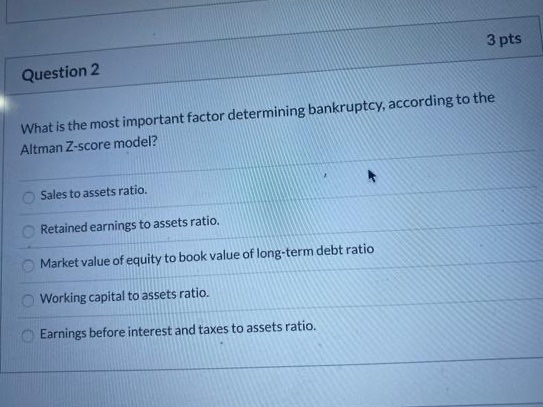

Question: please help me 3 pts Question 2 What is the most important factor determining bankruptcy, according to the Altman Z-score model? Sales to assets ratio.

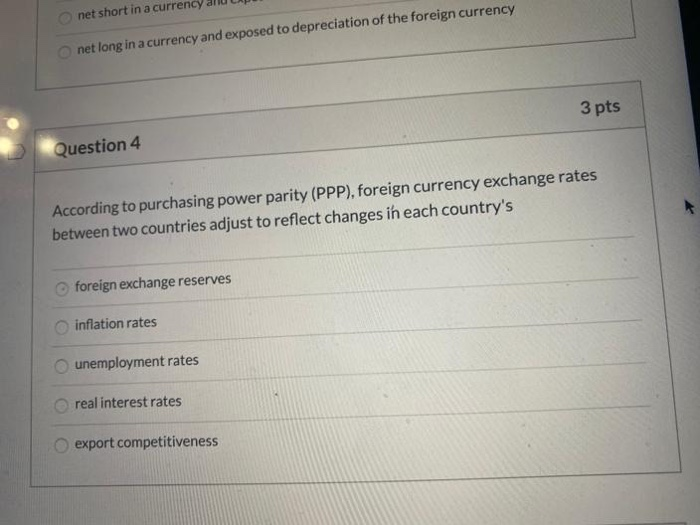

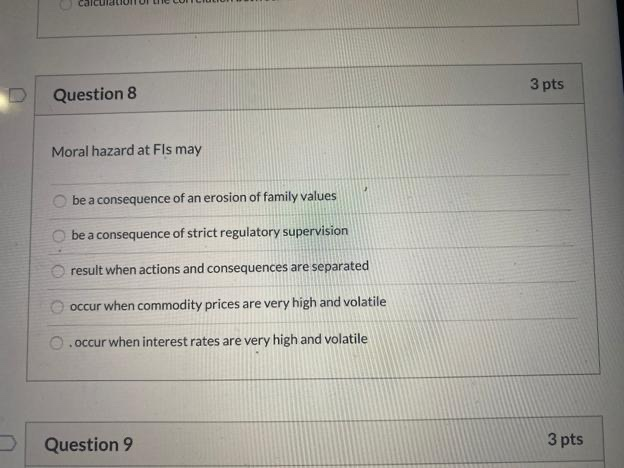

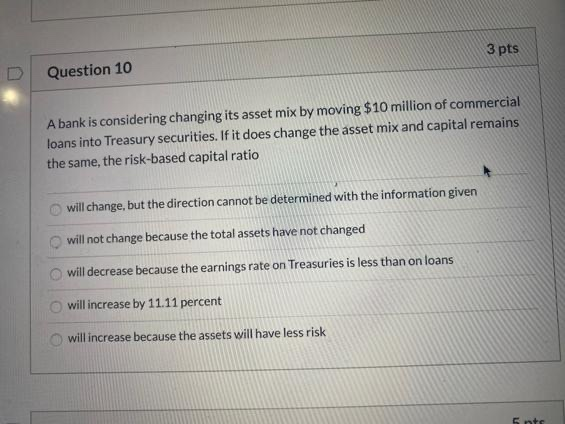

3 pts Question 2 What is the most important factor determining bankruptcy, according to the Altman Z-score model? Sales to assets ratio. Retained earnings to assets ratio. Market value of equity to book value of long-term debt ratio Working capital to assets ratio. Earnings before interest and taxes to assets ratio. net short in a currency and up net long in a currency and exposed to depreciation of the foreign currency 3 pts Question 4 According to purchasing power parity (PPP), foreign currency exchange rates between two countries adjust to reflect changes in each country's foreign exchange reserves inflation rates unemployment rates real interest rates export competitiveness Question 8 3 pts Moral hazard at Fis may be a consequence of an erosion of family values be a consequence of strict regulatory supervision result when actions and consequences are separated occur when commodity prices are very high and volatile 0.occur when interest rates are very high and volatile Question 9 3 pts 3 pts Question 10 A bank is considering changing its asset mix by moving $10 million of commercial loans into Treasury securities. If it does change the asset mix and capital remains the same, the risk-based capital ratio will change, but the direction cannot be determined with the information given will not change because the total assets have not changed will decrease because the earnings rate on Treasuries is less than on loans will increase by 11.11 percent will increase because the assets will have less risk 5te

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts