Question: PLEASE HELP!! Marcel Co. is growing quickly. Dividends are expected to grow at a rate of 0.07 for the next 4 years. with the growth

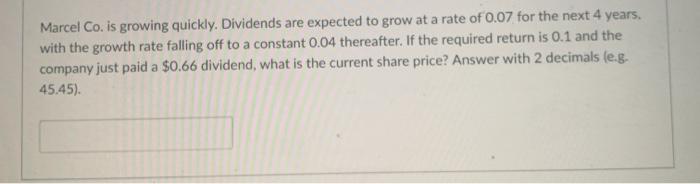

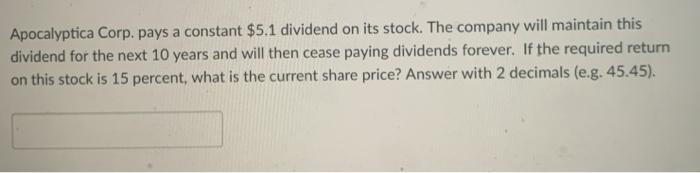

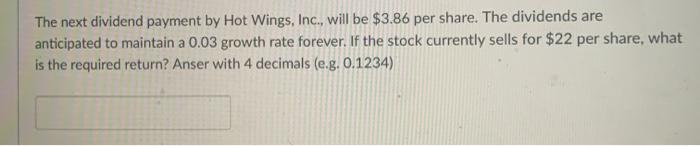

Marcel Co. is growing quickly. Dividends are expected to grow at a rate of 0.07 for the next 4 years. with the growth rate falling off to a constant 0.04 thereafter. If the required return is 0.1 and the company just paid a $0.66 dividend, what is the current share price? Answer with 2 decimals (e.g. 45.45). Apocalyptica Corp. pays a constant $5.1 dividend on its stock. The company will maintain this dividend for the next 10 years and will then cease paying dividends forever. If the required return on this stock is 15 percent, what is the current share price? Answer with 2 decimals (e.g. 45.45). The next dividend payment by Hot Wings, Inc., will be $3.86 per share. The dividends are anticipated to maintain a 0.03 growth rate forever. If the stock currently sells for $22 per share, what is the required return? Anser with 4 decimals (e.g. 0.1234)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts