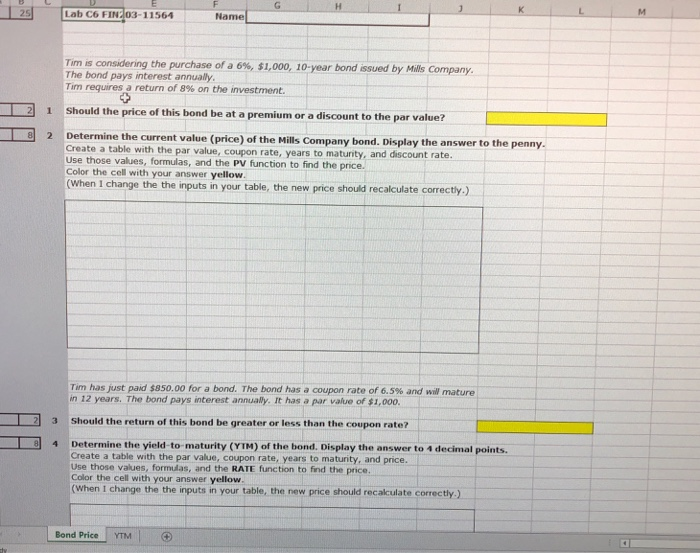

Question: please help Lab C6 FIN203-11564 Name Tim is consadering the purchase of a 6%, $1,000, 10-year bond issued by Mills Company The bond pays interest

Lab C6 FIN203-11564 Name Tim is consadering the purchase of a 6%, $1,000, 10-year bond issued by Mills Company The bond pays interest annually Tim requires) return of 8% on the investment. 21 Should the price of this bond be at a premium or a discount to the par value? Determine the current value (price) of the Mills Company bond. Display the answer to the penny. Create a table with the par value, coupon rate, years to maturity, and discount rate. Use those values, formulas, and the PV function to find the price. Color the cell with your answer yellow (When 1 change the the inputs in your table, the new price should recalculate correctly.) Tim has just paid $850.00 for a bond. The bond has a coupon rate of 6.5% and will mature n 12 years. The bond pays interest annually. It has a par value of $1,000o. 3 Should the return of this bond be greater or less than the coupon rate? 4 Determine the yield-to-maturity (YTM) of the bond. Display the answer to 4 decimal points. Create a table with the par value, coupon rate, years to maturity, and price. Use those values, formulas, and the RATE function to find the price. Color the cell with your answer yellow (When 1 change the the inputs in your table, the new price should recakculate correctly) Bond Price YTMG

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts