Question: please help + make steps clear ,, thank you ;) Price a convertible bond with par ( =$ 1000 ), conversion ratio ( =21 ),

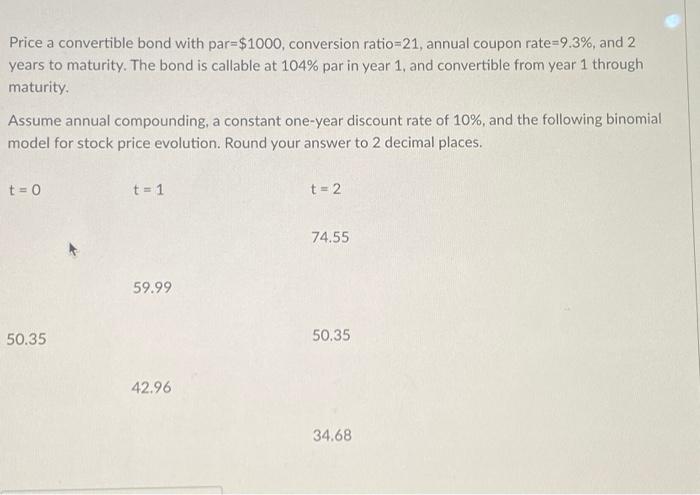

Price a convertible bond with par \\( =\\$ 1000 \\), conversion ratio \\( =21 \\), annual coupon rate \=9.3, and 2 years to maturity. The bond is callable at \104 par in year 1 , and convertible from year 1 through maturity. Assume annual compounding, a constant one-year discount rate of \10, and the following binomial model for stock price evolution. Round your answer to 2 decimal places. \\[ t=0 \\] \\[ t=1 \\] \\[ t=2 \\]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts