Question: Please help me answer all greatly appreciated. Thumbs up a rise in demand for loanable funds by a large country can result fall in interest

Please help me answer all greatly appreciated. Thumbs up

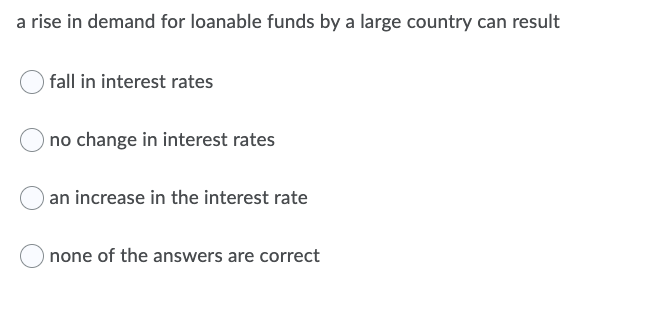

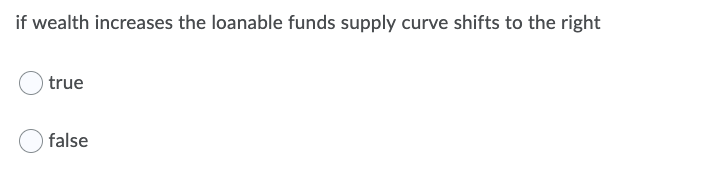

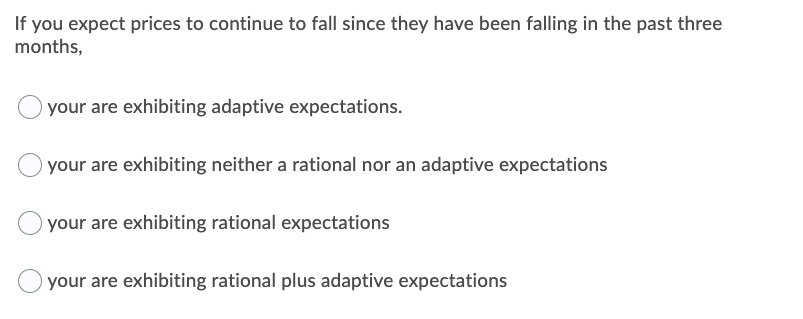

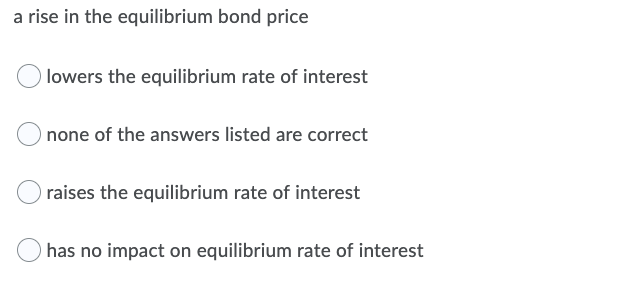

a rise in demand for loanable funds by a large country can result fall in interest rates Ono change in interest rates O an increase in the interest rate Onone of the answers are correct if wealth increases the loanable funds supply curve shifts to the right true false If you expect prices to continue to fall since they have been falling in the past three months, your are exhibiting adaptive expectations. your are exhibiting neither a rational nor an adaptive expectations O your are exhibiting rational expectations your are exhibiting rational plus adaptive expectations a rise in the equilibrium bond price Olowers the equilibrium rate of interest Onone of the answers listed are correct O raises the equilibrium rate of interest has no impact on equilibrium rate of interest Factors that affect the demand for loanable funds also affect the supply of loanable funds O true false an excess demand for bonds reflects that bond prices O are at the equilibrium price level. are below the equilibrium price and will rise. Onone of the answers are correct are above the equilibrium price and will fall. when expected profitability is falls, the demand curve for bonds shifts to the left. O the equilibrium interest rate falls. O the supply curve of bonds shifts to the left the equilibrium price of bonds rises

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts