Question: Please help me answer a,b,c,d Ganado and Equity Risk Premiums. Maria Gonzalez, Ganado's Chief Financial Officer, estimates the risk-free rate to be 3.60%, the company's

Please help me answer a,b,c,d

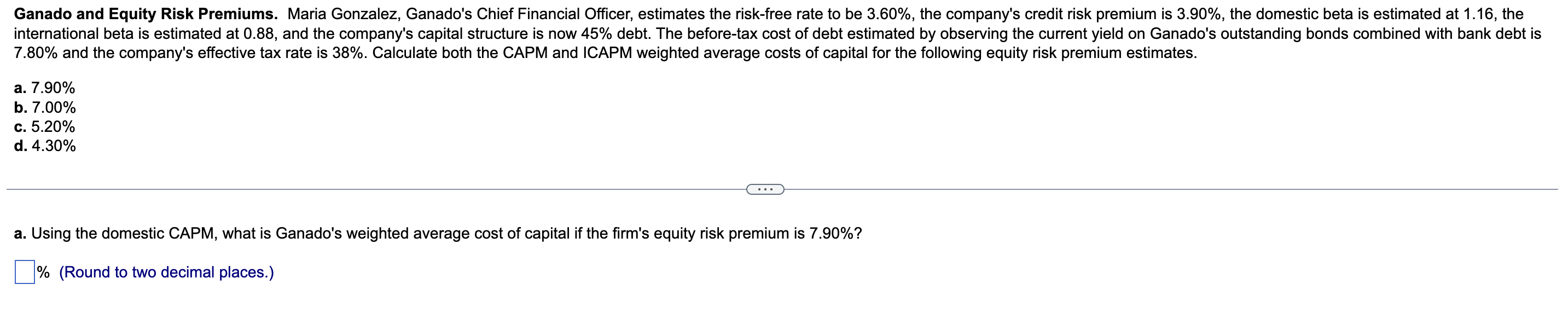

Ganado and Equity Risk Premiums. Maria Gonzalez, Ganado's Chief Financial Officer, estimates the risk-free rate to be 3.60%, the company's credit risk premium is 3.90%, the domestic beta is estimated at 1.16, the international beta is estimated at 0.88, and the company's capital structure is now 45% debt. The before-tax cost of debt estimated by observing the current yield on Ganado's outstanding bonds combined with bank debt is 7.80% and the company's effective tax rate is 38%. Calculate both the CAPM and ICAPM weighted average costs of capital for the following equity risk premium estimates. a. 7.90% b. 7.00% c. 5.20% d. 4.30% a. Using the domestic CAPM, what is Ganado's weighted average cost of capital if the firm's equity risk premium is 7.90%? % (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts