Question: Please help me answer 3&4!!! 7. (Humus peints) Read the ice and we the following question o Bullwhip Hits Firms as Growth Snaps Back By

Please help me answer 3&4!!!

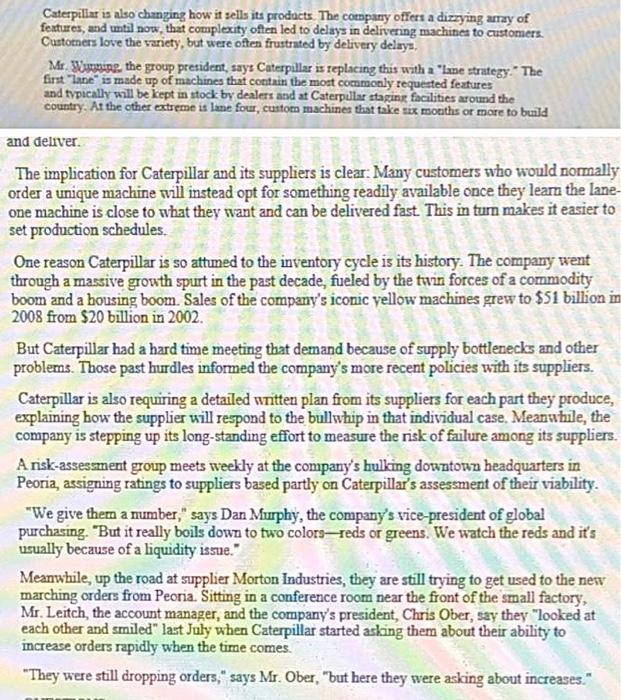

7. (Humus peints) Read the ice and we the following question o Bullwhip Hits Firms as Growth Snaps Back By TIMOTHY ALITER 21,2010, The PEORIA, It Capella Inc. recently told as steel supplies that it will meetu dobita purchases of the metal this year even if the consoles de esta In fact, the long equipment maker has been betagendens toppen Sie vything tentand bydwiches to empol How to Chikupillip efect which come US This chicantly de call tip de camps the Spa tuatianaletadani chain The bus pabaigos whide sig wheels theses to the actually the as, bold conceded och det he and small, respond to market shifte determines which coes emerge fint from the slump and start growing an Most forecaster expect the Commerce Department ce Friday will report that the US.COM grew at an inflation adjusted annual rate of better than 5% in the fourth quarter, the fastest pace since 2003. Economista estimate that the balk of the prouth came not because consumers were buying more, but became buisses stopped reducing mentories and therefore, had to produce more of what they sold "The inventory burn off is over," says Caterpillar CEO Jim Owens, a PhD. economist who has run the world's largest facturer of construction and mining machines since 2004 Caterpillar, which may investors ne poised to benefit from the scent global recovery, is likely to talk about its bullwhip preparations when it reports fourth quarter results Wednesday Going forward, a big question is how well suppliers are positioned to ramp up production Bottlenecks and other headaches may occur at spot shortages cause nexpected price files and hamper companied ability to meet dersand That's why Caterpillar took the unusual step late last year of viting whypisto they had the resources to quickly boost output. In extreme cases, the equipment suppliers et financing Up Caterpillar says that even if demand for its equipos flat this yearly projecte calls its "Great Receni od stilled to boost production is a factor by 10% to 15% just to restock dealers and meet pingui demand Mehle, output at Caterpillar's suppliers would have to rise 30% to this scenario becse Caterpillar would be relish Encuest Cutiple, though, we betting on growth. In that can, desand for partijos even more Caterpillereits productie 15 says Mr. Om opps would more than double that shpesto Anorgen is good forgy for work, especially state when the revival of economic growth has yet to trade to morejo The plynem sove 10% des have been used the projects for furthquare growth is gros dos puoducts with cho the extra growth and to companied by artist Duas the final.com, bele how Thening of them became the stones by 541 billion of the 2001 by be of Lehman Brothers and Its all y guest The very tisol Felden Sie, says that the US.com boys a la seva propewele this story at the sport Berylic specially in to recease Tahera pratlantatamil hape of pipi Miny ulla phaluee atty A Bow of tropiccolta est Be that is releashores o tome because the w to do nem - Sad wederer This Topo the Federal Takbeendet turt caltria , cong connected that China Caterpillars 2005- of the f.com on, which power M. , core story Show whold of the top To The thry The Cape apdom laste ma "Many of the alle compone de beach the cosy Steven the Capillar power to purchaning and led the recent with them to borrow more because they bring ople and also to say They're probably mag towy. W To ma the way, Caterpillar this methods that allows applies to borrow rytom a banka, ferrate This they can tag on fond within the day of demodate Capilloppend til 65.cat Mechanical Devices Content of the factory Blonde, por me while through last year, theding about 100 of 275 werkende kracht warm of the factory's le now and weigpelled spoken for the finally , Order Caterpillinen they het om very low lai of only be They made the Monate. The competich Caterpillar Sl Clapter 1 20 thum t the lur .lkattal in T thin Caterpillar They thing Wheth Me ph Cle ha " whick by ly ila de les Tech Caterpillar is also changing how it sells its products. The company offers a dizzying array of features, and until now, that complexity often led to delays in delivering machines to customers. Customers love the variety, but were often frustrated by delivery delays, Mr Worming the group president, says Caterpillar is replacing this with a "lane strategy. The first lane is made up of machines that contain the most commonly requested features and typically will be kept in stock by dealers and at Caterpillar staging facilities around the country y. At the other extreme is lane four, custom machines that take tix months or more to build and deliver. The implication for Caterpillar and its suppliers is clear: Many customers who would normally order a unique machine will instead opt for something readily available once they learn the lane- one machine is close to what they want and can be delivered fast. This in turn makes it easier to set production schedules. One reason Caterpillar is so attuned to the inventory cycle is its history. The company went through a massive growth spurt in the past decade, fueled by the twin forces of a commodity boom and a housing boom. Sales of the company's iconic yellow machines grew to $51 billion in 2008 from $20 billion in 2002. But Caterpillar had a hard time meeting that demand because of supply bottlenecks and other problems. Those past hurdles informed the company's more recent policies with its suppliers. Caterpillar is also requiring a detailed written plan from its suppliers for each part they produce, explaining how the supplier will respond to the bullwhip in that individual case. Meanwhile, the company is stepping up its long-standing effort to measure the risk of failure among its suppliers. A nisk-assessment group meets weekly at the company's hulking downtown headquarters in Peoria, assigning ratings to suppliers based partly on Caterpillar's assessment of their viability. "We give them a number," says Dan Murphy, the company's vice-president of global purchasing. "But it really boils down to two colors-reds or greens. We watch the reds and it's usually because of a liquidity issue." Meanwhile, up the road at supplier Morton Industries, they are still trying to get used to the new marching orders from Peoria. Sitting in a conference room near the front of the small factory, Mr. Leitch, the account manager, and the company's president, Chris Ober, say they "looked at each other and smiled" last July when Caterpillar started asking them about their ability to increase orders rapidly when the time comes "They were still dropping orders," says Mr. Ober, "but here they were asking about increases." 3. Describe the various actions taken by Caterpillar to reduce the negative effects of a supply chain bullwhip 4. What role does inventory management play in the bullwhip effect? Describe where inventory is held in Caterpillar's supply chain. Should these inventories be increased or decreased? Justify your response. I 7. (Humus peints) Read the ice and we the following question o Bullwhip Hits Firms as Growth Snaps Back By TIMOTHY ALITER 21,2010, The PEORIA, It Capella Inc. recently told as steel supplies that it will meetu dobita purchases of the metal this year even if the consoles de esta In fact, the long equipment maker has been betagendens toppen Sie vything tentand bydwiches to empol How to Chikupillip efect which come US This chicantly de call tip de camps the Spa tuatianaletadani chain The bus pabaigos whide sig wheels theses to the actually the as, bold conceded och det he and small, respond to market shifte determines which coes emerge fint from the slump and start growing an Most forecaster expect the Commerce Department ce Friday will report that the US.COM grew at an inflation adjusted annual rate of better than 5% in the fourth quarter, the fastest pace since 2003. Economista estimate that the balk of the prouth came not because consumers were buying more, but became buisses stopped reducing mentories and therefore, had to produce more of what they sold "The inventory burn off is over," says Caterpillar CEO Jim Owens, a PhD. economist who has run the world's largest facturer of construction and mining machines since 2004 Caterpillar, which may investors ne poised to benefit from the scent global recovery, is likely to talk about its bullwhip preparations when it reports fourth quarter results Wednesday Going forward, a big question is how well suppliers are positioned to ramp up production Bottlenecks and other headaches may occur at spot shortages cause nexpected price files and hamper companied ability to meet dersand That's why Caterpillar took the unusual step late last year of viting whypisto they had the resources to quickly boost output. In extreme cases, the equipment suppliers et financing Up Caterpillar says that even if demand for its equipos flat this yearly projecte calls its "Great Receni od stilled to boost production is a factor by 10% to 15% just to restock dealers and meet pingui demand Mehle, output at Caterpillar's suppliers would have to rise 30% to this scenario becse Caterpillar would be relish Encuest Cutiple, though, we betting on growth. In that can, desand for partijos even more Caterpillereits productie 15 says Mr. Om opps would more than double that shpesto Anorgen is good forgy for work, especially state when the revival of economic growth has yet to trade to morejo The plynem sove 10% des have been used the projects for furthquare growth is gros dos puoducts with cho the extra growth and to companied by artist Duas the final.com, bele how Thening of them became the stones by 541 billion of the 2001 by be of Lehman Brothers and Its all y guest The very tisol Felden Sie, says that the US.com boys a la seva propewele this story at the sport Berylic specially in to recease Tahera pratlantatamil hape of pipi Miny ulla phaluee atty A Bow of tropiccolta est Be that is releashores o tome because the w to do nem - Sad wederer This Topo the Federal Takbeendet turt caltria , cong connected that China Caterpillars 2005- of the f.com on, which power M. , core story Show whold of the top To The thry The Cape apdom laste ma "Many of the alle compone de beach the cosy Steven the Capillar power to purchaning and led the recent with them to borrow more because they bring ople and also to say They're probably mag towy. W To ma the way, Caterpillar this methods that allows applies to borrow rytom a banka, ferrate This they can tag on fond within the day of demodate Capilloppend til 65.cat Mechanical Devices Content of the factory Blonde, por me while through last year, theding about 100 of 275 werkende kracht warm of the factory's le now and weigpelled spoken for the finally , Order Caterpillinen they het om very low lai of only be They made the Monate. The competich Caterpillar Sl Clapter 1 20 thum t the lur .lkattal in T thin Caterpillar They thing Wheth Me ph Cle ha " whick by ly ila de les Tech Caterpillar is also changing how it sells its products. The company offers a dizzying array of features, and until now, that complexity often led to delays in delivering machines to customers. Customers love the variety, but were often frustrated by delivery delays, Mr Worming the group president, says Caterpillar is replacing this with a "lane strategy. The first lane is made up of machines that contain the most commonly requested features and typically will be kept in stock by dealers and at Caterpillar staging facilities around the country y. At the other extreme is lane four, custom machines that take tix months or more to build and deliver. The implication for Caterpillar and its suppliers is clear: Many customers who would normally order a unique machine will instead opt for something readily available once they learn the lane- one machine is close to what they want and can be delivered fast. This in turn makes it easier to set production schedules. One reason Caterpillar is so attuned to the inventory cycle is its history. The company went through a massive growth spurt in the past decade, fueled by the twin forces of a commodity boom and a housing boom. Sales of the company's iconic yellow machines grew to $51 billion in 2008 from $20 billion in 2002. But Caterpillar had a hard time meeting that demand because of supply bottlenecks and other problems. Those past hurdles informed the company's more recent policies with its suppliers. Caterpillar is also requiring a detailed written plan from its suppliers for each part they produce, explaining how the supplier will respond to the bullwhip in that individual case. Meanwhile, the company is stepping up its long-standing effort to measure the risk of failure among its suppliers. A nisk-assessment group meets weekly at the company's hulking downtown headquarters in Peoria, assigning ratings to suppliers based partly on Caterpillar's assessment of their viability. "We give them a number," says Dan Murphy, the company's vice-president of global purchasing. "But it really boils down to two colors-reds or greens. We watch the reds and it's usually because of a liquidity issue." Meanwhile, up the road at supplier Morton Industries, they are still trying to get used to the new marching orders from Peoria. Sitting in a conference room near the front of the small factory, Mr. Leitch, the account manager, and the company's president, Chris Ober, say they "looked at each other and smiled" last July when Caterpillar started asking them about their ability to increase orders rapidly when the time comes "They were still dropping orders," says Mr. Ober, "but here they were asking about increases." 3. Describe the various actions taken by Caterpillar to reduce the negative effects of a supply chain bullwhip 4. What role does inventory management play in the bullwhip effect? Describe where inventory is held in Caterpillar's supply chain. Should these inventories be increased or decreased? Justify your response