Question: Please Help ! Lawrence owns a small candy store that sells one type of candy. His beginning inventory of candy was made up of 10,000

Please Help !

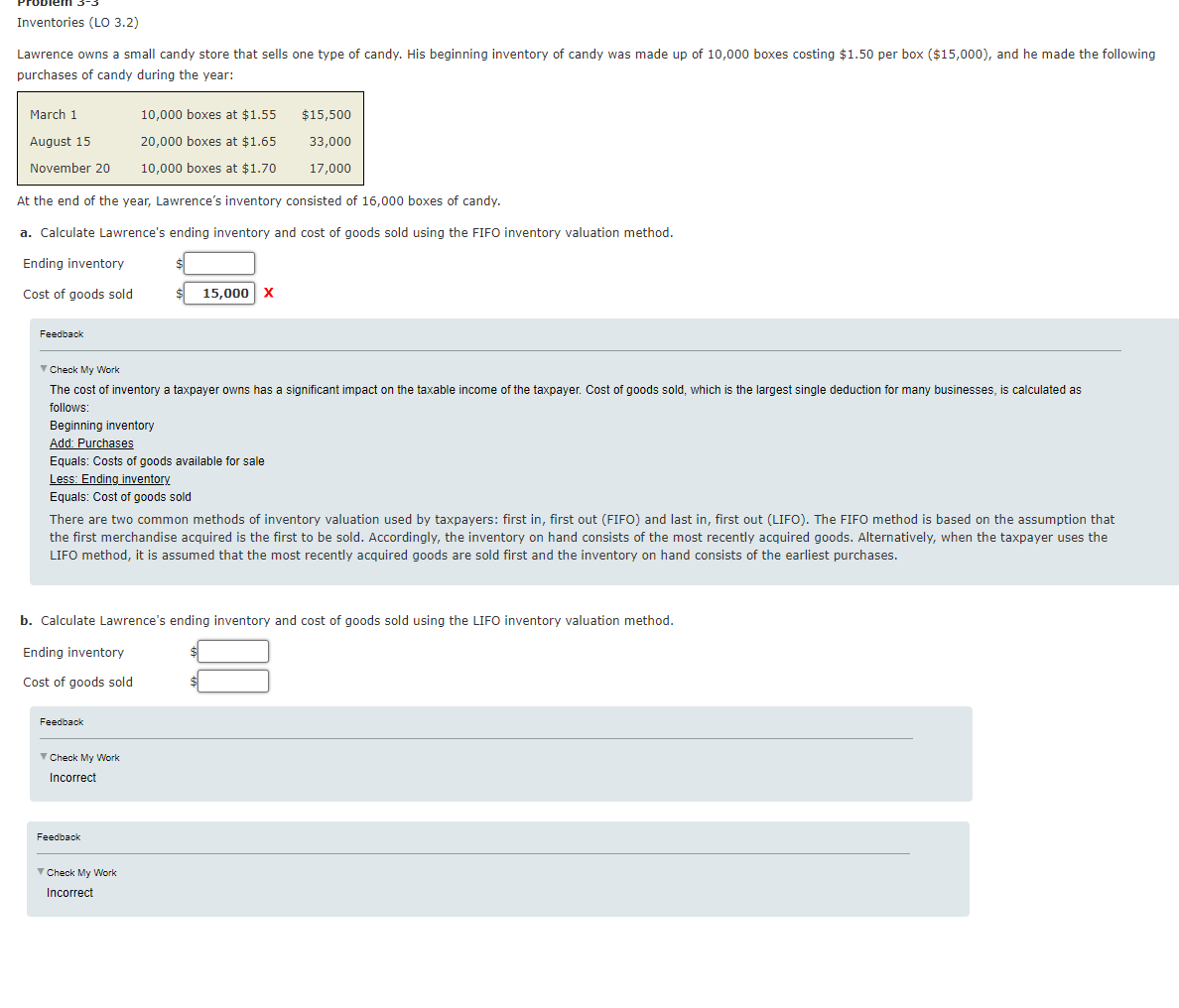

Lawrence owns a small candy store that sells one type of candy. His beginning inventory of candy was made up of 10,000 boxes costing $1.50 per box ( $15,000 ), and he made the following purchases of candy during the year: At the end of the year, Lawrence's inventory consisted of 16,000 boxes of candy. a. Calculate Lawrence's ending inventory and cost of goods sold using the FIFO inventory valuation method. Feedback Check My Work The cost of inventory a taxpayer owns has a significant impact on the taxable income of the taxpayer. Cost of goods sold, which is the largest single deduction for many businesses, is calculated as follows: Beginning inventory Add: Purchases Equals: Costs of goods available for sale Less: Ending inventory Equals: Cost of goods sold There are two common methods of inventory valuation used by taxpayers: first in, first out (FIFO) and last in, first out (LIFO). The FIFO method is based on the assumption that the first merchandise acquired is the first to be sold. Accordingly, the inventory on hand consists of the most recently acquired goods. Alternatively, when the taxpayer uses the LIFO method, it is assumed that the most recently acquired goods are sold first and the inventory on hand consists of the earliest purchases

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts