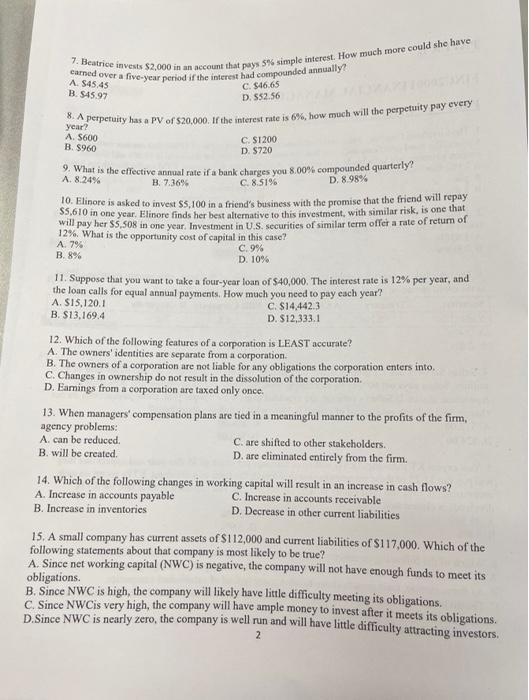

Question: please help me!! A. $45.45 B. $45.97 cared over a five-year period if the interest had compounded annually? 7. Beatrice invests $2.000 in an account

A. $45.45 B. $45.97 cared over a five-year period if the interest had compounded annually? 7. Beatrice invests $2.000 in an account that pays 3 simple interest. How much more could she have C. $46.65 D. 552.56 8. A perpetuity has a PV of $20,000. Ir the interest rate is 6%, how much will the perpetuity pay every CS1200 D. 5720 D. 8.98% year? A. 5600 B. $960 2. What is the effective annual rate if a bank charges you 8.00% compounded quarterly? A. 8.24% B. 7.36% C. 8.5196 10. Elinore is asked to invest $5,100 in a friend's business with the promise that the friend will repay $5.610 in one year, Elinore finds her best alternative to this investment, with similar risk, is one that will pay her $5.508 in one year, Investment in U.S. securities of similar term offer a rate of retum of 12%. What is the opportunity cost of capital in this case? A. 79 C.9% B8% D. 10% 11. Suppose that you want to take a four-year loan of S40,000. The interest rate is 12% per year, and the loan calls for equal annual payments. How much you need to pay each year? A. $15.120.1 C. $14.442.3 B. $13,169.4 D. $12,333.1 12. Which of the following features of a corporation is LEAST accurate? A. The owners' identities are separate from a corporation B. The owners of a corporation are not liable for any obligations the corporation enters into C. Changes in ownership do not result in the dissolution of the corporation. D. Eamings from a corporation are taxed only once. 13. When managers' compensation plans are tied in a meaningful manner to the profits of the firm, agency problems: A. can be reduced C. are shifted to other stakeholders. B. will be created D. are eliminated entirely from the firm. 14. Which of the following changes in working capital will result in an increase in cash flows? A. Increase in accounts payable C. Increase in accounts receivable B. Increase in inventories D. Decrease in other current liabilities 15. A small company has current assets of $112,000 and current liabilities of $117,000. Which of the following statements about that company is most likely to be true? A. Since net working capital (NWC) is negative, the company will not have enough funds to meet its obligations. B. Since NWC is high, the company will likely have little difficulty meeting its obligations C Since NWCis very high, the company will have ample money to invest after it meets its obligations. D. Since NWC is nearly zero, the company is well run and will have little difficulty attracting investors 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts