Question: Please Help le answer only questions 2,g,h, h1 and h2. Thank you so much, I will give thumbs up. 23.-40. Stewart's Home & Garden is

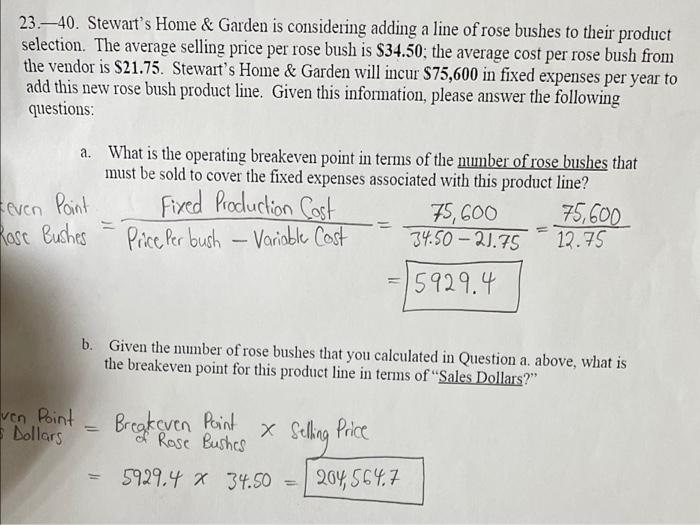

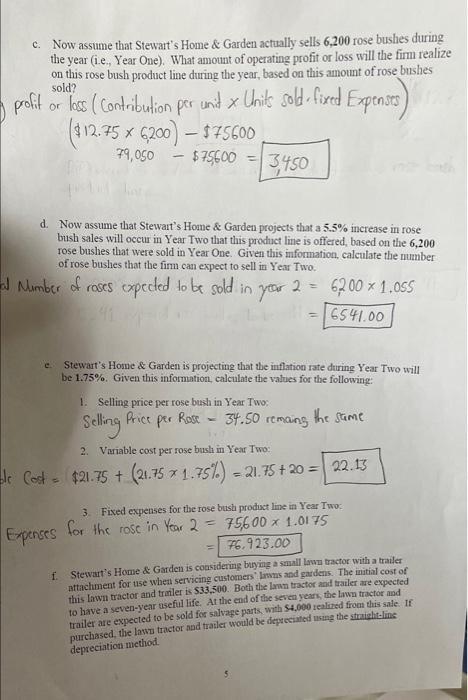

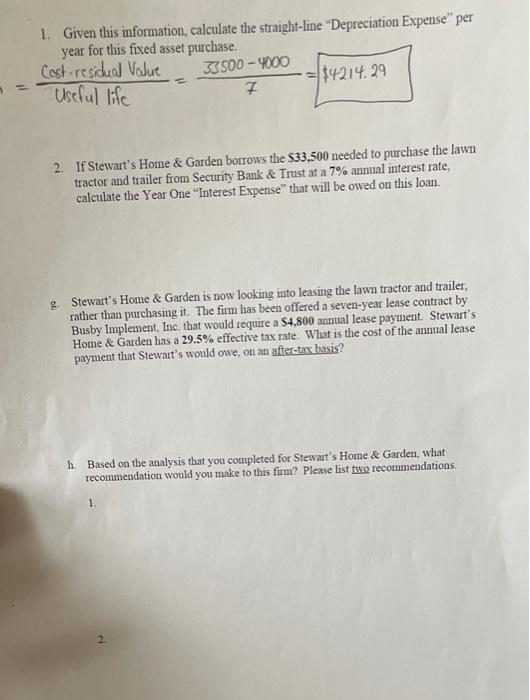

23.-40. Stewart's Home & Garden is considering adding a line of rose bushes to their product selection. The average selling price per rose bush is $34.50; the average cost per rose bush from the vendor is $21.75. Stewart's Home & Garden will incur $75,600 in fixed expenses per year to add this new rose bush product line. Given this information, please answer the following questions: even Point Rose Pushes a. What is the operating breakeven point in terms of the number of rose bushes that must be sold to cover the fixed expenses associated with this product line? Fixed Production Cost 75,600 75,600 Price per bush - Variable Cost 34.50 - 21.75 12.75 15929.4 . b. Given the number of rose bushes that you calculated in Question a, above, what is the breakeven point for this product line in terms of "Sales Dollars?" ven Point = Dollars - Breakeven Point of Rose Bushes x Selling Price 5929.4 x 34.50 204,564.7 c. Now assume that Stewart's Home & Garden actually sells 6,200 rose bushes during the year (ie. Year One). What amount of operating profit or loss will the firm realize on this rose bush product line during the year, based on this amount of rose bushes sold? profit or los contribution per unit x Unit sold-fired Expenses) x ($12.75 X 6200) $75600 79,050 - $75600 3,450 d. Now assume that Stewart's Home & Garden projects that a 5.5% increase in rose bush sales will occur in Year Two that this product line is offered, based on the 6,200 rose bushes that were sold in Year One. Given this information, calculate the number of rose bushes that the firm can expect to sell in Year Two Number of roses expecled to be sold in your 2 = 6200 * 1,055 41 = 6541.00 e Stewart's Home & Garden is projecting that the inflation rate during Year Two will be 1.75%. Given this information, calculate the values for the following: 1. Selling price per rose bush in Year Two: the same Selling Price per Rose = 34.50 remains 2. Variable cost per rose bush in Year Two: ble Cod. $21.75 + (21.75*1.75%) = 21.75 + 20 = 22.13 Expenses for the rose in Year 2 3. Fixed expenses for the rose bush product line in Year Two 75600 x 1.0175 76.923.00 1 Stewart's Home & Garden is considering buying a small lawu tractor with a trailer attachment for use when servicing customersus and gardens. The initial cost of this lawn tractor and trailer is $33,500. Both the lawn tractor and trailer are expected to have a seven-year useful life. At the end of the seven years, the lawn tractor and trailer are expected to be sold for salvage parts, with S4,000 sealed from this sale is purchased, the last tractor and trailer would be depreciated using the straight-line depreciation method 1. Given this information, calculate the straight-line "Depreciation Expense" per year for this fixed asset purchase. Cost-residual Value 33500-4000 14214.29 7 Useful life 2. If Stewart's Home & Garden borrows the S33,500 needed to purchase the lawn tractor and trailer from Security Bank & Trust at a 7% annual interest rate, calculate the Year One "Interest Expense" that will be owed on this loan. g. Stewart's Home & Garden is now looking into leasing the lawn tractor and trailer, rather than purchasing it. The firm has been offered a seven-year lease contract by Busby Implement, Inc. that would require a S4,800 annual lease payment. Stewart's Home & Garden has a 29.5% effective tax rate. What is the cost of the annual lease payment that Stewart's would owe, on an after-tax basis? h. Based on the analysis that you completed for Stewart's Home & Garden, what recommendation would you make to this fum? Please list two recommendations. 1. 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts