Question: Please help me!!! (a) Compute Lockheed Martin's current ratio and quick ratio for 2005 and 2004. (Round your answers to two decimal places.) 2005 current

Please help me!!!

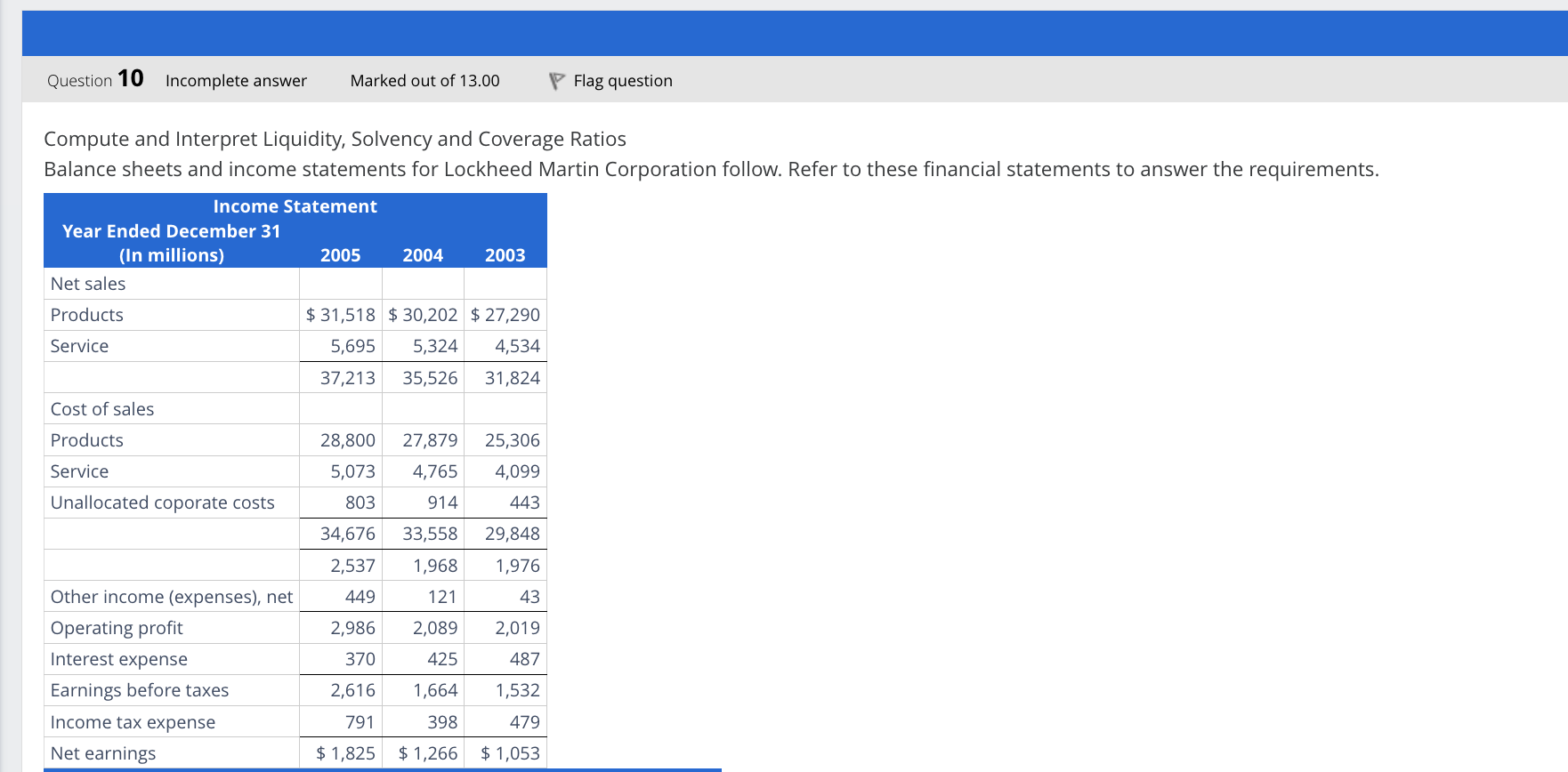

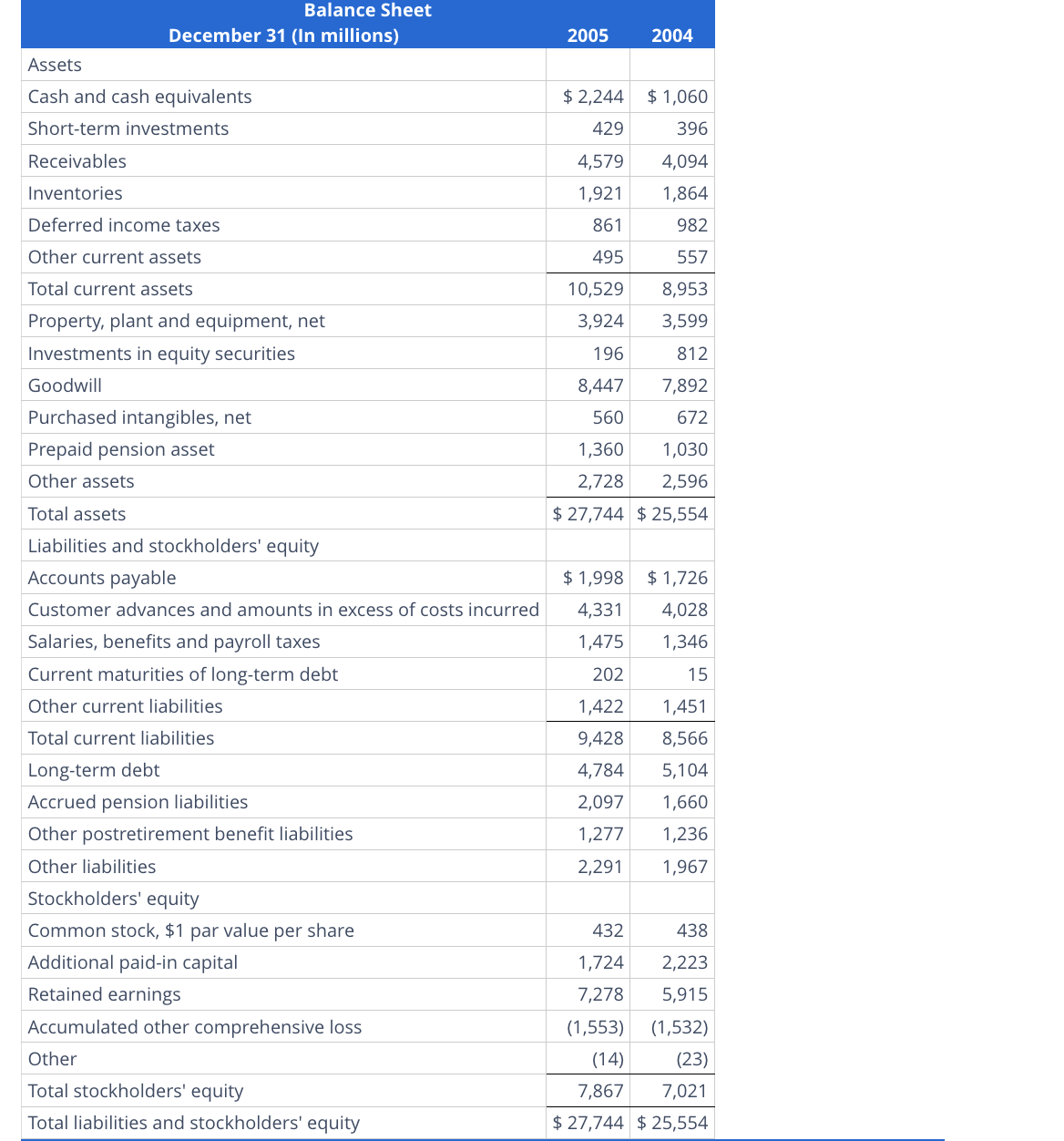

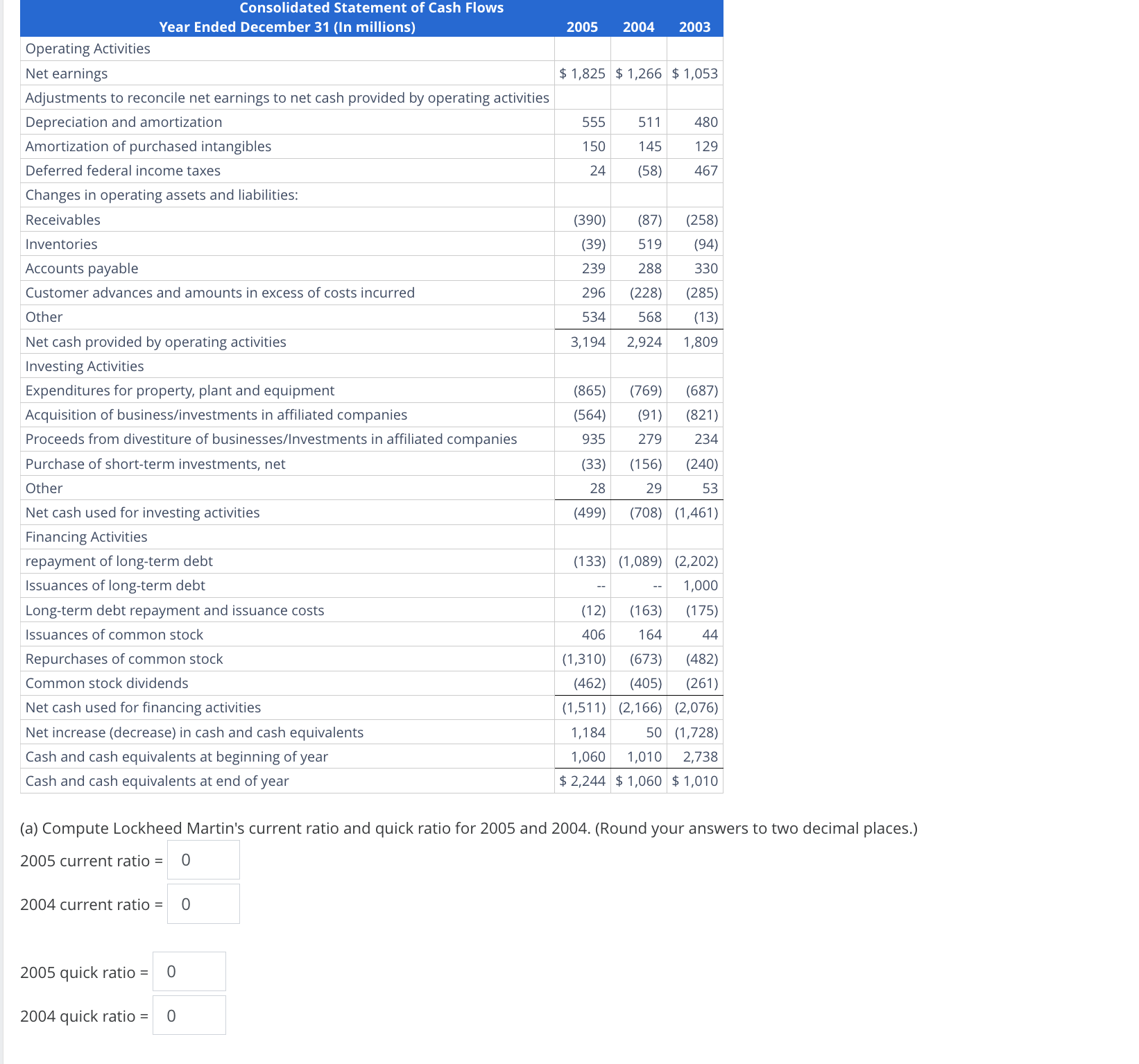

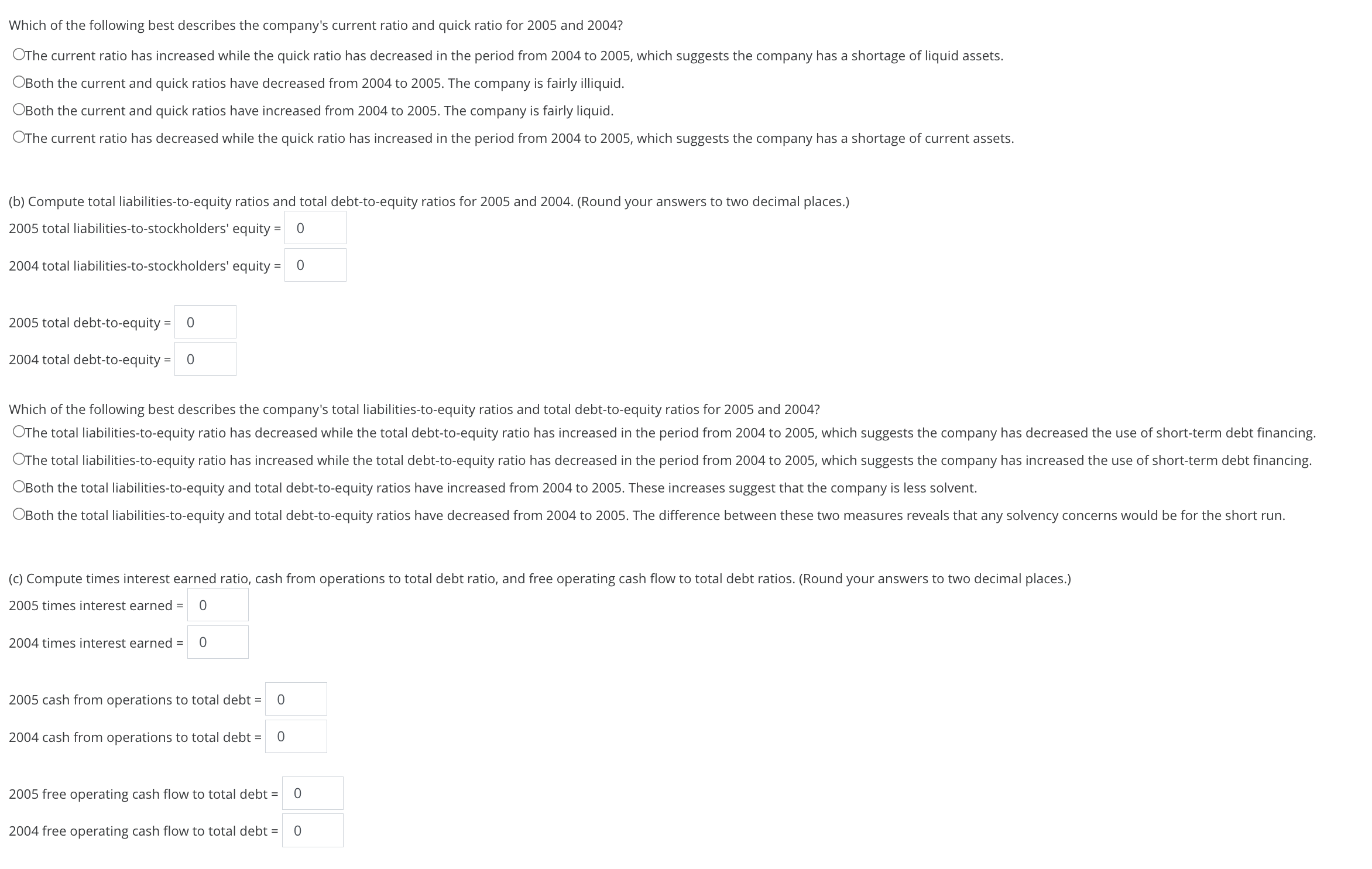

(a) Compute Lockheed Martin's current ratio and quick ratio for 2005 and 2004. (Round your answers to two decimal places.) 2005 current ratio = 2004 current ratio = 2005 quick ratio = 2004 quick ratio = Which of the following best describes the company's current ratio and quick ratio for 2005 and 2004 ? OThe current ratio has increased while the quick ratio has decreased in the period from 2004 to 2005, which suggests the company has a shortage of liquid assets. OBoth the current and quick ratios have decreased from 2004 to 2005 . The company is fairly illiquid. OBoth the current and quick ratios have increased from 2004 to 2005 . The company is fairly liquid. OThe current ratio has decreased while the quick ratio has increased in the period from 2004 to 2005, which suggests the company has a shortage of current assets. (b) Compute total liabilities-to-equity ratios and total debt-to-equity ratios for 2005 and 2004. (Round your answers to two decimal places.) 2005 total liabilities-to-stockholders' equity = 2004 total liabilities-to-stockholders' equity = 2005 total debt-to-equity = 2004 total debt-to-equity = Which of the following best describes the company's total liabilities-to-equity ratios and total debt-to-equity ratios for 2005 and 2004 ? OBoth the total liabilities-to-equity and total debt-to-equity ratios have increased from 2004 to 2005. These increases suggest that the company is less solvent. (c) Compute times interest earned ratio, cash from operations to total debt ratio, and free operating cash flow to total debt ratios. (Round your answers to two decimal places.) 2005 times interest earned = 2004 times interest earned = 2005 cash from operations to total debt = 2004 cash from operations to total debt = Balance Sheet December 31 (In millions) 2005 2004 Assets Cash and cash equivalents $2,244 $1,060 Short-term investments Receivables Inventories Deferred income taxes Other current assets Total current assets Property, plant and equipment, net Investments in equity securities Goodwill Purchased intangibles, net Prepaid pension asset Other assets Total assets \begin{tabular}{|r|r|} \hline$27,744$25,554 \end{tabular} Liabilities and stockholders' equity Accounts payable Customer advances and amounts in excess of costs incurred Salaries, benefits and payroll taxes Current maturities of long-term debt Other current liabilities Total current liabilities Long-term debt Accrued pension liabilities Other postretirement benefit liabilities Other liabilities Stockholders' equity Common stock, \$1 par value per share Additional paid-in capital Retained earnings Accumulated other comprehensive loss $1,998$1,726 4,3314,028 1,475 1,346 202 15 Other Total stockholders' equity Total liabilities and stockholders' equity \begin{tabular}{|r|r|} \hline 1,422 & 1,451 \\ \hline 9,428 & 8,566 \\ \hline 4,784 & 5,104 \\ \hline 2,097 & 1,660 \\ \hline 1,277 & 1,236 \\ \hline 2,291 & 1,967 \\ \hline \end{tabular} 432 438 \begin{tabular}{|l|r|} 1,724 & 2,223 \end{tabular} 7,278 5,915 (1,553)(1,532) (14) (23) \begin{tabular}{|l|r|} \hline 7,867 & 7,021 \\ \hline \end{tabular} \begin{tabular}{l|l} $27,744 & $25,554 \end{tabular} Compute and Interpret Liquidity, Solvency and Coverage Ratios Balance sheets and income statements for Lockheed Martin Corporation follow. Refer to these financial statements to answer the requirements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts