Question: please help me analysis this post Solid work team. We've examined a few companies. Let's look at Netflix: Formula: RRR = [(expected market RR -

please help me analysis this post

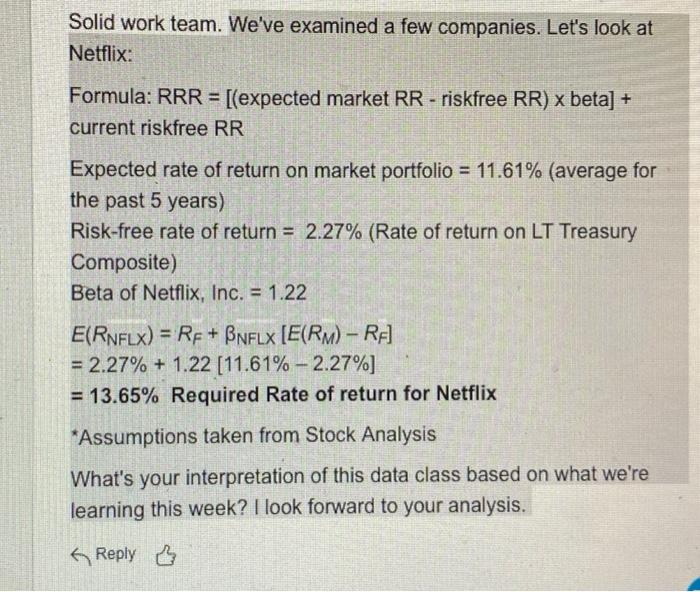

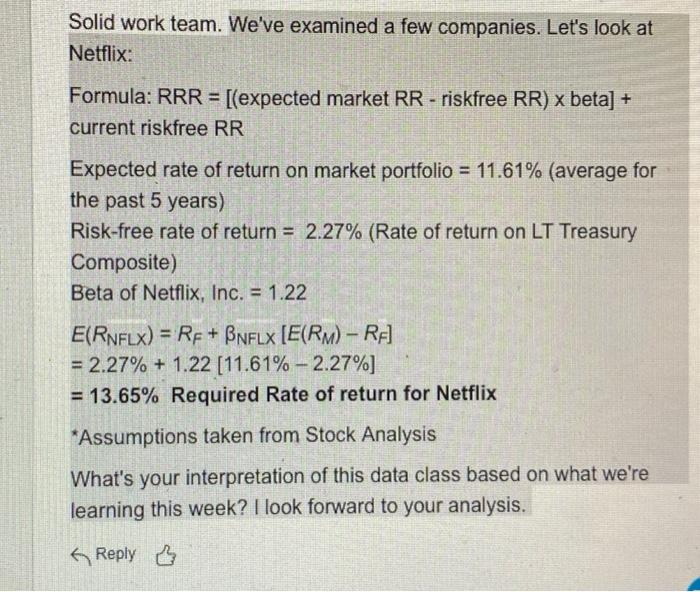

Solid work team. We've examined a few companies. Let's look at Netflix: Formula: RRR = [(expected market RR - riskfree RR) x beta] + current riskfree RR Expected rate of return on market portfolio = 11.61% (average for the past 5 years) Risk-free rate of return = 2.27% (Rate of return on LT Treasury Composite) Beta of Netflix, Inc. = 1.22 E(RNFLX) = RF+ BNFLX [E(RM) - RA] = 2.27% + 1.22 [11.61% -2.27%] = 13.65% Required Rate of return for Netflix *Assumptions taken from Stock Analysis What's your interpretation of this data class based on what we're learning this week? I look forward to your analysis. Reply &

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock