Question: please help me and give this answer properly View Polldes Current Attempt in Progress At the end of June, the manager of the B.C. manufacturing

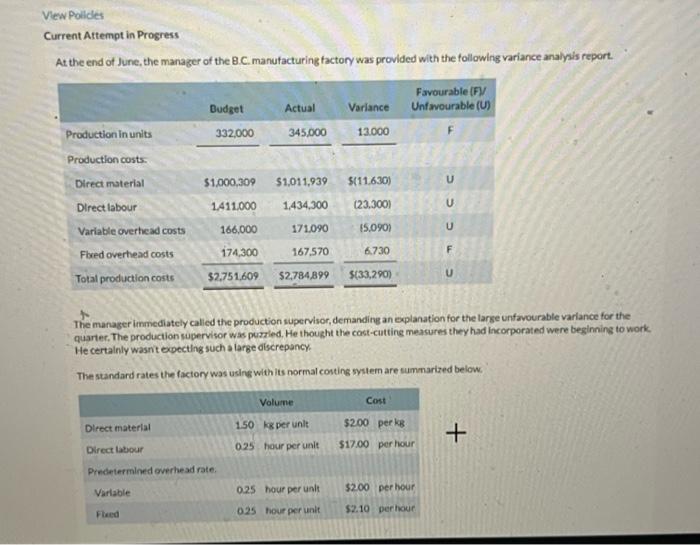

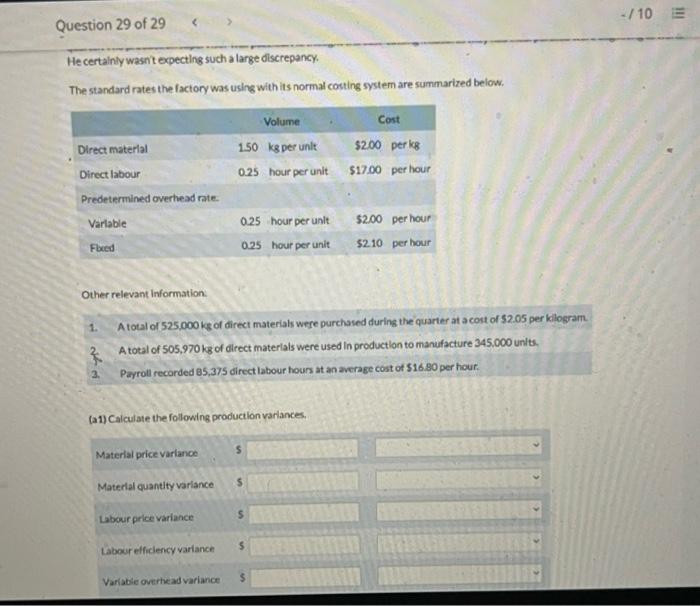

View Polldes Current Attempt in Progress At the end of June, the manager of the B.C. manufacturing factory was provided with the following variance analysis report. Favourable (FV Budget Actual Variance Unfwourable (U) Production in units 332,000 345.000 13.000 Production costs Direct material $1,000,309 $1.011.939 $(11.630) Direct labour 1411000 1.434,300 (23.3001 Variable overhead costs 166,000 171.090 15.090) Fixed overhead costs 174,300 167,570 Total production costs $2.751.609 $2,784,899 $(33,2901 U U U 6.730 F U The manager immediately called the production supervisor, demanding an explanation for the large unfavourable variance for the quarter. The production supervisor was puzzied. He thought the cost-cutting measures they had incorporated were beginning to work He certainly wasn't expecting such a large discrepancy The standard rates the factory was using with its normal conting system are summarized below. Volume Cost Direct material 1.50 ka per unit $200 per ke + Direct labour 0.25 tour per unit $17.00 per hour Predetermined overhead rate Variable 0.25 hour per unit $2.00 per hour Fleed 025 hour per unit $2.10 per hour -/10 Question 29 of 29 He certainly wasn't expecting such a large discrepancy, The standard rates the factory was using with its normal costing system are summarized below. Volume Cost 1.50 kg per unit $2,00 per kg 0.25 hour per unit $17.00 per hour Direct material Direct labour Predetermined overhead rate. Vartable Feed $2.00 per hour 0.25 hour per unit 0.25 hour per unit $2.10 per hour Other relevant information 1. A total of 525.000 kg of direct materials were purchased during the quarter at a cost of $2.05 per kilogram * A total of 505,970 kg of direct materials were used in production to manufacture 345.000 unts. Payroll recorded 85,375 direct labour hours at an average cost of $16.80 per hour. 3 (21) Calculate the following production varlances. Material price variance $ Material quantity variance $ Labour price variance $ Labour efficiency variance $ Variable overhead variance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts