Question: PLEASE HELP ME ANSWER ALL PARTS WITH GIVEN TABLES: FSA 5 : Ratio of liabilities to stockholder s equity and quick ratio Ratio of liabilities

PLEASE HELP ME ANSWER ALL PARTS WITH GIVEN TABLES:

FSA : Ratio of liabilities to stockholders equity and quick ratio

Ratio of liabilities to stockholders equity

You will use the NIKE financial statement located in appendix CThe information required for this ratio analysis is all found on the consolidated balance sheets. You will use the information from the most current year and

The formula is total liabilities total stockholders equity

Total liabilities are equal to the the sum of current liabilities, long term debt, operating lease facilities and deferred income taxes and other liabilities. You can also subtract owners equity from total liabilities and equity to get the total liabilities.

All of the business assets are financed either by debtliabilities or owner investment and accumulated earnings.

Calculate the ratio for NIKE and comment about your findings. Round the ratio to the nearest hundredth. In the comment, address whether the ratio or increasing or decreasing.

ratio:

ratio

Comment:

You will use the NIKE financial statement located in appendix C The information required for this ratio analysis is all found on the consolidated balance sheets. You will use the information from both years and Round the ratios to the nearest tenth

Quick Ratio Quick assets current liabilities

Note: the quick assets only include those current assets easily converted to cash, so inventories and prepaid expenses will not be included. Ideally, the quick ratio should be greater than one.

ratio:

ratio:

Ideally the quick ratio should be or above. Calculate the ratio and comment on Nikes ability to pay its current liabilities.

We have served as the Company's auditor since

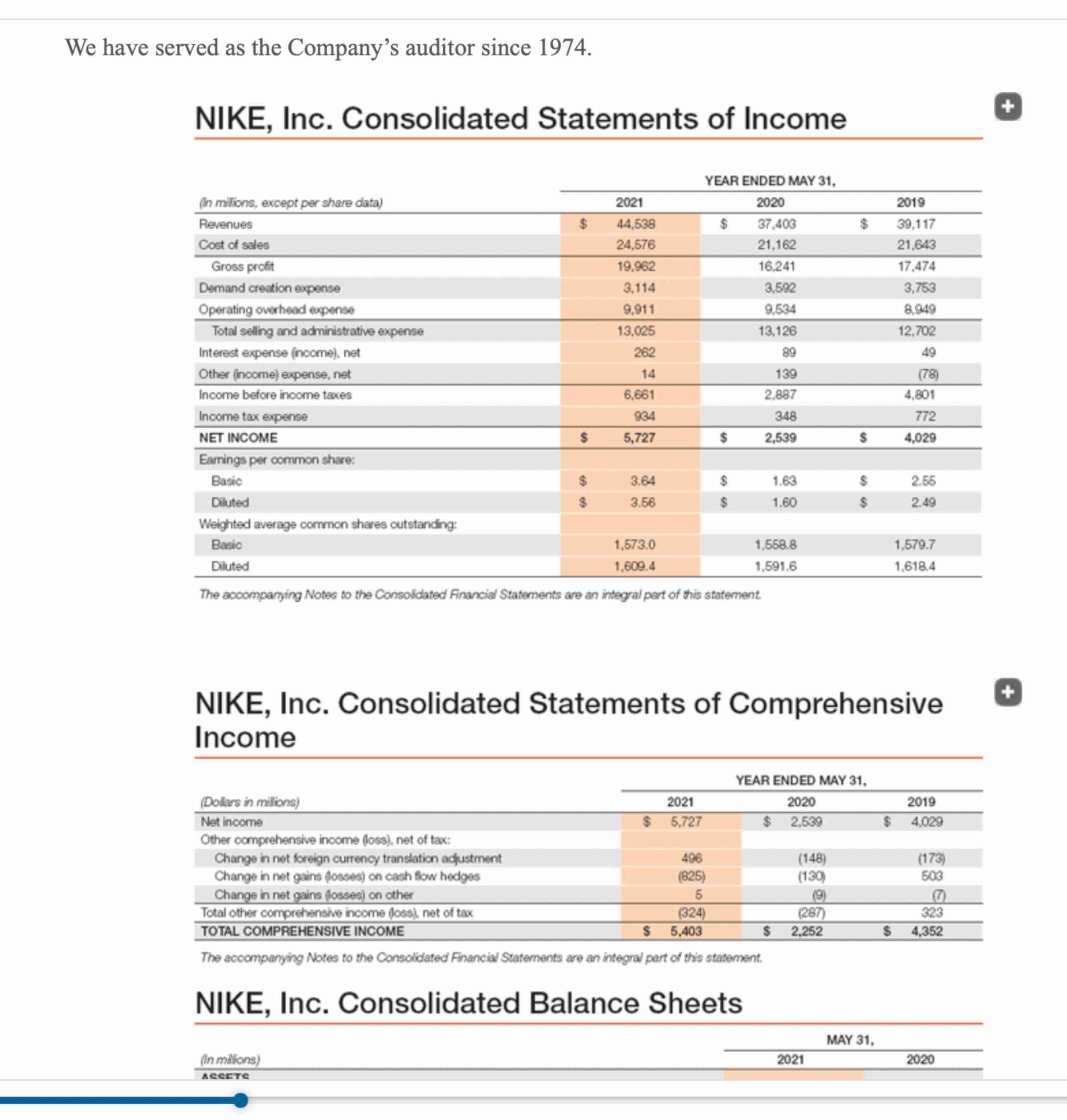

NIKE, Inc. Consolidated Statements of Income

YEAR ENDED MAY

in milions, except per share data Revenues $ $ $ Cost of seles Gross profit Demand creation expense Operating overhead expense Total selling and administrative expense Interest expense income net Other income expense, net Income before income taxes Income tax expense NET INCOME $ $ $ Earrings per common share: Basic $ $ $ Diluted $ $ $ Weighted average cormmon shares cutstanding: Basio Diluted

The accompanying Notec to the Consolidated Financial Statements are an integral pert of this statement.

NIKE, Inc. Consolidated Statements of Comprehensive Income

Dolars in milions YEAR ENDED MAY Not income $ $ $ Other comprehensive income loss net of tax: Change in net foreign currency translation adjustment Change in net gains losses on cash flow hedges Change in net gains losses on other Total other comprehensive income loss net of tax TOTAL COMPREHENSIVE INCOME $ $ $

The accompanying Notes to the Consoldated Financial Statements are an integral part of this statement.

NIKE, Inc. Consolidated Balance Sheets

in milions MAY

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock